About the company

Bansal Roofing Products Limited (BRPL), Mcap 80 Cr laid down its roots in the year 2008. After a successful business run, it got listed on BSE SME Platform on 14th July 2014 and migrated to the Mainboard of BSE on 14th December, 2021. It is a dedicated manufacturer of Pre- Engineering Building (PEB) and all kinds of Roofing Products and accessories.

Business Verticals:

- Roofing Solutions and Accessories

- Pre-Engineered Buildings

Revenue mix:

Geographical Mix:

- Domestic – 99%

- Export – 1%

BRPL – Roofing Solutions

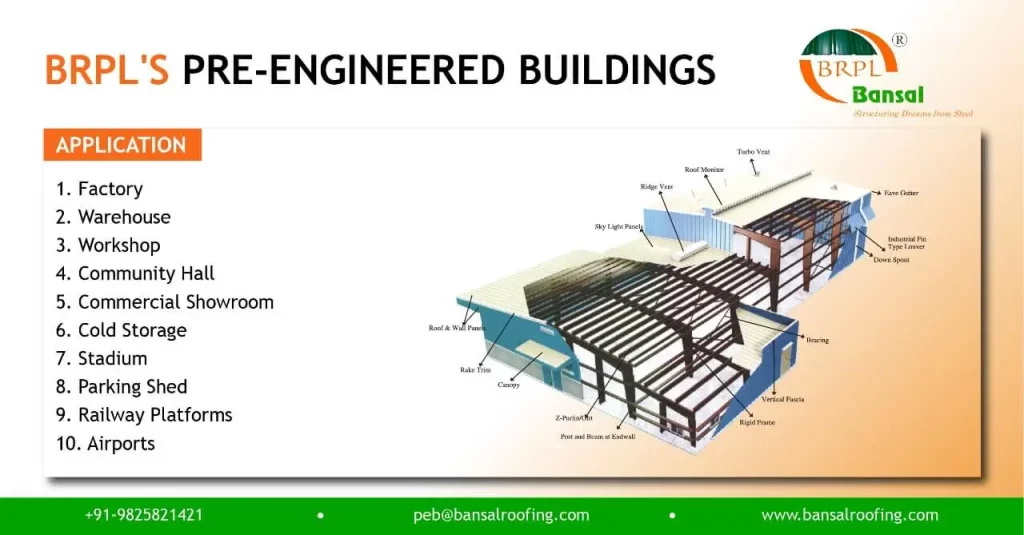

BRPL – Pre-Engineered Buildings

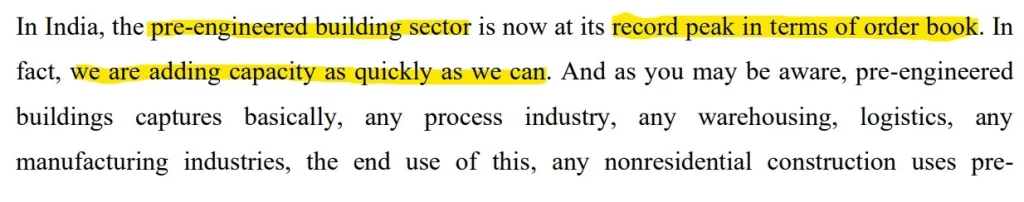

PEB Market

The Indian pre-engineered buildings (PEB) market is growing rapidly, driven by government initiatives for manufacturing and infrastructure development. PEBs offer advantages such as shorter construction time, cost-effectiveness, and mobility. The global PEB industry is projected to grow at a CAGR of 10% during 2023 – 2028, with Asia Pacific leading due to economic growth and urbanization. Warehousing is a significant segment boosting PEB demand. PEBs provide wide space, fewer columns, and high material reusability. The global PEB market is expected to reach USD 24.4 bn by 2028

As per our discussion with an expert in the Industry, the PEB industry in India has seen significant growth, with a CAGR of over 30% in recent years. This growth is driven by government support, policies, schemes, and market cash flow. The industry is expected to maintain or surpass this growth in the upcoming year, although actual growth rates may vary depending on various factors.

Advantages of PEBs:

- Cost-effectiveness

- Faster Construction

- Design Flexibility

- Durability

- Versatility

- Low Maintenance

PEBs have a wide range of applications from showrooms, commercial complexes to exhibition centers, and railway stations.

BRPL follows International Design Standards to manufacture steel buildings.

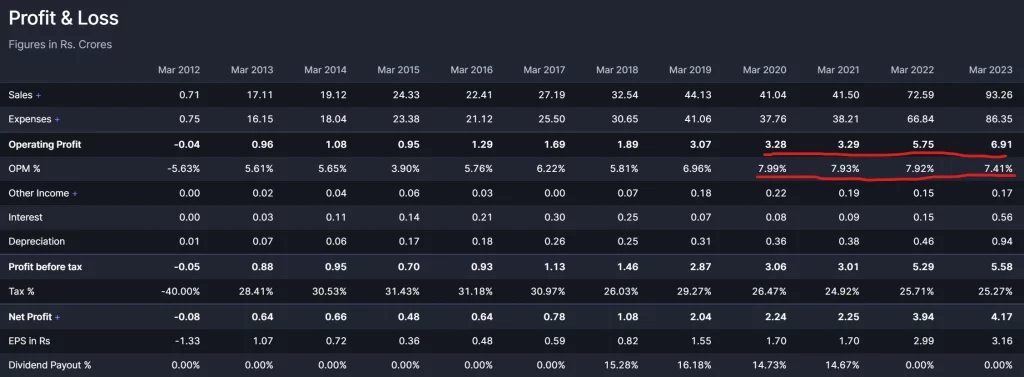

BRPL – Financials

Operating Profit more than doubled in last 3 years. Margins are also at the highest level in last 10 years.

Some Interesting Pointers for an 80 Cr Mcap Company:

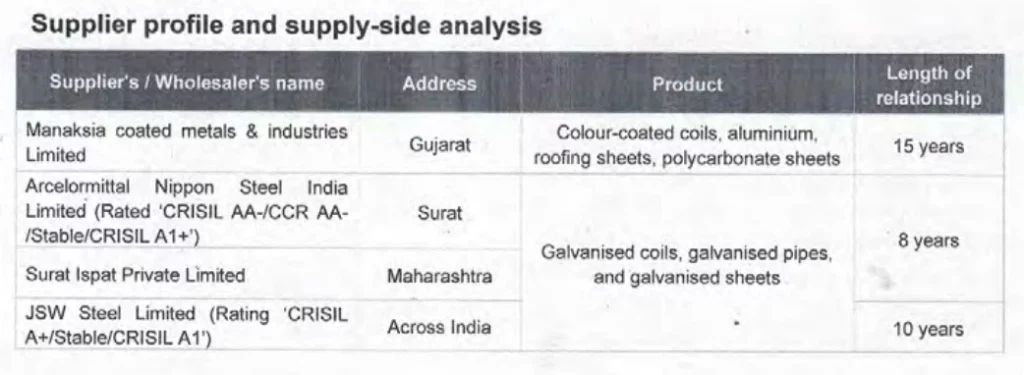

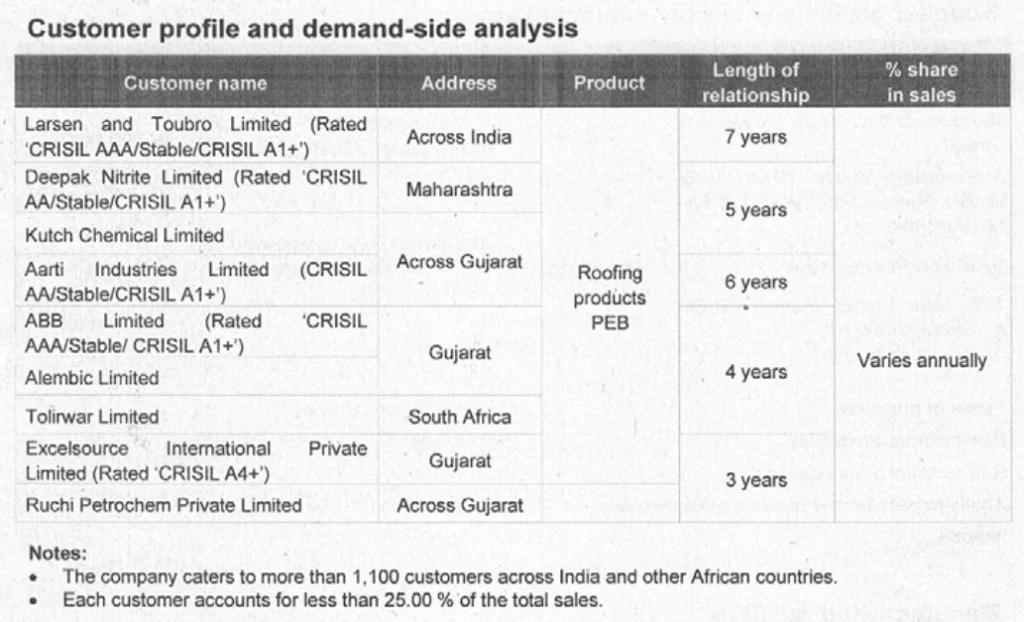

As evident from the above snippets from CRISIL Credit Report, they are committed to and able to maintain very long term relationships with their suppliers and customers.

Company’s liquidity and efficiency of its working capital management – indirectly reflects their quality of earnings.

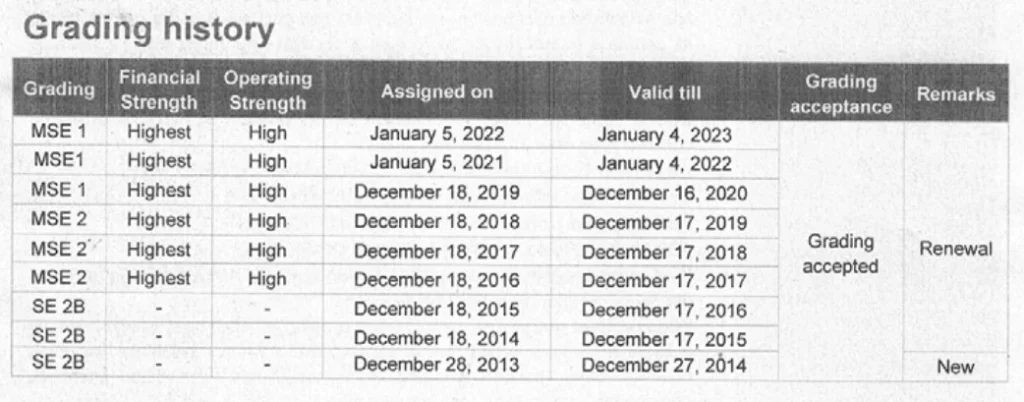

BRPL have consistently improved their credit rating from CRISIL. From SE 2B to MSE 1 (Highest Creditworthiness in relation to other MSEs).

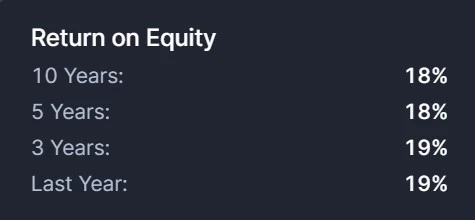

BRPL have been able to maintain a consistent ROE over the last decade.

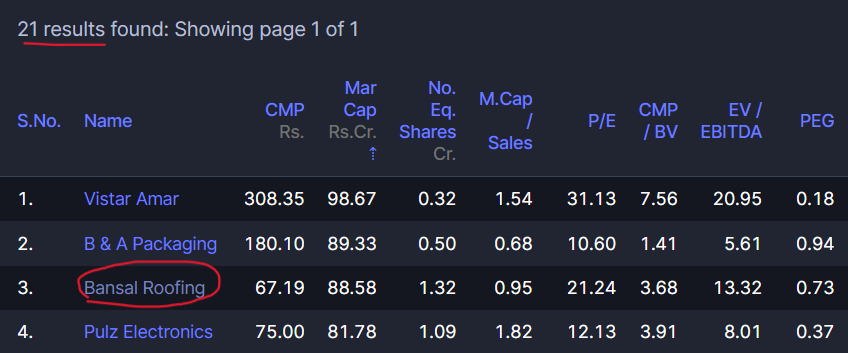

Out of the 6k+ companies listed in both exchanges, we have found only 21 companies under 100 Cr Mcap that have maintained an Average ROE >= 17%, Average ROCE >= 20% over the last 10 years.

Growth Triggers

- Production started in Unit II Phase 2 and expansion started for Unit II Phase 3.

- Focus on high Margin and high ROCE products.

- BRPL plans to increase their exports.

- Increased focus on PEBs.

- Plans to further increase productivity by 30-40%.

- In the process of enhancing capacity utilizations.

- Current Capacity of PEBs stands at 600 MT per month. Plans to reach production capacity of 2000 MT per month.

BRPL – Clients

What we like?

- Experienced Management Team with over 20 years of experience.

- One-stop solution for steel structures, shed and roof coverings.

- Focus on high margin products and capacity utilization.

- Strong and long-standing relationships with customers and suppliers.

- BRPL manufactures 95% parts of its PEBs

- High credit worthiness by CRISIL (MSE -1 rated)

What we don’t like?

- Management over-estimated its revenue to reach 100 Cr by FY18 in its listing ceremony

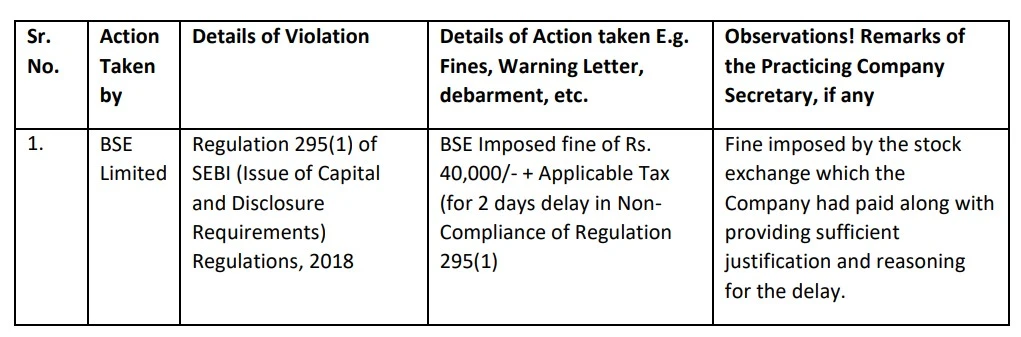

- Company had faced a compliance issue of Capital and Disclosure Requirements in 2018

Some interviews you may go through:

See you next time.

Until then… Stay Prudent

Also read:

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

Just chanced upon your Twitter account and read one of your write up on a micro cap. And really liked it.

I hold some shares of Amba, Marine,

Just want to learn.

Thank you .

Thank You

Insightful