The Rationale

1. Naya Energy Works – Future Division

This is a 100% owned subsidiary of Balu Forge Industries Ltd (Current Mcap 2500 Cr). Naya Energy is engaged in the manufacturing of products for the New Energy Sector

What is a Fuel-Agnostic System?

Many more developments are happening in this space. Just search the keyword with “New Energy ” in Annual reports 2021, 2022, and 2023

Naya Energy Division Plans

2. Raising funds through multiple Preferential Issues

Raising funds by issuing shares at ₹115.45/-

- Non-Promoter Group: ₹158.47 Cr

- Promoter Group: ₹34.63 Cr

Raising funds by issuing shares at ₹ 183.6/-

- Non-Promoter Group: ₹45 Cr

- Promoter Group: ₹92 Cr

Some interesting names from the Non-Promoter Group:

Objectives of the fundraise

3. Capacity Expansion

Existing Machining capacity to produce 18,000 tonnes of Forged Components per annum. They are increasing it to 32,000 Tonnes per annum

| Forging Capacities Comparisions | Balu Forge Industries Ltd | Ramkrishna Forgings Ltd | Bharat Forge Ltd |

| Capacity (in Tonnes per annum) | 18,000 + 14,000 (Capacity to be added) | 56,100 | 7,50,126 |

NOTE: Bharat Forge Ltd is India’s largest forging company, followed by Ramkrishna Forgings Ltd.

4. End User Industries going through Massive Tailwinds

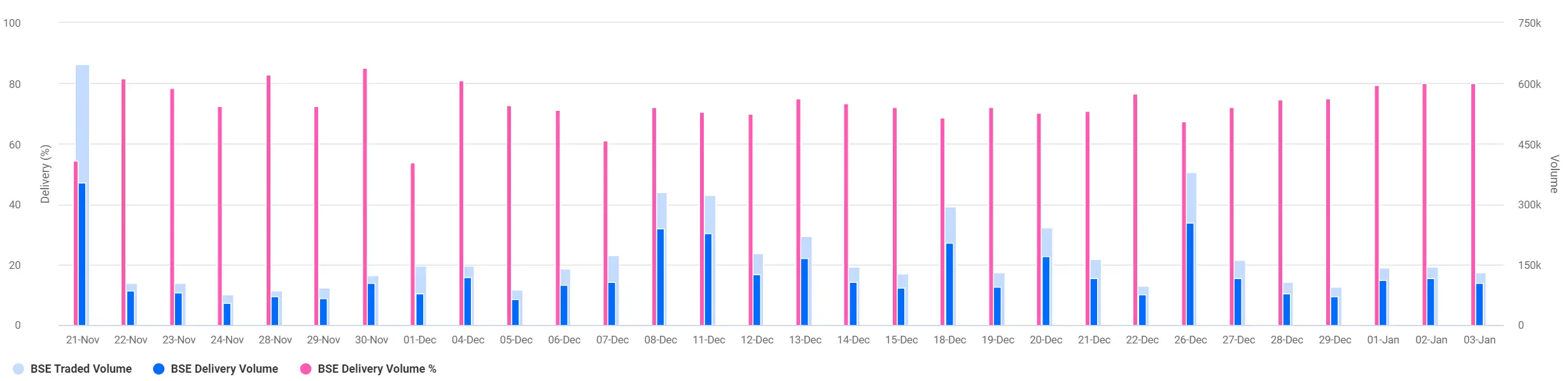

5. Unusual price movements:

Disc: We are invested and holding from lower levels around 850-900 Cr Mcap.

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

Also read:

Nice work on this.