Hi All, ever since we put out the tweet below, the unusually high fixed asset turnover ratio has been nagging at us.

It didn’t quite sit right, and that curiosity turned into a deeper investigation.

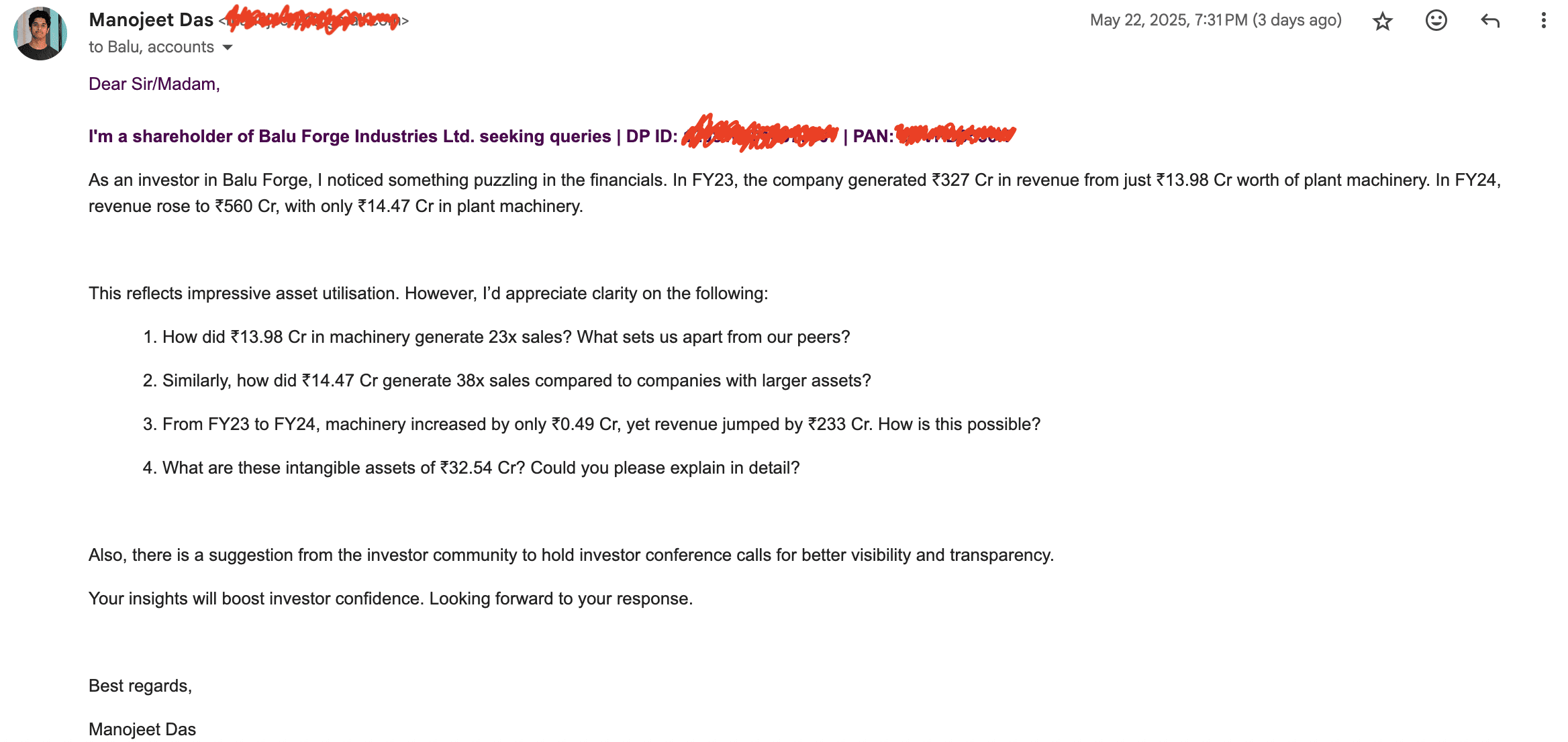

Regarding the same, we sent an email to the company, asking questions on Plant and Machinery and asset turnover ratios. See the screenshots below

See their reply below, avoiding our questions. “revaluation of the assets was not done since August 2020”, so 5 years have passed still they didn’t get an opportunity to re-evaluate? This raises some serious concerns about the officials and auditors. They replied with some vague figures (No official document references)

So, we decided to do a deep dive into the financials of the Balu Forge and its subsidiaries. We found out some irregularities, and we don’t have any explanation for those.

We want to be very transparent with our readers, so sharing our unfiltered thoughts (please note that we may be wrong in our direction of thinking, and we’re open to being corrected)

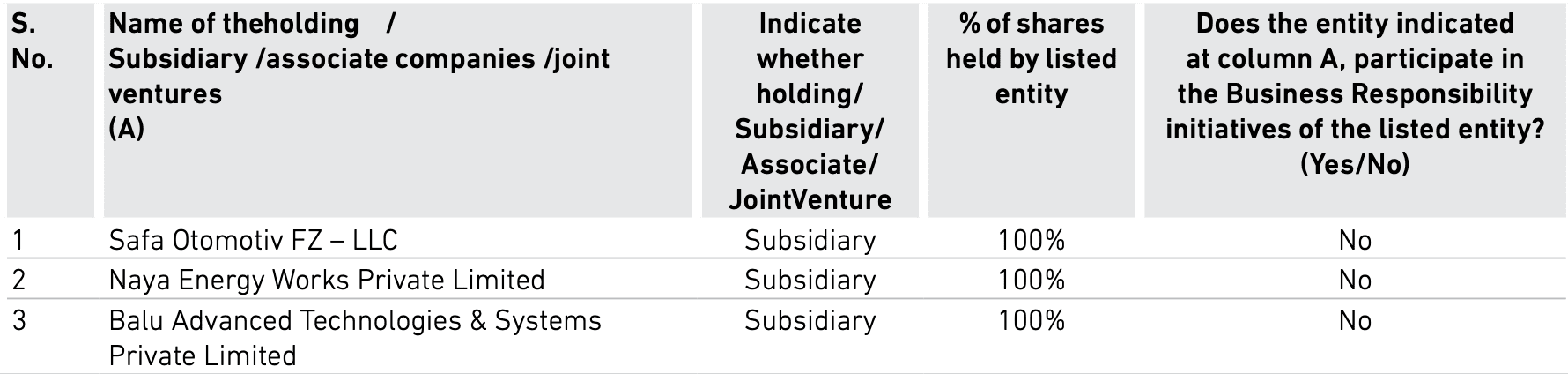

First, let us see how many subsidiaries Balu Forge has:

Let us explore the first subsidiary – Safa Otomotic FZ-LLC:

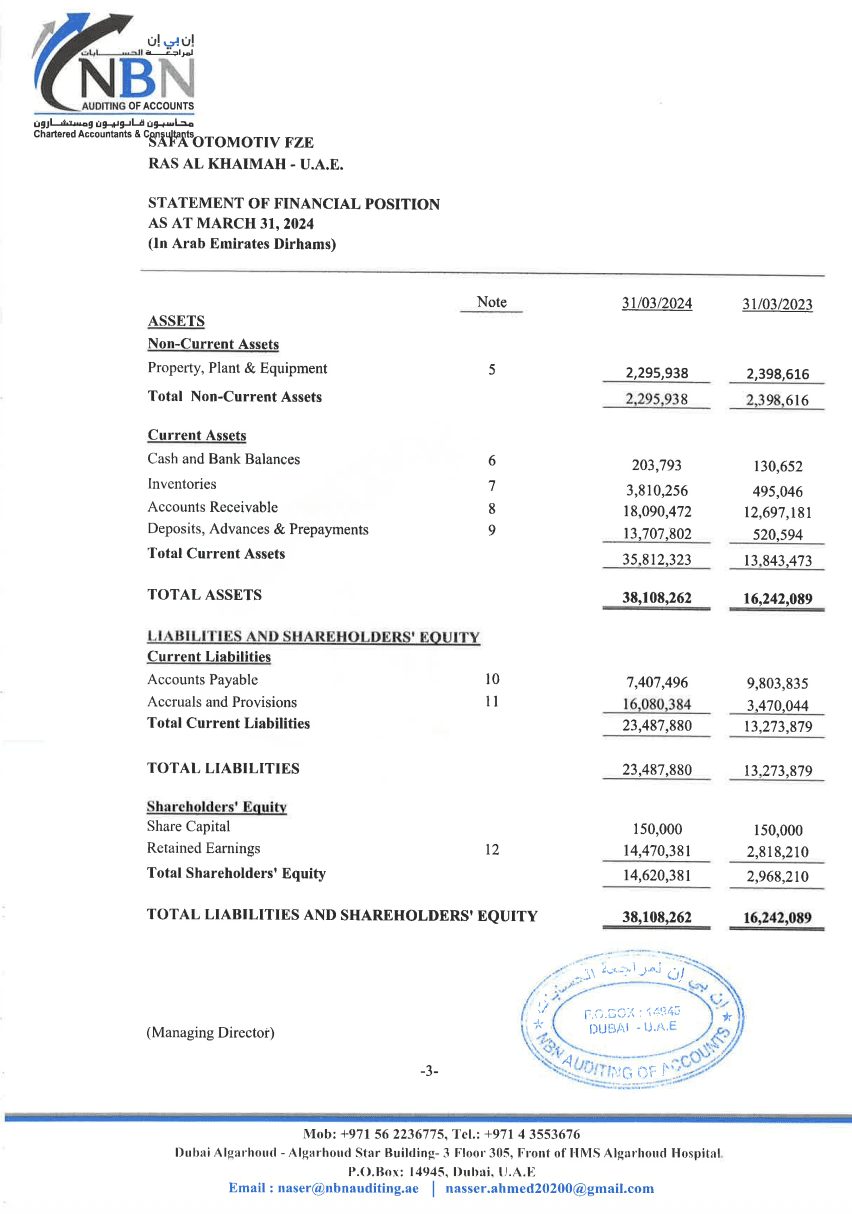

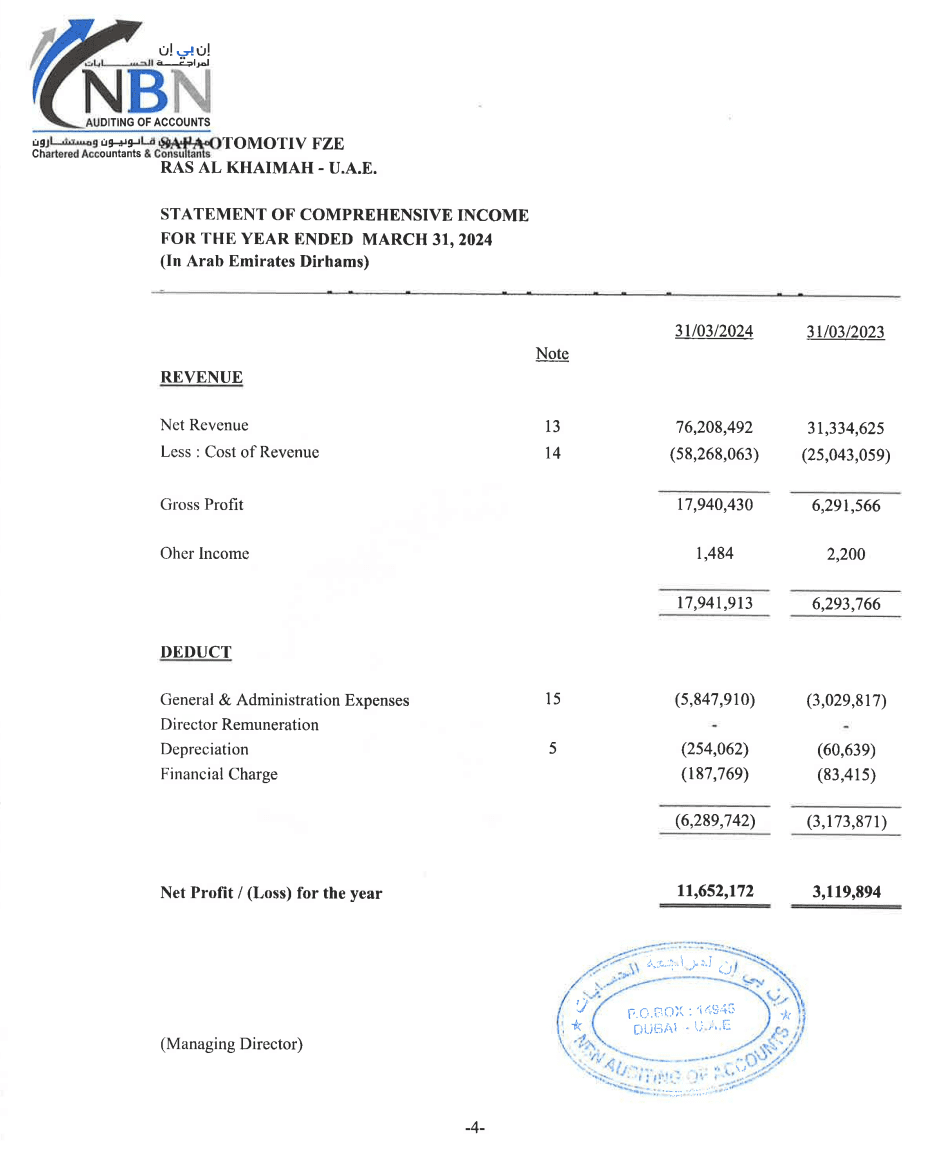

1. See the below Balance and P&L snapshots (only auditor’s stamp, no company official signature. Raises governance concerns ⚠️)

Revenue (FY24): AED 76.4 million (~₹176.7 Cr)

Fixed Assets: AED 2.29 million (~₹5.32 Cr)

Asset Turnover = 33.2x — extremely high ⚠️

SAFA was incorporated in January 2021. Hit ₹176 Cr in revenue by FY24. While it could be impressive execution, the other red flags suggest otherwise

2. Revenue Overlap / Double Counting?

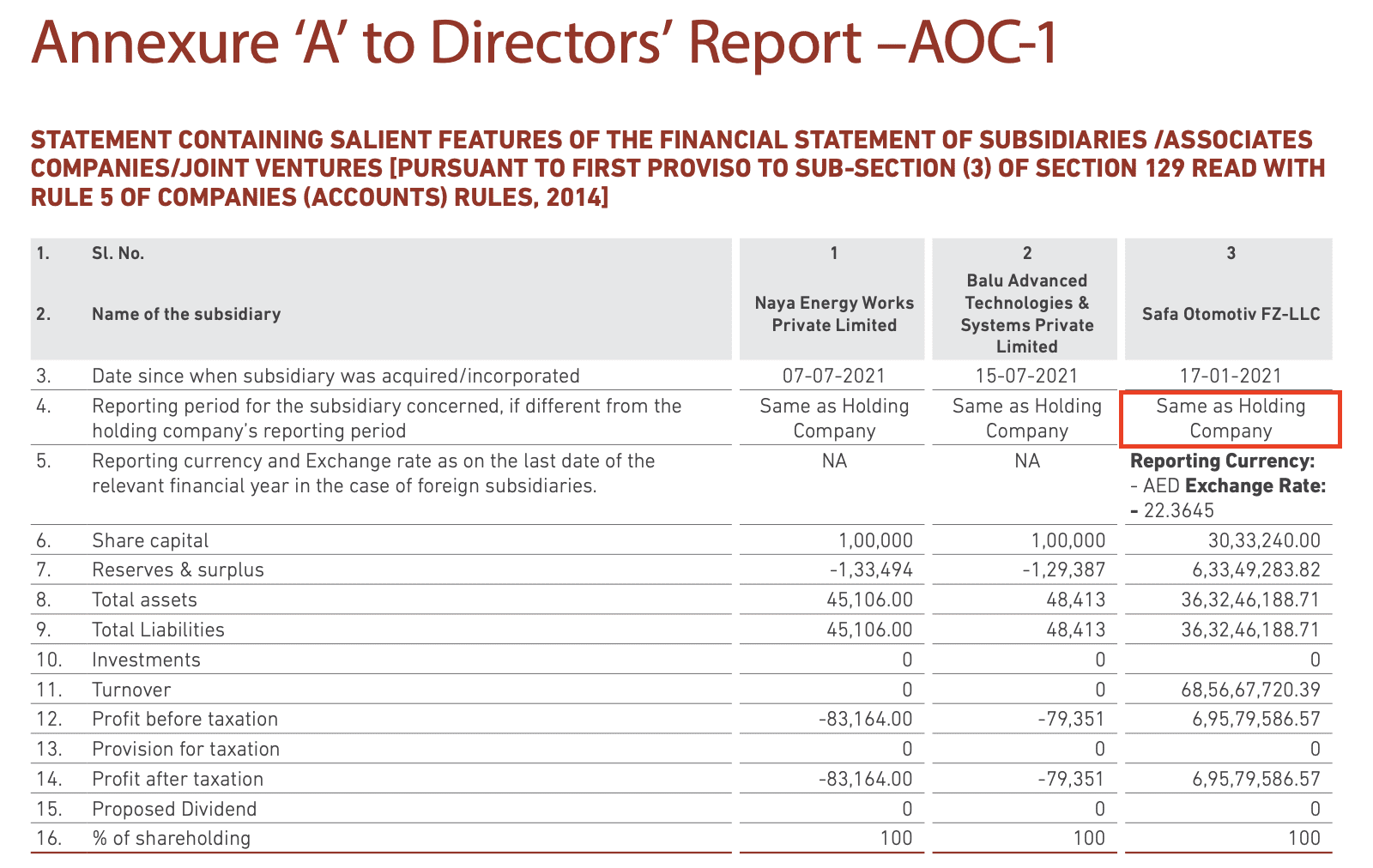

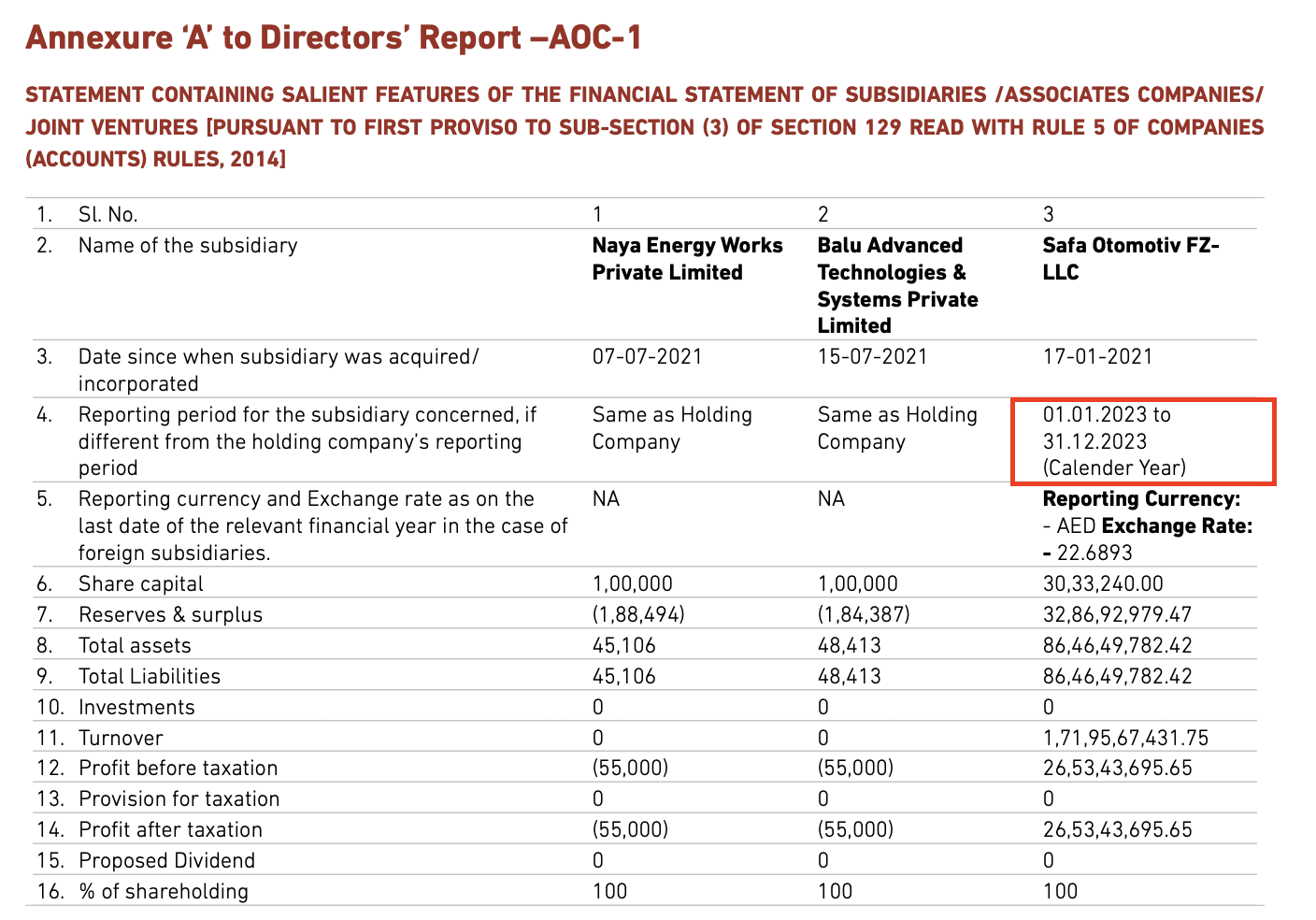

FY23 AR: SAFA reporting period = Apr 2022 – Mar 2023

FY24 AR: SAFA reporting period = Jan 2023 – Dec 2023

Means Jan–Mar 2023 revenue included twice, once in FY23 and again in FY24. Not sure what the independent Auditors of the holding company (Balu Forge) are doing. 🤷🏼♂️

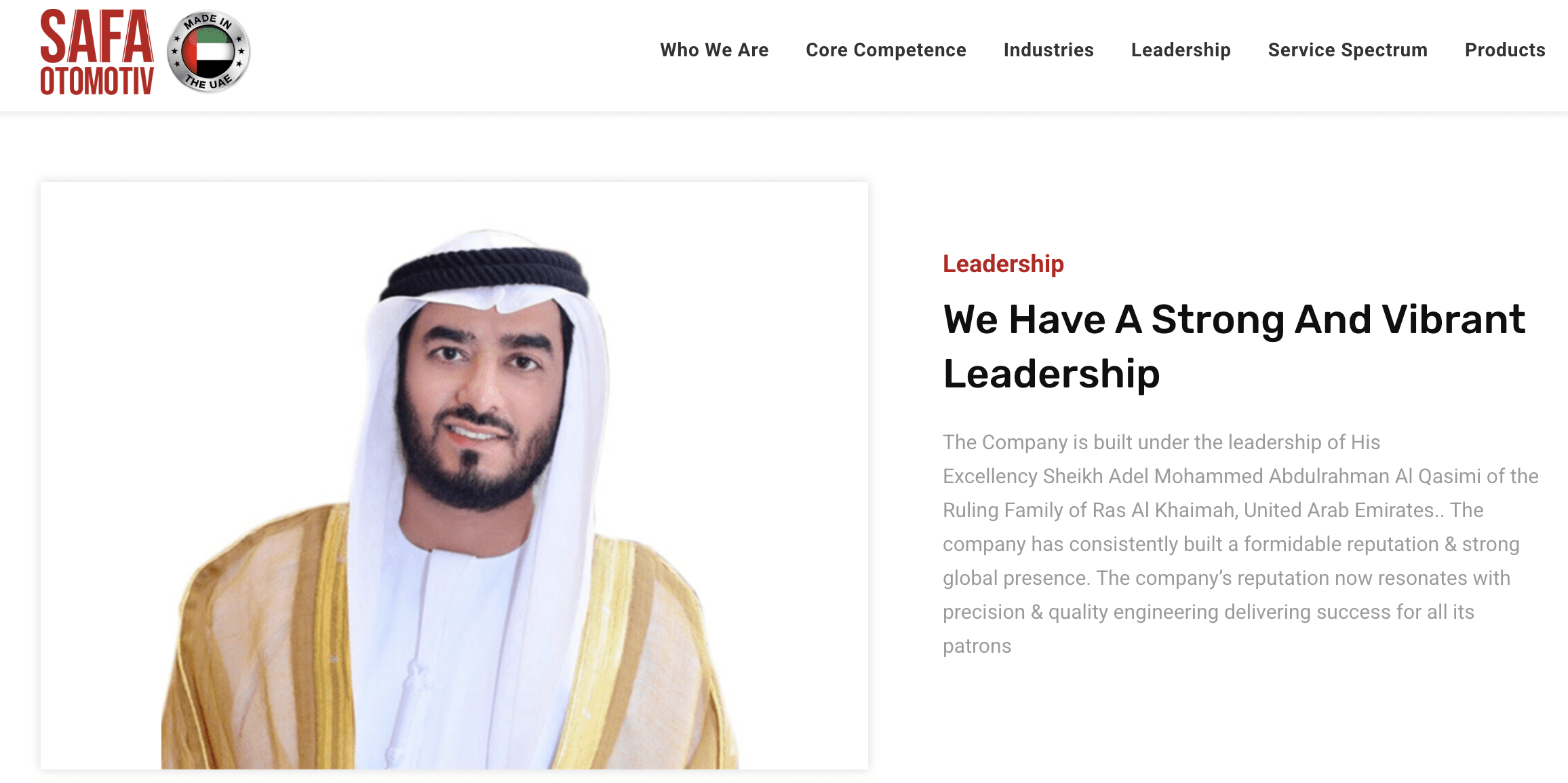

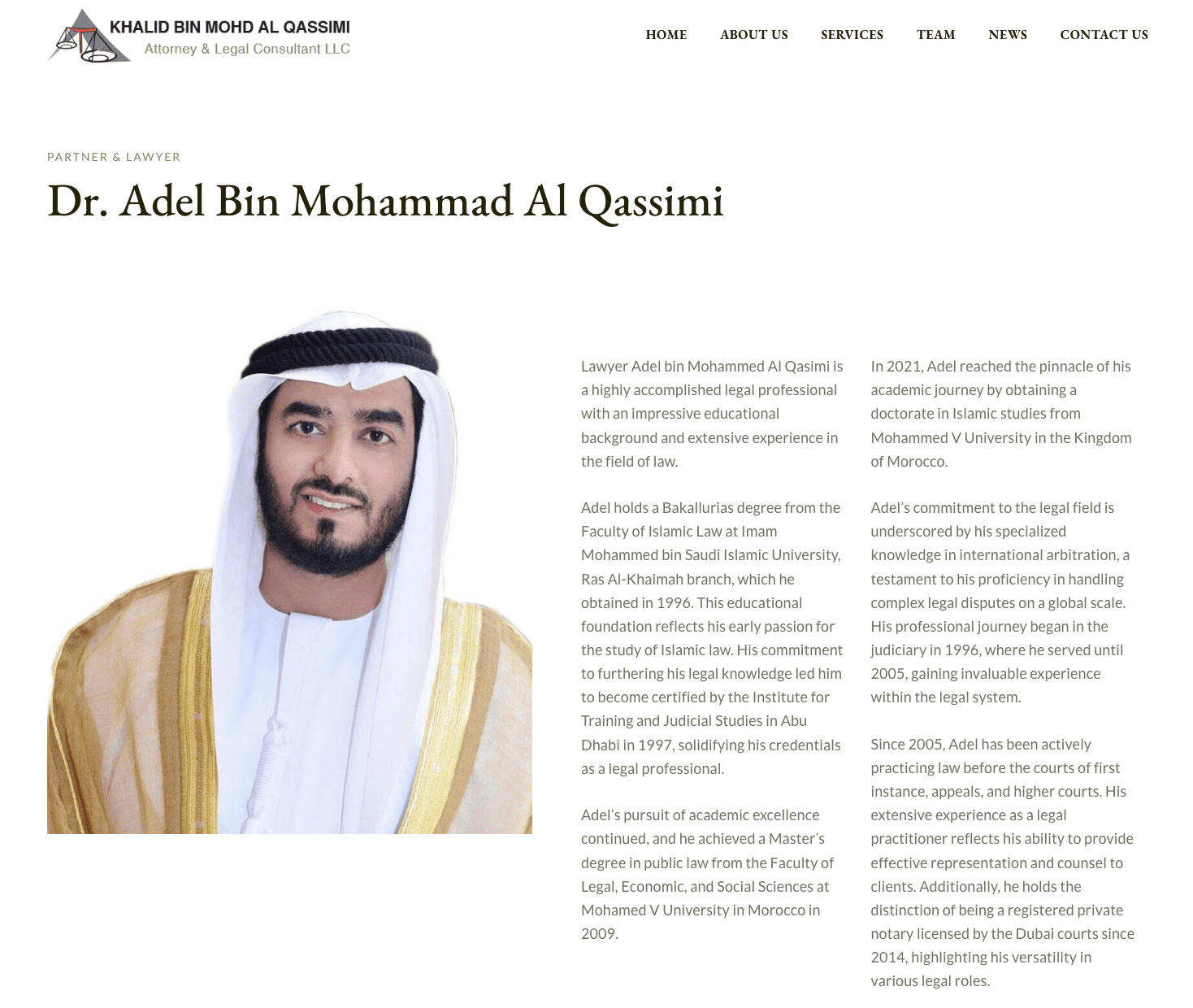

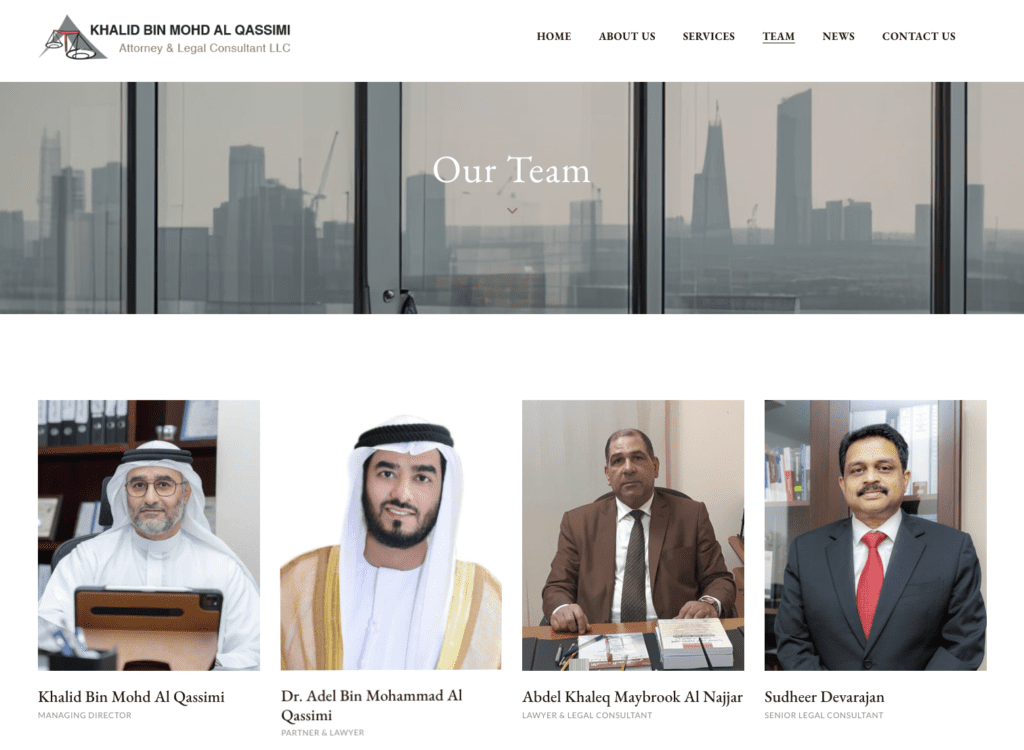

3. Questionable Leadership Profile

Leadership section of SAFA Otomotiv shows a Royal Family Member – SAFA Otomotiv Leadership Page

Same Person is a Lawyer 🤔

Same individual shown here as a seasoned lawyer – KMQ Legal Profile – Amir L

No mention of this person in any of the annual reports of Balu Forge. Strange 👀

The other two subsidiaries – Naya Energy Works Private Limited (incorporated on 7th July 2021) and Balu Advanced Technologies & Systems Private Limited (incorporated on 15th July 2021) – have no revenues.

Balu Forge Industries generated outstanding returns for us in last 2 years (From 800 Cr Mcap to almost 9700 Cr Mcap at the top) almost 12x, let's say we were lucky, but their unsatisfactory response has triggered us to do a deep dive into their subsidiaries, and due to the above pointers we have lost all confidence in staying with this company.As a result, we’ve decided to exit our entire position and say goodbye to Balu Forge Industries!

See you next time.

Until then… Stay Prudent!

Disclaimer: This post is intended to disclose all our latest thoughts. Please take an independent buy/sell decision. Peace!

Respected Prudentparrot owners….

Some of queries as naive investor …

1. Do u think about mailing them once again regarding all the discrepancies that arose amidst of recent years ???

2. What is that ED jaipur holding in govt. holding???

3. Exit call is gut feeling or these fradulent acrivities that are getting worse day by day???

Last but not least… Following u since one month but my intuition says u guys are really a blessing…

Thanks & regards…

1. We as small individual investors could find the posted discrepancies. Don’t you think the auditors (both internal and independent) should have been aware of these? They have been ignoring Concall requests from many investors, not just us. Also, please check how they have copy pasted a boiler template for our queries. We don’t think mailing them again would make any difference.

2. We believe this is Tibrewal’s ceased holding by ED Raipur.

3. All the above discrepancies/ irregularities are enough to get away from the company. This is very important for our peace of mind.

Lastly, thank you for believing in us. Your trust is what motivates us to do our job properly.

You should have given credit to the original person who found this discrepancy and told everyone on twitter.

Please let us know who is the original contributor.

This twitter handle called – Variance highlighted this first.

This was our tweet on 16th April 2025.

In uae if any nri need to establish his business he has to incorporate local uae person .without being included no nri can do business. Either u have to pay them dirhams or percentage of your share.

My immediate relative is doing business with 14 machines and his annual turnover is 400 cr that too in normal city near delhi. Cost of machines approx 21.2 cr bought over the period of ten years. I am not saying u r wrong . But it is better to take exit if u r doubtful

You’re running a paid platform but didn’t even conduct basic financial checks. Meanwhile, your founder was busy on social media with his “Balu this, Balu that” routine. Now that an independent analyst flagged the issue, you simply rebranded his finding and passed it off as your own.

Maybe spend less time drawing Trendlyne on charts and more time actually reading a balance sheet..

Just to clarify — our Tweet dated 16th April 2025 on Balu Forge clearly raised concerns about the numbers and even mentioned that they might be fudged. This was well before the independent analyst’s thread.

We’ve never rebranded anyone’s work. The SAFA subsidiary and its unusually high fixed asset turnover had been bothering us for a while, and we flagged it publicly. Happy to see more people digging in — that’s the whole point.

Ignoring all the concerns raised was an option but we felt accountable so we tried to dig deeper and showcase our findings to everyone who have been associated with us.

Pretty Good work Team Prudent Parrot. Interesting findings relating to their subsidiary based in UAE. Never saw anyone on twitter highlighting any concerns with their UAE based subsidiary SAFA. Keep it up.

Have been folowing you & after seeing this post I sent email to company for clarification. I also checked audited statements of subsidiaries of other companies as well, I noticed the other company subsidiary statements also do not have signatures on them.

Please see below company reply,

”

Good Evening,

We acknowledge receipt of your email & the queries therein,

Please kindly find below our detailed feedback in reference to the same point wise:

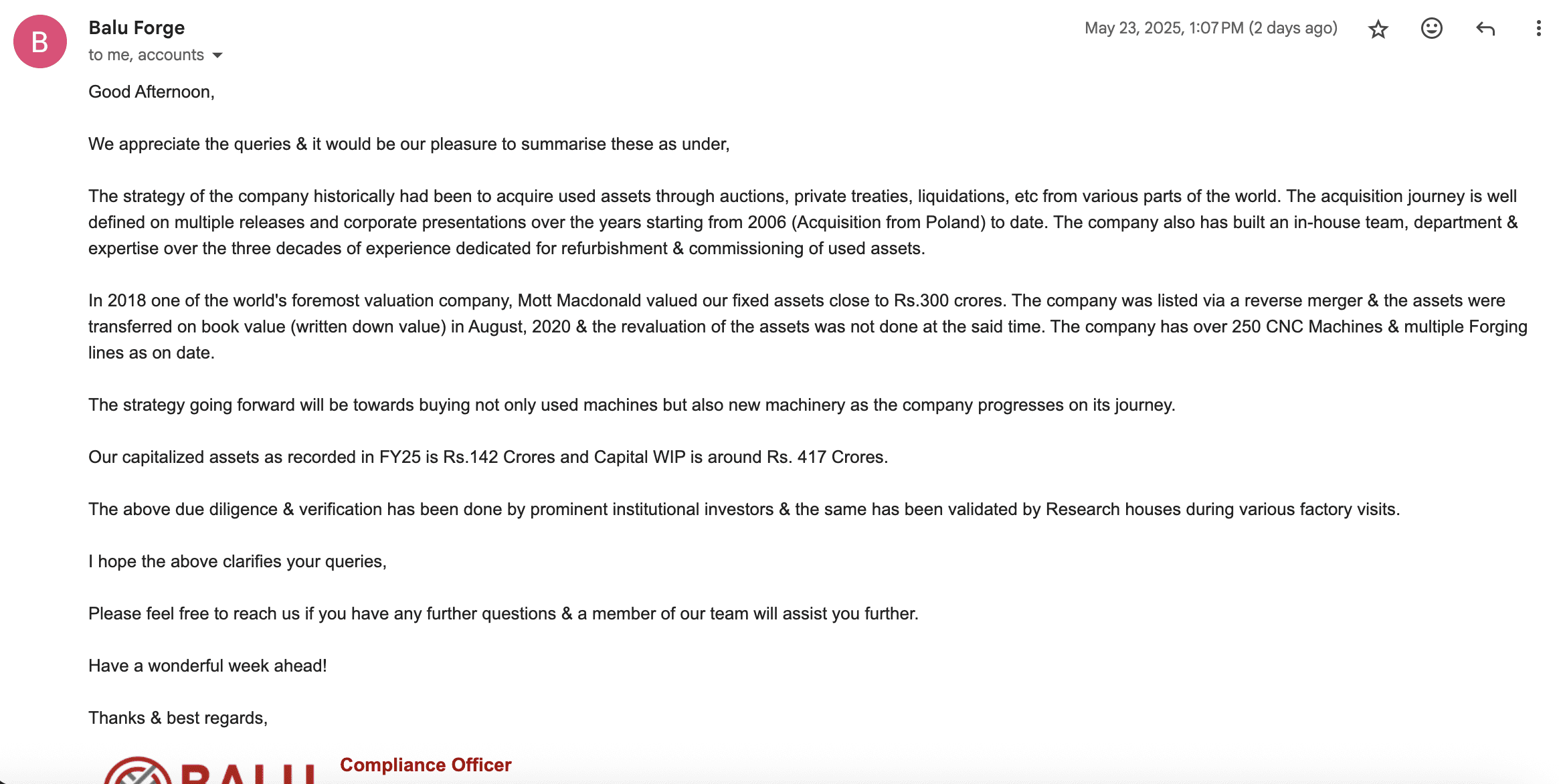

Revaluation of assets

The company has not revalued its Fixed Assets (i.e Plant and Machinery) as the Indian Accounting Standard (IND-AS) allows to book fixed assets at amortized cost or at original acquisition cost less accumulated depreciation i.e WDV value. There is no mandatory requirement in companies act 2013 to record the Fixed Assets at revalued amount. Even if we do the revaluation of fixed assets now the income tax law will not allow depreciation on the revalued amount. Therefore, our Fixed Assets i.e plant and machinery stand at WDV value.

There are no vague figures & there is a Mott Macdonald valuation report which supports the same. We have added the executive summary screenshot below for your easy reference,

I AM UNABLE TO UPLOAD THE IMAGE ON THE BLOG

Note: Balu India was reverse merged to form Balu Forge Industries Limited

Safa Otomotiv asset turnover & business

At Safa Otomotiv we are predominantly doing assembly of half engines/short blocks which are inputs as sub-assemblies for larger OEM & aftermarket players. The items are purchased from a number of suppliers & assembled to serve the customers. The complete machinery required for an assembly process is an assembly line, testing equipment & a few machining centres. An assembly line for such an assembly does not require a large capex. There was a press release done on 14th March, 2023 explaining clearly the business of sub-assemblies. At the onset of the subsidiary, there was a plan to have a production line which was changed in due course to an assembly line as new orders were received to that effect.

The website of Safa Otomotiv was last updated in 2021 & the new updated website will be going live very soon as it is nearing the completion in the development phase.

In reference to the leadership role, the image is from January, 2021 where we had onboarded His Excellency Sheikh Adel Mohammed Abdulrahman Al Qasimi to assist at the time of inception. The role was limited to the inception phase & there was no key role allotted to him. There is no need to mention the same in the Balu Forge annual report. The image with the management that is taken from Social Media platforms of Balu Forge Industries Ltd & is from the inception phase as well (early 2021).

In reference to the audit firm used, the address on the website is the current office address of the company & the address of the subsidiary financials from last year is of the previous office where the company moved to from to their new office.

Regarding the certification of foreign subsidiary financials

The financial statements of the foreign subsidiary of the company uploaded on the website is an audited financial statement and has been uploaded in compliance with the SEBI LODR regulations 2015.

Regarding revenue Overlap/double counting queries

In reference to the revenue double counting, there is no revenue double counting done.

Pursuant to the provision of section 129 of the companies act 2013 the format of AOC 1 is as per the prescribed format given in the act.

Further the reporting period for the subsidiary concerned is required to be mentioned as per the prescribed format, but the figures mentioned in relation to share capital, reserves & surplus, total assets, total Liabilities, investments, turnover, profit before taxation and Profit after taxation in the Annual report of FY 2022-23 is related to FY 2022-23 only (April 1st to March 31st) and in the Annual report of FY 2023-24 is related to FY 2023-24 only (April 1st to March 31st). The reporting period for Safa Otomotiv is the calendar year.

I hope we could clarify your concerns as we aspire to be as transparent as possible with all our shareholders at all times. If you have any further concerns or if we may have missed any specific concern, it would be our pleasure to clarify the same as well.

Thanks & best regards,

“