Hi There! You might be wondering why we chose to cover a company of this size, especially since we rarely feature businesses with a market cap above ₹3,000 crore. But we’ve made an exception for Archean Chemical. It’s in a uniquely strategic space and is well-positioned to tap into a massive market opportunity. Since Archean’s business is quite complex, we’ve shared a simple hack at the end of the article to help you track it more easily 😊

Let’s deep dive into the business! 👇🏻

About the company

Archean Chemical Industries Limited (ACIL), Mcap 7300 Cr, is a speciality chemicals manufacturing company that produces and supplies marine chemicals, including industrial salt, liquid bromine, and sulphate of potash (SOP). ACIL serves a range of industries, including agriculture, pharmaceutical, water treatment, aluminium, glass, and textiles.

Core products of the company

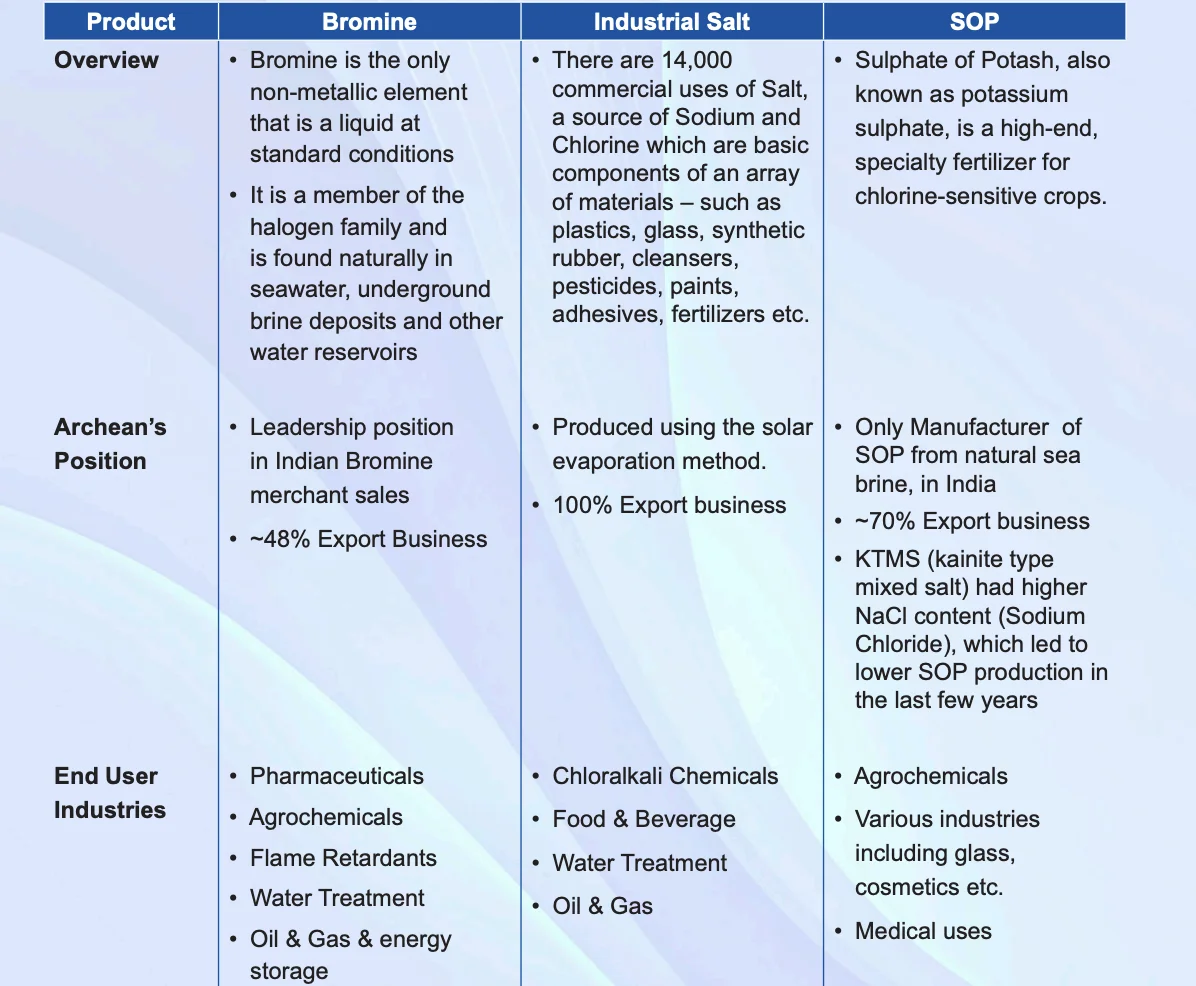

Let’s start by knowing the three products produced by ACIL:

1. Bromine (Br)

Atomic number: 35 | Atomic weight: 79.9 u

It is a volatile red-brown liquid at room temperature that evaporates readily to form a similarly coloured vapour.

Elemental Bromine is highly reactive and thus doesn’t occur as a free element in nature.

It is the starting point for manufacturing a wide range of bromine derivative performance products. ACIL’s bromine and bromine-based products are used in a broad range of end-use industries and have applications in the pharmaceuticals, fumigants and agrochemicals, water treatment, mercury control, flame retardants, additives and oil & gas segments of the chemicals industry. Globally, the leading producers of elemental bromine are the United States, China, India, Israel, and Jordan.

2. Industrial Salt (NaCl)

ACIL is India’s largest producer of industrial salt, with a capacity of 4 million MT in FY24. Industrial salt has 14,000 commercial uses, a source of sodium and chlorine, which are essential components of an array of materials, glass, synthetic rubber, cleansers, pesticides, paints, adhesives, fertilisers, explosives and metal coatings. The company exported 100% of its industrial salt production.

3. Sulphate of Potash (K2SO4)

Sulphate of potash, also known as potassium sulphate, is a high-end, speciality fertiliser for chlorine-sensitive crops. The primary end-use industries for their sulphate of potash include the agrochemicals industry.

ACIL is India’s only large-scale producer of fertiliser-grade water-soluble SOP. It is produced through sea brine, which has a low cost of production and is green (no chemical process involved). Globally, only 15% of SOP is produced through this brine route. The cost of production of SOP is lowest for brine-based production.

They have received certification under the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), a European Union regulation that allows them to export their sulphate of potash products to their European customers.

Core products at a glance

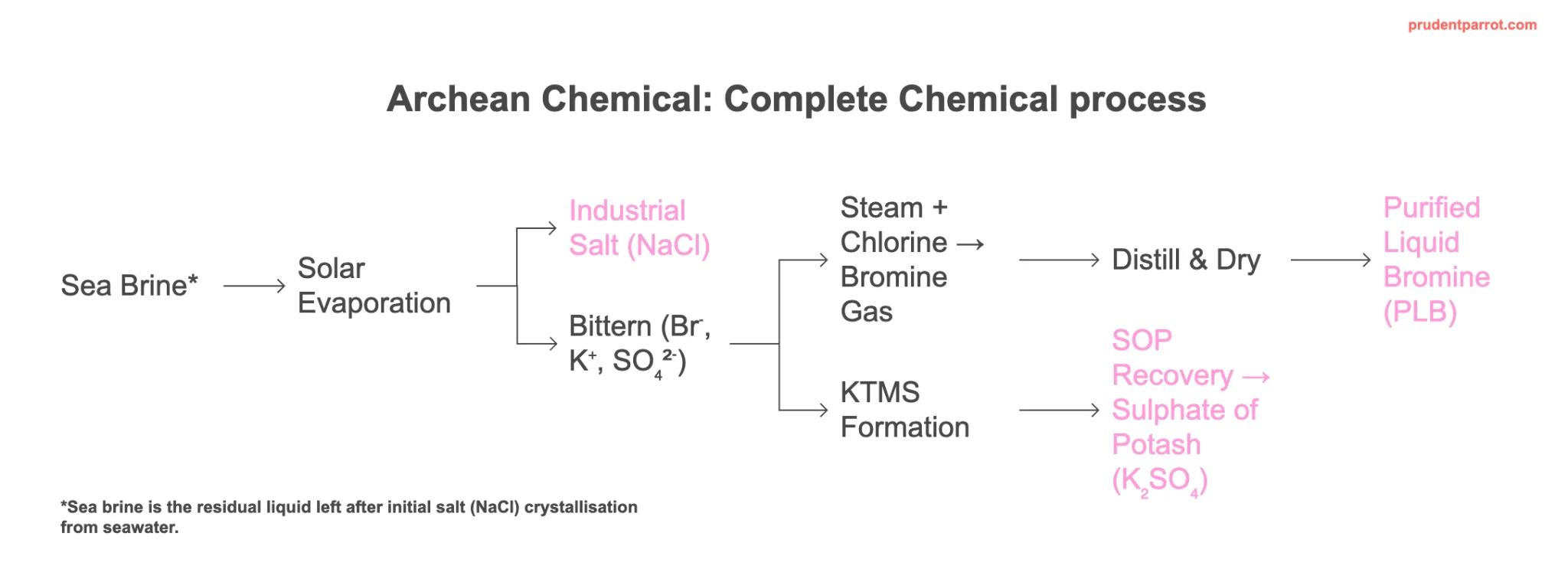

Manufacturing processes

1. Bromine:

The technical know-how and technology for ACIL’s bromine plant was provided by a German engineering company pursuant to a technology transfer agreement. ACIL produces liquid bromine with specifications of <60 ppm of chlorine and < 30 ppm of moisture.

There are generally two processes for bromine production: (i) the steaming out process and (ii) the blowing-out process.

They operate and utilize the steaming-out process for the following reasons:

| Reason | Advantage |

| High-grade brine access | Rann of Kutch brine has >2g/L Bromine |

| Energy efficiency | Requires less energy Vs blowing-out process |

| Better purity | Superior control <60 ppm Chlorine ; <30 ppm moisture in the Purified Liquid Bromine |

| Integrated byproducts | Naturally integrates Industrial Salt & SOP recovery via bitterns |

2. Industrial Salt:

There are generally three processes for industrial salt production: (i) solar evaporation, (ii) vacuum evaporation, and (iii) rock salt mining. The type of process utilized is largely dependent on access to salt reserves and geography. They operate and utilize the solar evaporation process. Refer to the above diagram for a better understanding.

3. SOP:

The technical know-how and technology for their sulphate of potash plant were provided under contract with a German engineering company. There are generally three processes for sulphate of potash production: (i) the Mannheim process, (ii) the MOP and Kieserite process and (iii) the salt lake/seawater process. They operate and utilize the salt lake/sea water process.

The recovery of sulphate of potash is based on potassium chloride (KCl) and sodium chloride (NaCl) content. Lower levels of NaCl yields better recovery of sulphate of potash from KTMS and an increased level of NaCL yields lower outputs.

The method of precipitation of KTMS was changed from parallel to series mode in the crystallized, which is expected to yield a lower NaCl content.

There are more steps involved in converting KTMS to the final SOP. This diagram (on the left) shows the complete flow.

Capacities of Archean’s products:

| Product | Capacity | Notes |

| Bromine | Around 42,000 MT per year. Out of which they will use 14,000 MT for Bromine Derivatives (BD). To have capacity of 28,000 MT of BD – 14,000 MT of Bromine is required for captive use. | Management is aiming to produce at least 20,000 MT of Bromine in FY25 |

| Industrial Salt | Management is confident in maintaining 4M+ volumes | Management is confident on maintaining 4M+ volumes |

| SOP | Around 1,30,000 MT per year | Meaningful volumes around 20k MT can be expected from H2FY26 onwards |

Maximum possible revenue from each segment at full utilisation

Rough Average Per Kg Prices from previous concalls, Annual reports:

Industrial Salt: ≈ 1.91 INR/Kg

Bromine: ≈ 204.62 INR/Kg

Sulphate of Potash (SOP): ≈ 43.85 INR/Kg

At 100% Capacity Utilisation of each segment, on paper revenue comes around ₹1900 Cr (Additional revenue will be added by Bromine Derivatives)

It should be noted that this ₹ 1900 Cr is derived from average past prices. The prices fluctuate in the real world depending on many factors such as:

- Demand from end-user industries

- Global Market Conditions

- Supply and production levels

To make it less variable, the company does have long-term contracts for fairly large volumes with customers.

Market Size and Opportunity

1. Bromine

The global Bromine market is on a growth trajectory and is anticipated to continue expanding in the coming years. Valued at approximately INR 23k Cr in 2022, the market is forecasted to reach around INR 40k Cr by 2033, with a CAGR of about 2.7%. The market is segmented by derivatives such as clear brine fluids and hydrogen bromide, and by applications including flame retardants, oil & gas drilling, water treatment, among others. The Asia-Pacific region is expected to dominate the market share, driven by increasing demand from sectors like electronics, automotive, and pharmaceuticals. Countries like China and India are key players in bromine production.

Industry Drivers: The primary demand driver for liquid bromine is its use in flame retardants, which are vital in electronics, construction materials, and textiles for fire prevention. Additionally, the pharmaceutical industry uses bromine compounds in the synthesis of sedatives and certain cancer treatments. Sustainability and Regulations: Given bromine’s reactivity and environmental concerns associated with its use, there is a growing focus on sustainable extraction and the development of environmentally friendly bromine alternatives. Strict environmental regulations, especially in Europe and North America, are encouraging the use of safer brominated compounds.

2. Industrial Salt

The global industrial salt market was valued at US$ 14.7 billion in 2023 and is projected to grow at a CAGR of 4.0% from 2023 to 2033. The market’s growth is fuelled by rising demand from the chemical processing, oil & gas, and de-icing sectors. Additionally, the increasing demand for chlorine alkali in the production of vinyl and other downstream chemicals contributes to market expansion.

3. Sulphate of Phosphate (SOP)

The global Potassium Sulphate market is projected to reach US$5.4 billion by 2027, with a CAGR of 4.8% from 2022 to 2027. In the Asia-Pacific region, the SOP market is expected to grow from USD million in 2022 to USD million by 2028, at a CAGR of 5%.

Industry drivers: Key drivers for the SOP market include the increasing adoption of high-efficiency fertilizers, growing urbanization, and the emphasis on food security, particularly in regions like Asia and Latin America. The market is characterized by its segmentation based on grade, form, end-use industry, and geography, highlighting the diverse applications and growth opportunities within the SOP sector.

What next? From where will the next phase of Growth come?

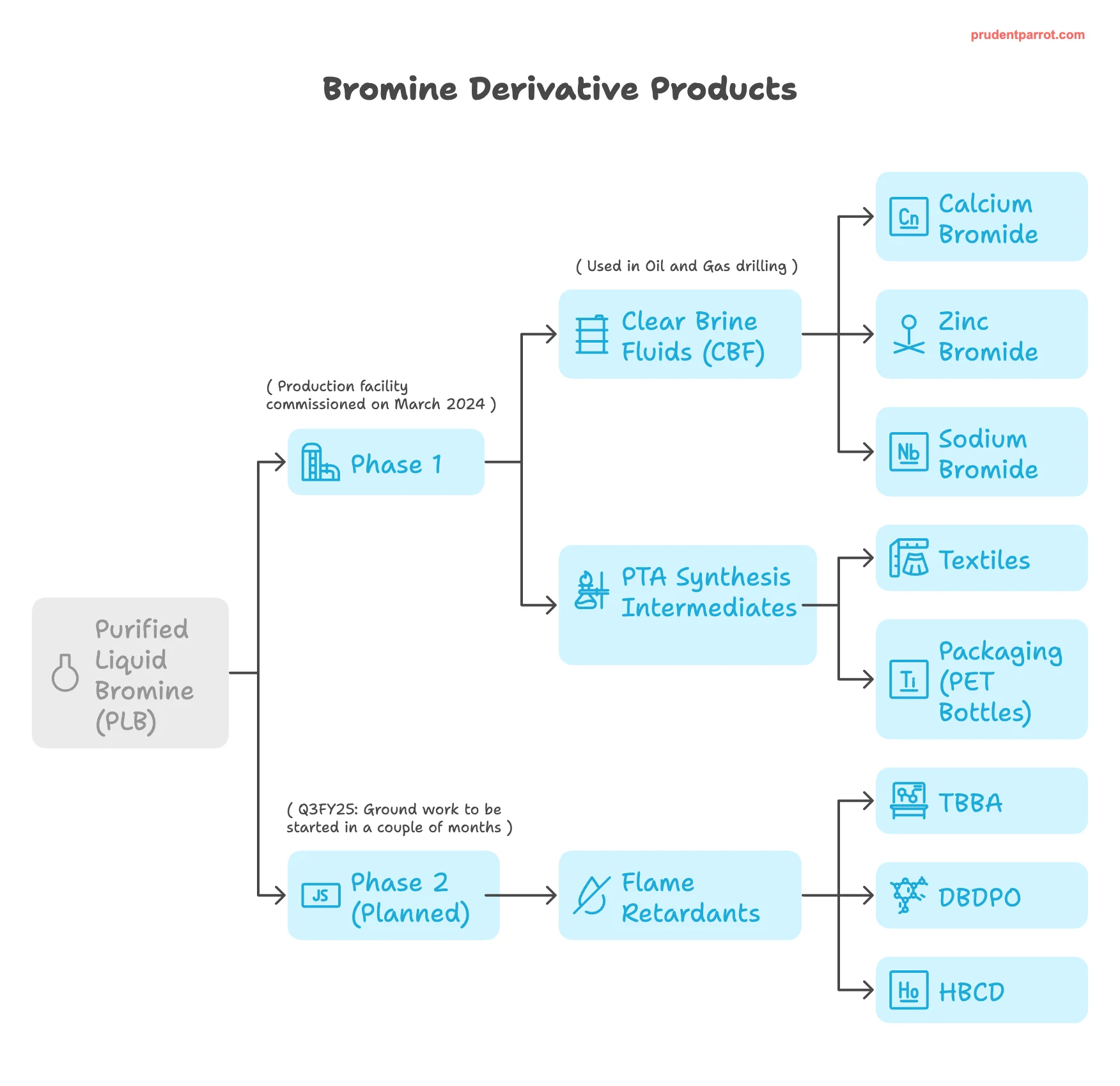

1. Greenfield Expansion: Expanding downstream Bromine derivative performance products.

Capex Size: 250 Cr (140 Cr used till now) | expecting 3x Asset turns i.e. 750 Cr at full capacity utilisation.

Mainly three categories:

- Clear Brine Fluids (CBF): Think of Clear Brine Fluids as super-clean salty liquids. These are special types of saltwater, made using salts of bromine, potassium, calcium, or sodium.

They’re mainly used in oil and gas drilling. When companies drill deep into the earth for oil or natural gas, they need a fluid to stabilize the well, control pressure, and avoid damage. Clear Brine Fluids are perfect because they are heavy enough to balance underground pressure but clear and non-damaging to the equipment.

The global clear brine fluids market was valued at $1.5 billion in 2023 and is projected to reach $2.49 billion by 2032, growing at a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period (2025-2032).

- PTA: Stands for Purified Terephthalic Acid — a chemical building block mainly used to make polyester. Without PTA, we wouldn’t have affordable clothing, bottles, or lightweight, durable packaging.

The global PTA market was valued at $ 95.8 billion in 2024 and is projected to reach $ 143.3 billion by 2033, exhibiting a growth rate of 4.35% (CAGR) during 2025-2033.

- Flame Retardants: Flame retardants are special chemicals added to materials (like plastics, textiles, and electronics) to slow down or prevent fires.

TBBA (Tetrabromobisphenol A) is a common bromine-based flame retardant used especially in electronic circuit boards.

The global flame retardants market is valued at USD 7.0 billion in 2022 and is projected to reach USD 9.5 billion by 2028, growing at 5.2% CAGR from 2023 to 2028.

As of date, ACIL has decided to expand into the above Bromine Derivatives in two phases:

- Phase 1 includes CBF and PTA – The production facility at Jhagadia, GIDC, through Acume Chemicals Private Limited (Subsidiary) commissioned in March 2024. The production is in the ramp-up stage, with the company actively working on client trials, approvals, and aiming for meaningful revenue growth in the coming fiscal year

- Phase 2 includes Fire Retardants – The groundwork will be started from H2FY26

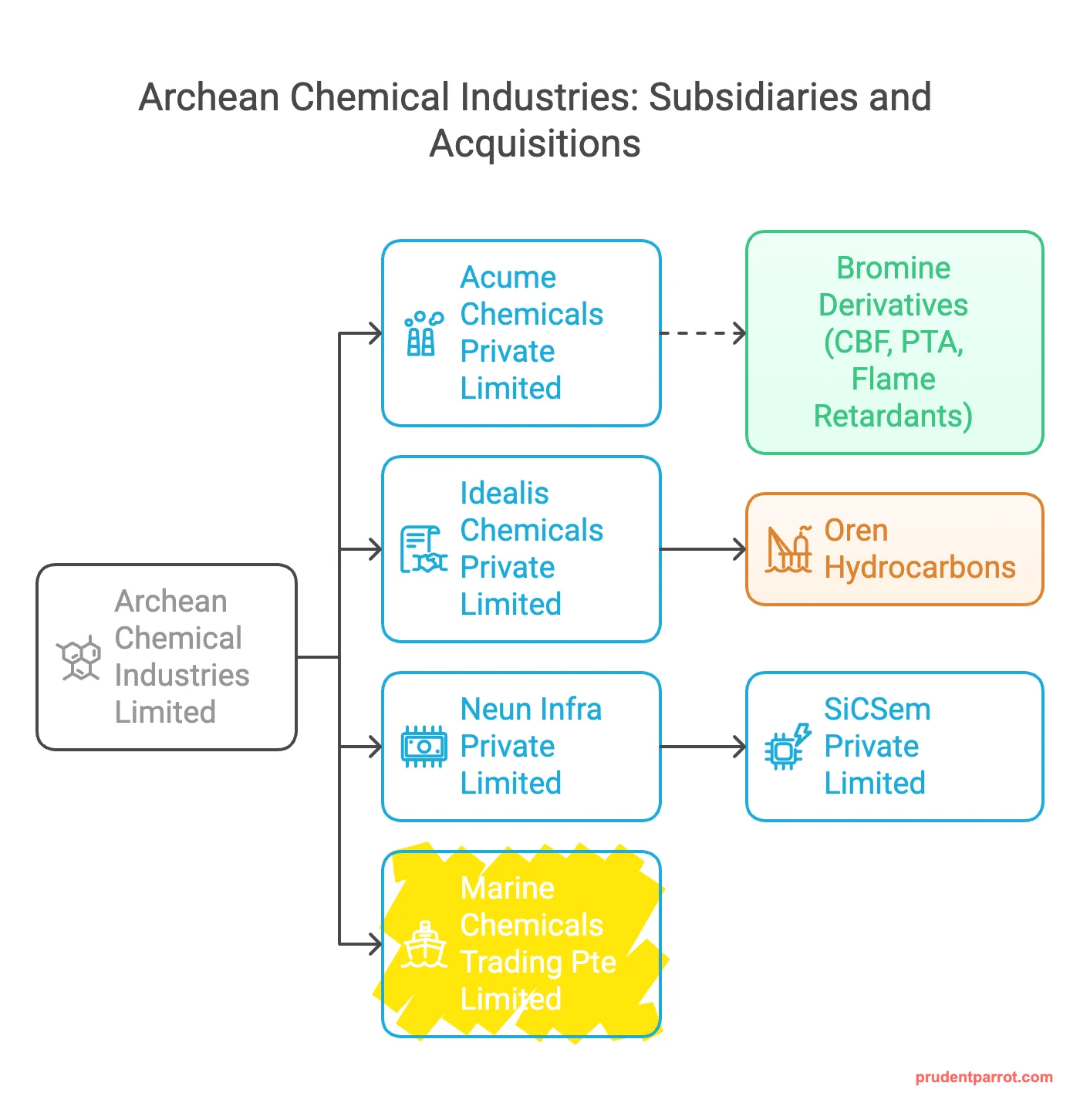

2. Strategic acquisitions:

a. Oren Hydrocarbon: Chemical Industries acquired Oren Hydrocarbon through the NCLT route in July 2024 for around 70 Cr. An additional ₹20-₹30 crores is expected to be invested to refurbish the plants and make most of the assets operational. Oren Hydrocarbons is involved in barites and bentonites, which are specialty mud chemicals used in the oil and gas drilling industry.

The products are complementary to Archean’s bromine derivatives, allowing them to offer a broader basket of products to customers . Oren Hydrocarbons was started in 1990 by a former Schlumberger oil drilling professional . Archean aims to bring the operations of Oren back to their historical levels (Peak Revenue was 430 Cr with 15% EBITDA margins).

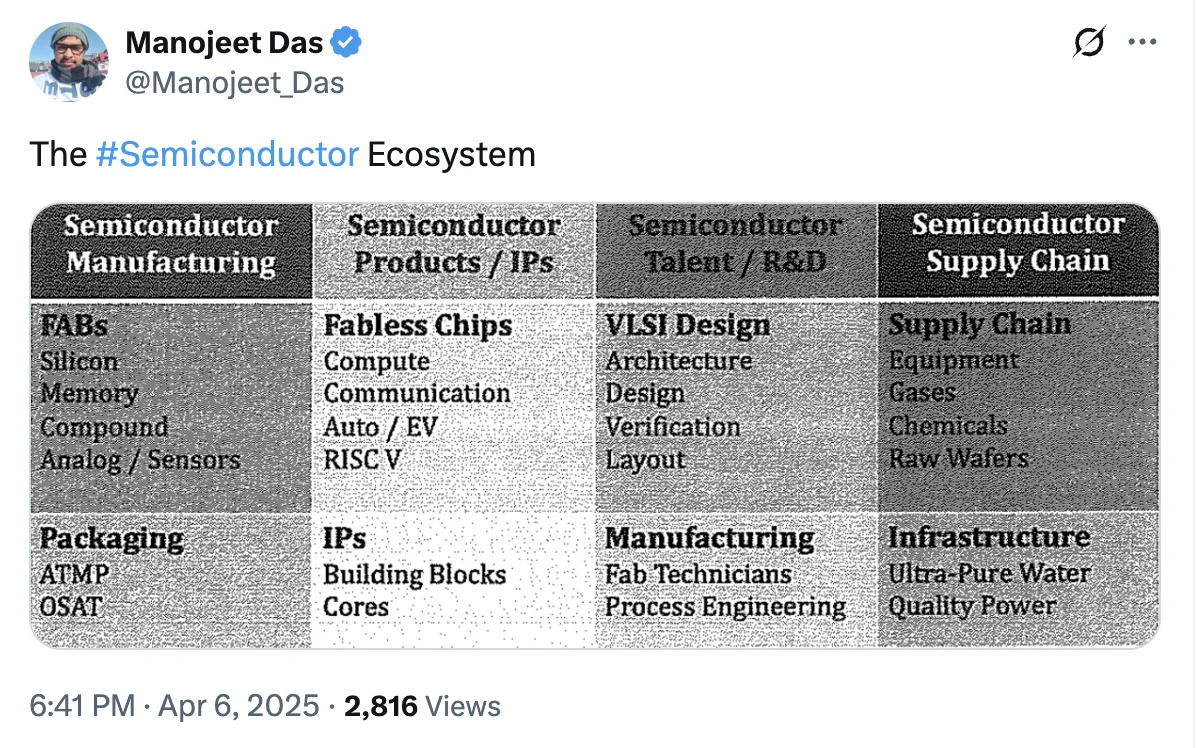

Archean has made an investment (21.33% stake is being acquired for a total of GBP 15 million) in Clas-SiC Wafer Fab in the UK for technology and process know-how in silicon carbide (SiC) power devices.

This investment is part of Archean’s strategy to venture into the semiconductor initiative, specifically the manufacturing of Silicon Carbide (SiC) wafers through their subsidiary SiCSem Private Limited. The technology acquired will be used by SiCSem under a licensing, royalty, and consulting agreement . The SiC market is forecast to grow at a 26% CAGR through 2030, reaching over USD 14 billion.

SiCSem Private Limited will eventually invest about Rs. 3,000 crores in a compound semiconductor facility, the first of its kind in the country, which integrates wafer fabrication for key industries such as electric vehicles, energy storage, industrial tools, data centers, fast chargers and consumer appliances, etc. The state government of Odisha has allotted 14.32 acres of land in Bhubaneswar for this project.

Under the Odisha Semiconductor and Fabless Policy 2023, further reinforcing commitment to India’s semiconductor ecosystem, which is encouraged and envisaged by the India Semiconductor Mission.

This investment positions Archean in the rapidly growing market for SiC power devices, driven by the increasing demand in power electronics. They are targeting to manufacture these devices over the next 24 to 36 months.

Archean has made an investment (21% stake acquired for a total of $12 million) in Offgrid Energy Labs, a company focused on energy storage solutions, specifically zinc-bromide batteries.

This investment allows Archean to participate in the rapidly growing energy storage market, creating long-term value. Zinc-bromide batteries offer advantages like superior cycle life (7,500 cycles), safety, and cost-effectiveness for commercial and industrial solar applications and utility-scale grid stability projects.

ACIL is supporting the establishment of a pilot manufacturing facility in the UK, with an intention to establish a giga-factory in India in near future to scale Zinc Bromide battery production

The global demand for stationary energy storage is expected to exceed $30 billion by 2030. In India alone, 2024 saw the announcement of tenders for over 7GWh of battery energy storage systems (BESS), valued at approximately $1 billion.

Customers

All the customers of the company are industrial customers. Their end users are in agriculture, Pharmaceuticals, water treatment, flame retardant, Oil, gas & energy storage, Chloralkaline Chemicals, Food & Beverage, medical uses, aluminium, glass, and textile industry.

Total customers: 74. Domestic: 33 & Global: 41

Subsidiaries

There are 3 direct subsidiaries of Archean Chemical Industries:

- Acume Chemicals Pvt Ltd: The purpose of this wholly owned subsidiary is to manufacture Bromine Derivatives. Phase 1 facility commissioned (Mar 14, 2024), exports started. FY24 revenue: ₹51.44 lakhs. As of Q4FY25: ₹24 Cr | 500 MT volumes of Bromine Derivatives.

- Idealis Chemicals Pvt Limited: The purpose of this wholly owned subsidiary is to acquire Oren Hydrocarbons. Operations yet to commence.

- Neun Infra Pvt Ltd: The purpose of this wholly owned subsidiary is to venture into the semiconductor business.

For this Neun has incorporated a subsidiary Company SiCSem (a step-down subsidiary of ACIL) on Dec 30, 2023. Neun owns 70%.

Purpose: Power electronics-focused semiconductor manufacturing.

Operations: Yet to commence (as of Mar 31, 2024).

Share Capital: ₹5 lakhs (Neun: ₹3.5 lakhs).

Key Partnerships with Global companies:

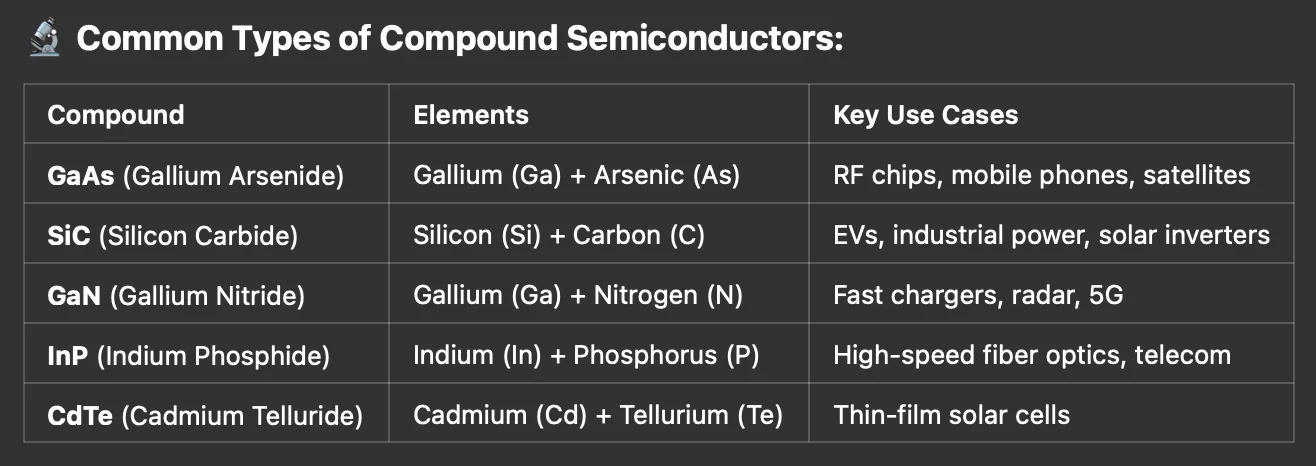

But what are Compound Semiconductors?

Unlike silicon, which is a single-element semiconductor (from the periodic table), compound semiconductors are made from two or more elements.

Why Silicon Carbide (SiC) is a Big Deal?

SiC semiconductors will have higher efficiency at high voltages and temperatures. They will produce smaller and lighter power devices.

Will be widely used in: EVs, Solar Inverters, Charging Infrastructure and Industrial power supplies.

That’s why companies like Archean (via SiCSem) are entering this space — it’s the future of power electronics.

Strengths

1. Integrated Operations & Infrastructure

• Leading Marine Chemical Manufacturer in India.

• Integrated facility at Hajipir, Gujarat, spread over ~240 sq.km in the Rann of Kutch, handles bromine, industrial salt, and SOP.

• Access to Brine Reserves: ensure raw material security and cost efficiency.

• Proximity to ports (Jakhau Jetty, Mundra) supports seamless exports.

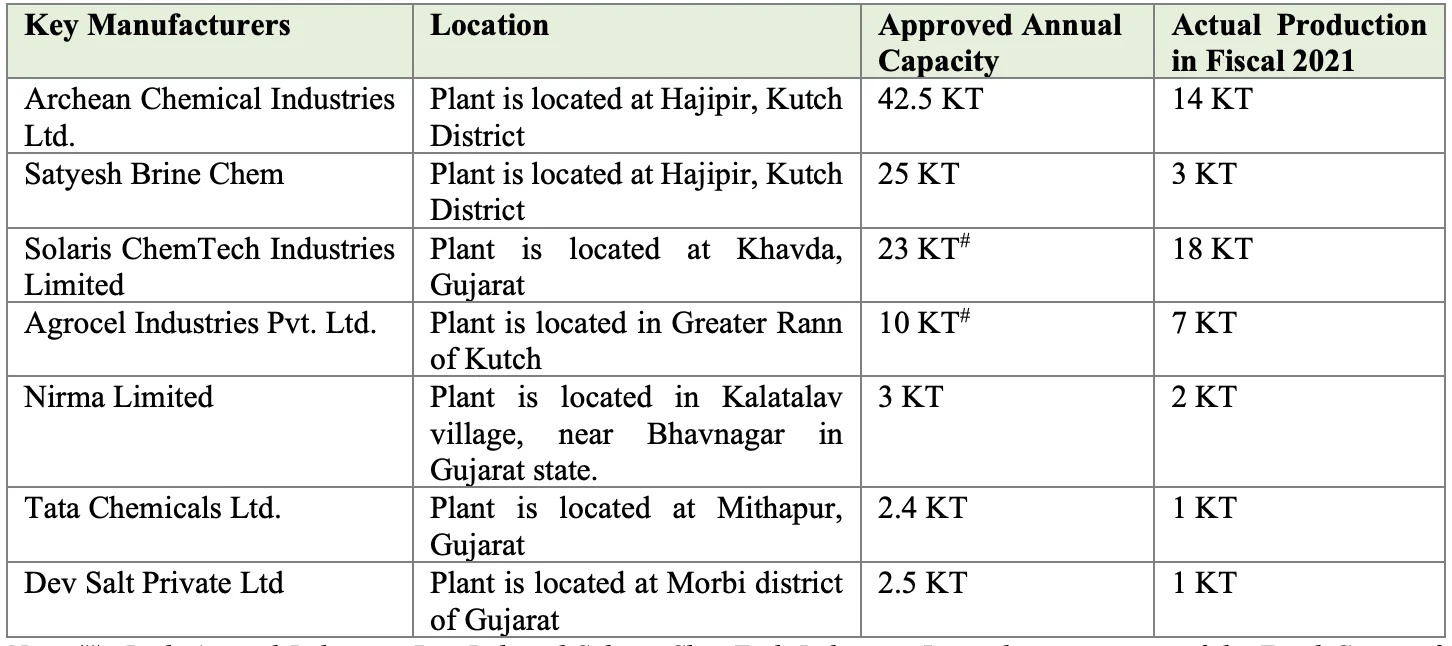

2. Bromine Segment

- India’s top bromine exporter (82.8% export market share in FY21).

- Capacity: Increased from 28,500 MTPA in FY21 to 42,500 MTPA in FY23.

- Lowest global production cost (per Frost & Sullivan).

- High purity: <60 ppm chlorine, <30 ppm moisture.

3. Industrial Salt Segment

- India’s largest producer and exporter.

- Capacity: 4 million MT in FY24; among the largest single-location saltworks globally.

- Entire output exported; major client: Sojitz Corporation (also a shareholder).

- Critical raw material for chloralkali industry; global demand rising.

4. Sulphate of Potash (SOP)

- Only Indian SOP producer from natural sea brine.

- Eco-friendly and low-cost production process.

- Improvement underway via facility upgrades to enhance recovery.

5. Strategic Diversification

- Downstream Bromine Derivatives: Via subsidiary Acume; exports of Clear Brine Fluids have begun.

- Oren Hydrocarbons Acquisition: Through subsidiary Idealis; barites & bentonites (mud chemicals). Approved by NCLT in July 2024. ₹20–₹30 Cr to refurbish plants.

- Semiconductors: Step-down subsidiary SiCSem (70% owned via Neun Infra) is entering power electronics. Tie-up with IIT Bhubaneswar signed.

- Energy Storage: Exploring zinc-bromide battery applications.

6. Barriers to Entry in Bromine Segment

- Complexity and Technical Requirements

- Regulatory and approval processes

- Raw Material Access

- Customer Relationships and Switching Costs

- High Gestation periods of 5 years at least

- Low competition in the elemental bromine segment:

Key elemental bromine producers in India:

7. Environmental & Safety Focus

- ISO 9001:2015, REACH, Responsible Care certified.

- Safe chemical transport (IMS/Nicer Globe certified).

- Regular safety & environment audits.

Risks

1. Dependency on three core products—bromine, industrial salt, SOP—makes the business vulnerable to segment-specific or customer-specific issues.

2. Customer concentration risk: 27% from a single client (Sojitz) and 70% from the top 10 clients.

3. The huge investments in SiCSem may not deliver the anticipated projections.

4. Operating leases on government land have expired—renewal is pending.

5. Price volatility in Bromine, Salt and SOP and raw materials can compress margins.

6. Excessive rainfalls could decrease the quality of their salt and brine reserves which could affect the Bromine and other products yield volumes.

7. The impact of Cyclone Asna in August/September 2024 resulted in an exceptional item in the Q2FY25 results, reporting a loss of 472,000 metric tons of Industrial Salt, amounting to ₹40.18 crores.

8. Logistical challenges on mobilization and transport also impacted Salt volumes in Q3FY25, following the weather impact in Q2FY25.

Financials

The drop in the FY25 and FY24 revenue and margins was primarily due to the following reasons:

- Muted demand from the end-user Market.

- Lower Bromine realisation and less volume yield.

- Softness and deferment in export markets.

- External factors like cyclones affected the operations and thus the volume production.

- Logistic challenges in Q2FY25 and Q3FY25.

Revenue mix (%)

Sulphate of potash revenue declined in Fiscal 2022 as the company focused on improving the kainite-type mixed salt (KTMS) ratio. Lower sodium chloride (NaCl) levels enhance sulphate of potash recovery, while higher NaCl levels reduce output. Recent upgrades to the facility and flotation circuit aim to improve conversion efficiency. As KTMS quality improves, the company expects lower utility and raw material costs, driving stronger sulphate of potash production.

The SOP volumes are coming back – as evident from FY24 SOP contribution.

Revenue and Volume Comparison: FY24 Vs FY25

| Product | FY24 Revenue (₹ Million) | FY24 Volume (Tons) | FY25 Revenue (₹ Million) | FY25 Volume (Tons) |

| Bromine | 4,274.28 | ~17,300 | 3531 | 18,000 |

| Industrial Salts | 8,400.62 | ~4,250,000 | 6,594 | 3,500,000 |

| SOP | 359.56 | 8,200 | Not Available | Not Available |

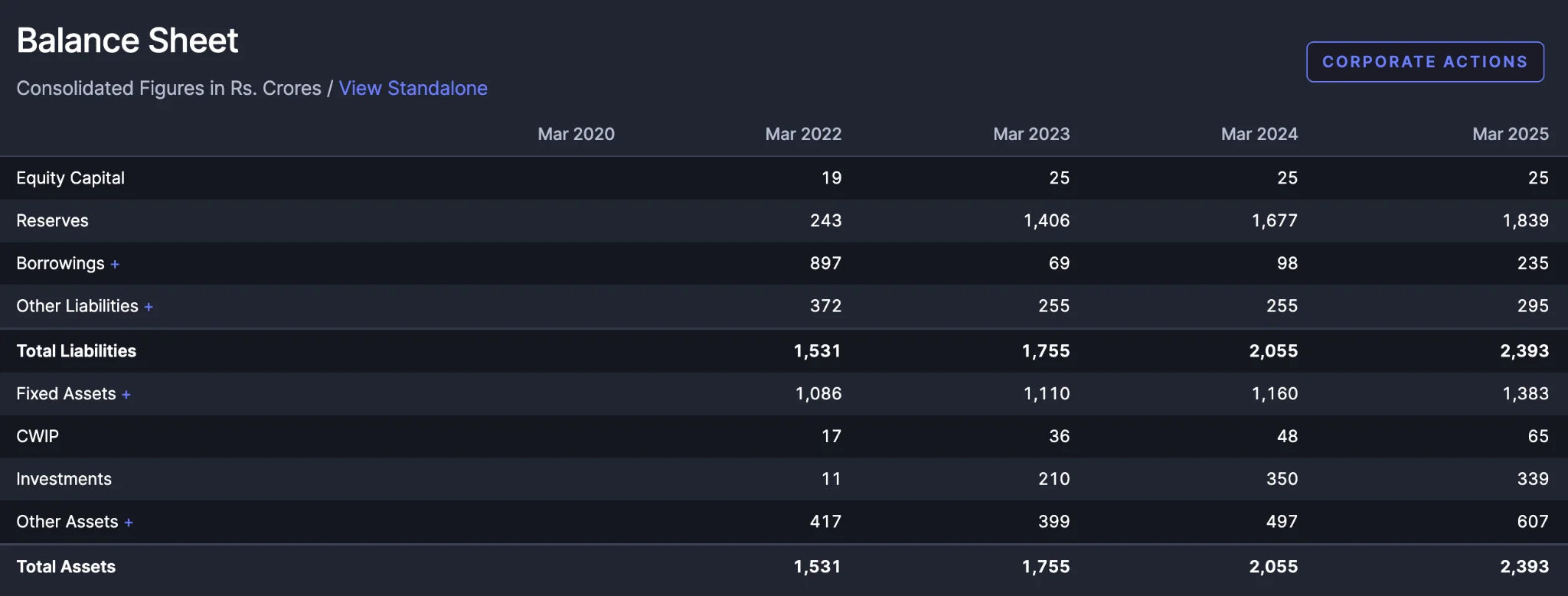

The sudden decrease in borrowings and increase in reserves are due to the IPO proceeds. As of date, the outstanding borrowings of the company are ₹ 235 Cr (end of March 2025).

Balance sheet contains a total of ₹ 392 Cr (Cash + Equivalents) end of March 2025.

Overall, the Balance sheet looks healthy

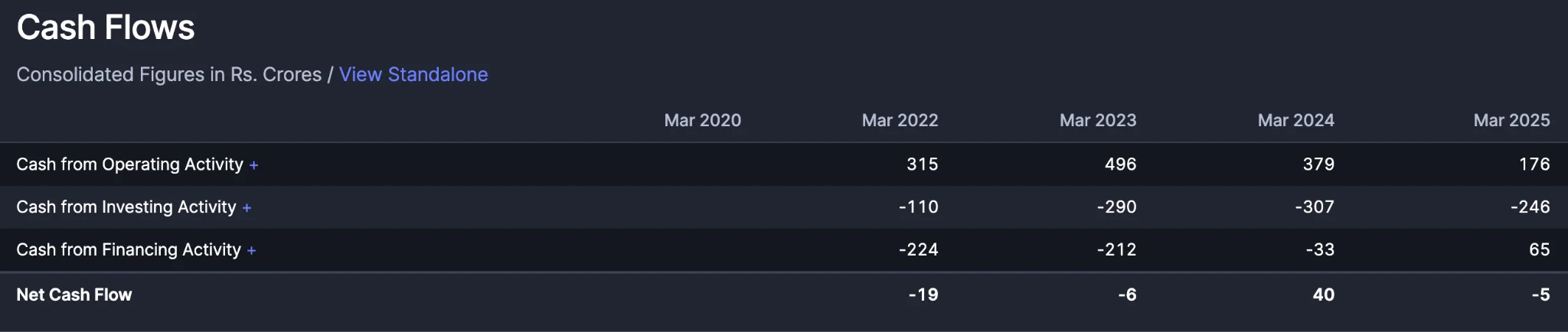

Positive Cash Flows from Operations for the last 3 years.

A hack to track the company:

Since there are lot of stuff to be known, it will be easier for an investor to track the following keywords from quarterly concalls:

- Bromine

- Industrial Salt

- SOP

- Bromine, salt and SOP Prices and Volumes. Contracts etc.

- Bromine Derivatives

- Oren Hydrocarbon.

- Offgrid Energy Labs

- ClasSic Wafer Fab

Why PrudentParrot finds this company interesting?

1. The company is placed in a very beautiful business segment of manufacturing speciality marine chemicals, viz. Bromine and its derivatives, Industrial Salt and SOP.

2. The complexity and technical know-how to manufacture these critical products acts as a Barrier to Entry in this segment.

3. Integrated manufacturing facility and operations.

4. Access to a high-purity bromine source, the lowest-cost producer globally.

5. De-risking their business model by going into downstream products and acquiring companies (Oren Hydrocarbon)

6. Investing in the future – Semiconductor and Battery Energy Storage System space.

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

Also Read:

Greate post. Keep writing such kind of info on your blog.

Im really impressed by your site.

Hey there, You’ve performed an incredible job. I’lldefinitely digg it

and in my opinion suggest to my friends. I’m confident they will be benefited from this website.