When you’re into investing, you’ve probably heard people compare the stock market to a wild rollercoaster. And that’s even more accurate when we talk about microcaps and nanocaps – those super small companies that nobody seems to notice because they’re, well, really tiny. While the market may overlook them, these companies can sometimes hold remarkable potential for investors. Today, we’ll delve into a real-world example of such potential, focusing on Carysil, formerly known as Acrysil.

The Temptation to Disregard

The journey of investing in microcaps and nanocaps can be a treacherous one. It’s easy to dismiss these small players, especially when they appear to be struggling or their prospects seem dim. However, one cardinal rule of investing is never to make a hasty decision based solely on a company’s current condition. As the saying goes, “You never know what the future holds.”

Carysil’s story serves as a compelling testament to this notion. Back in 2013, this company had a market capitalization of a mere 53 Crores, Ayush Mittal and Pratyush Mittal wrote about this company in their blog dalal-street.in

At that time, a user with the username “ROFL” raised questions about the integrity of Carysil’s promoters, alleging wrongful claims of exclusivity. Concerns like this may arise when researching small companies, but it’s important not to dismiss the idea entirely just because you think it might not be true.

Catching Promising Signals

Instead of blindly ignoring or avoiding such situations, savvy investors should pay close attention to the signals emanating from the company’s management. The management had big plans and ambitions for the company, which they articulated in their first-ever investor presentation in FY17.

These plans were ambitious, and the market awaited with bated breath to see if Carysil could deliver. At this point, investors faced two possible scenarios:

Failure to Deliver: If the company couldn’t meet its ambitious goals, it wouldn’t be the end of the world. In such cases, it’s prudent not to allocate a significant portion of your capital. In fact, it’s often best to wait on the sidelines until the company proves it can “walk the talk”

Delivering on Promises: If Carysil started achieving the targets set in its investor presentation, it was a clear signal that the company had potential. In such cases, investors should consider increasing their allocation as their conviction in the idea grows.

The Carysil Transformation

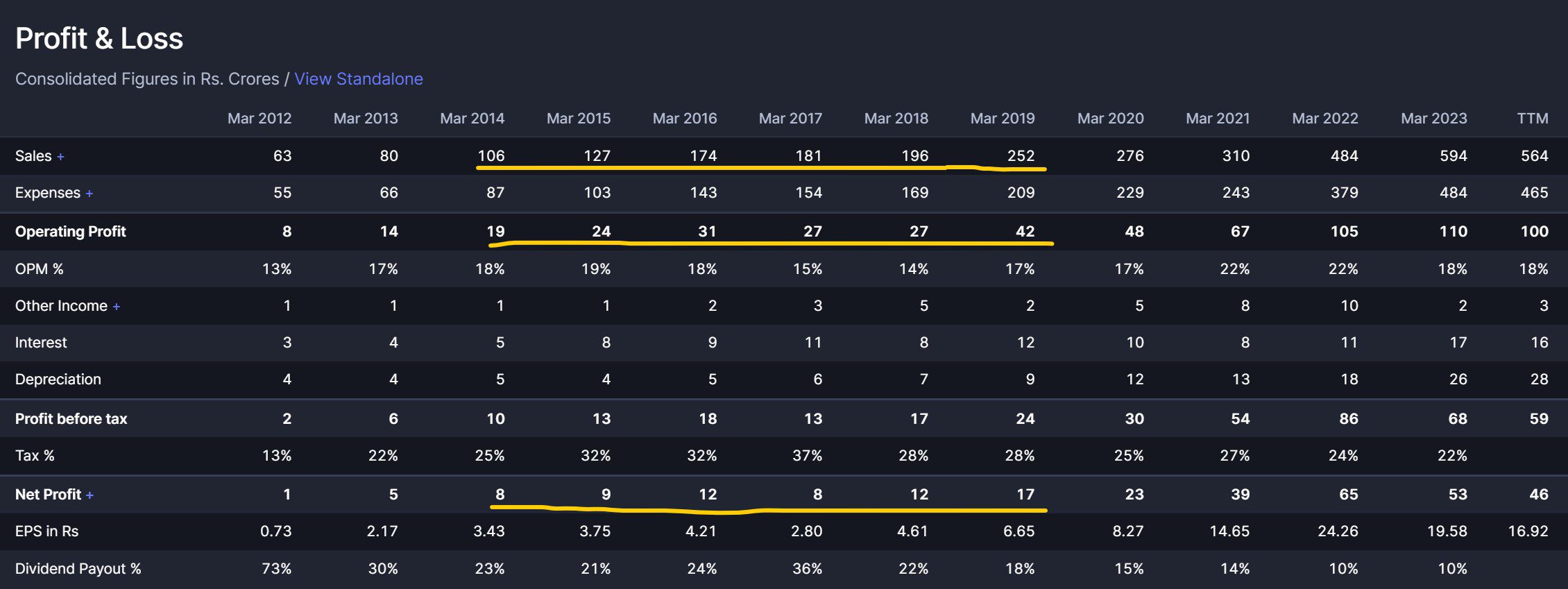

Between 2014 and 2019, Carysil’s stock price appeared stagnant, seemingly going nowhere. However, behind the scenes, something remarkable was happening. The company’s revenue was quietly growing from 106 Crores to 252 Crores in just six years, achieving a commendable CAGR (Compound Annual Growth Rate) of 15.5%. The bottom line followed a similar upward trajectory, with a CAGR of 15%.

For 65 consecutive months, the stock price remained stagnant. However, in the subsequent 23 months, the stock delivered remarkable returns, exceeding 700%, and soaring over 1500% from its lowest point during the Covid pandemic.

Fast forward to the present, and Carysil is now valued at 1500 Crores in terms of market capitalization, with a revenue of around 600 Crores in FY23. The company has set its sights on reaching the 1000 Crore mark by FY25. This remarkable transformation serves as a testament to the potential hidden within microcaps and nanocaps.

Final Thoughts

Carysil’s journey is a great example of why patience and good research matter when you’re dealing with tiny stocks. Investing in these little guys can be risky, but it can also pay off big time. When you’re diving into the world of microcaps and nanocaps, keep in mind that it’s not just about where a company is today, but where it could go tomorrow. The story of Carysil is a reminder that sometimes, the most significant gains come from the smallest of stocks.

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

Also read:

q2 should be good.