CGVAK is providing cutting-edge solutions for more than 25 years to companies around the globe. They are a group of around 300 people thriving on the 3 tenets “IDEATE, INNOVATE, CREATE”.

The company helps transform businesses and organizations by delivering Digital Innovation, Product Innovation, and Modernization at business speed.

They have developed tools and components for their product partners, as well as custom software solutions for the manufacturing, financial, accounting, banking, healthcare, e-commerce, hospitality, government agencies, automobile, chemical, food & beverage, sales, and service industries among others

CGVAK is growing continuously quarter after quarter as well as YoY.

Mcap – 175 Cr. Promoter Holding is 53.75%. The free float Market cap is around 81 Cr

In our opinion, the differentiating factor considering the size of the company:

- Writes Blog

- Provides Case Studies on the projects by their clients and the solutions they have offered. One such example – Revolutionizing Insurance Firm with Voice Recognition Technology

CGVAK – Management

The company is managed by a well-experienced Board of Directors who have vast experience in creating many success stories in varied businesses.

They have over 30 years of business experience including 23 years in the IT business, Manufacturing and International trade. The business units are headed by Vice Presidents and Managers who are well-qualified and experienced in their respective fields.

Qualitative thought: A brief description of each member on their website Management Info. Very few companies under a 200 Cr MCap provide this information.

Resource retaining is always a challenge for any IT company. If we see this company’s top-level management, all are associated with this company for a long time which is eventually benefiting to company

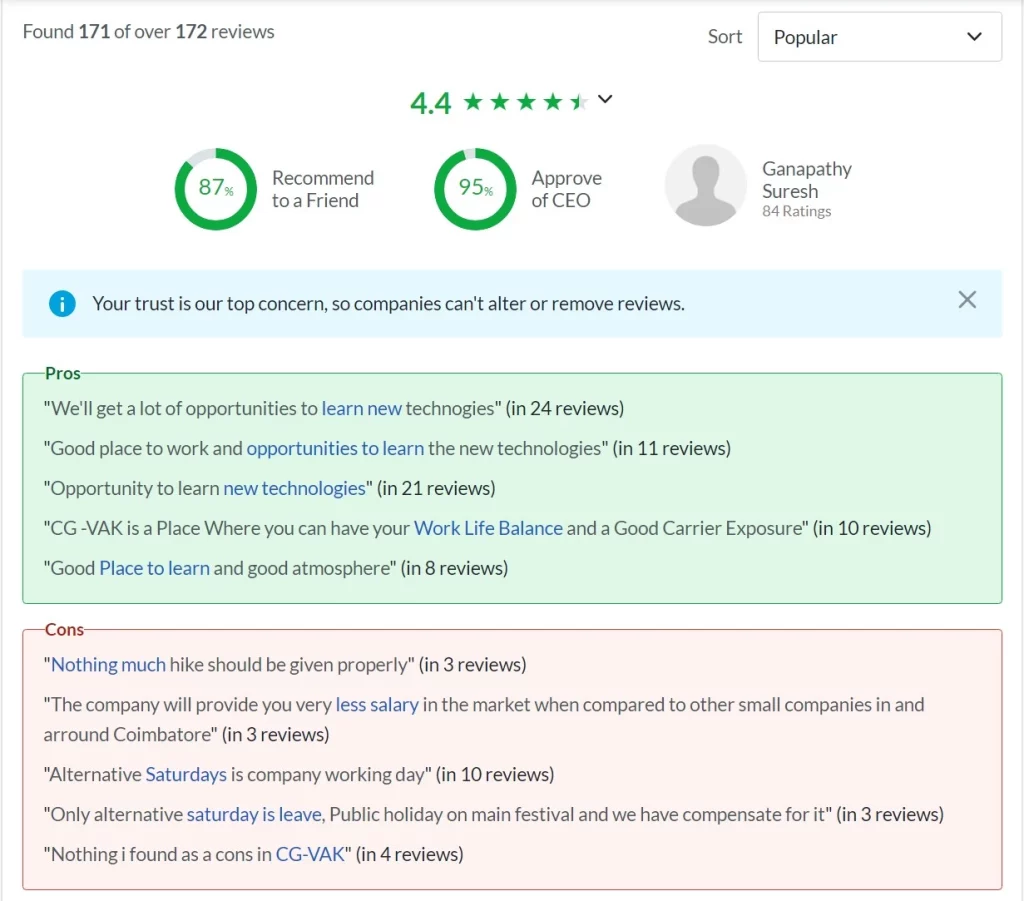

CGVAK – Company Reviews from Employees

Financials

The company ended FY23 with highest ever revenue of 77 Cr with a 23% Operating Margin

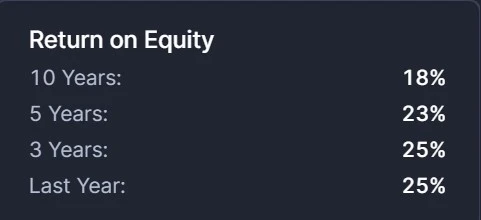

Consistent ROEs

Growth Triggers

- Last 3-4 quarters, each quarterly revenue number has been their highest ever. Benefits of operating leverage kicking in

- Oct 2021: 90 cr Market Cap company buying a 15 cr office with 25 cr cash on the balance sheet. New premises can accommodate 700 employees when fully constructed and used

- Promoter Buying – They are buying from the open market every quarter for the last two years

- The company is hiring aggressively – 322 employees as of FY22 AGM. Their website shows that it employs over 525+ professionals (at the time of publishing this article). They are still hiring through LinkedIn and seem to be offering permanent WFH as an option

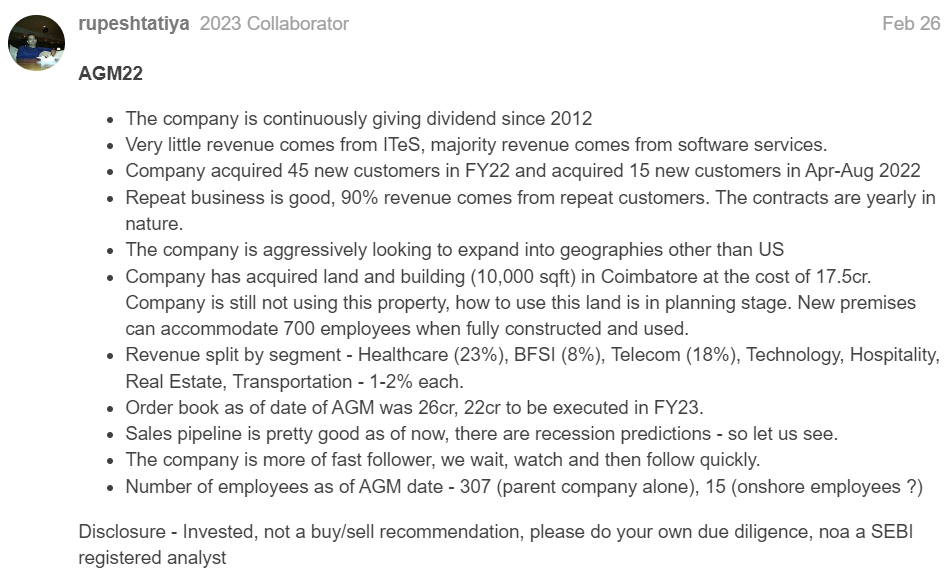

- The company acquired 45 new customers in FY22 and acquired 15 new customers in Apr-Aug 2022

- The company is aggressively looking to expand into geographies other than the US

CGVAK – Achievements

- 2500+ successful projects

- 1100+ satisfied customers

- 35+ finest of technologies deployed.

Thanks to @rupeshtatia for summarising the critical points from AGM 2022.

What we like

- The company is continuously giving dividends since 2012 – demonstrating its commitment to providing returns to shareholders and enhancing shareholder value

- Repeat business is good, 90% of revenue comes from repeat customers. The contracts are yearly in nature

- The company operates across a wide range of sectors

- Promoter buying since April 2018

What we don’t like

Salary of Rs. 30,00,000/- Per month is drawn by Mr. G Suresh, Managing Director & CEO which is 30% of FY23 Net Profit

See you next time.

Until then… Stay Prudent!

Also read:

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

Looking forward

How do you see recent Cgvak results?