What is a Cash Flow Statement?

The Cash Flow statement is one of the three key financial statements that tell us about a company’s financial health, the other two being the Balance Sheet and Income/ Profit & Loss Statement. The Cash Flow statement outlines a company’s cash inflow and outflow, shedding light on where the money comes from and where it goes. This statement is key in evaluating a company’s financial health, showing if it can cover its expenses, debts, and investments.

Why the Hype?

The Cash Flow Statement gives investors a clear view of a company’s cash position showcasing whether it can meet obligations, invest in its growth plans, and maintain operations. It’s a good practice to analyze the Cash Flow Statement if you are looking to invest in a certain company as it reflects the real cash health of a company beyond reported profits.

Note: Cash inflow can differ from revenue in different ways (we’ll discuss that in a later article).

Key Components

There are three major components of a Cash Flow Statement:

- Cash from Operating Activity (CFO) – Reflects cash generated or used in core business operations, like sales, production, and expenses.

- Cash from Investing Activity (CFI) – Shows cash flow from investments, such as buying or selling assets, stocks, or bonds.

- Cash from Financing Activity (CFF) – Illustrates cash from financing, like borrowing, repaying loans, or issuing stock.

Cash Flow from Operating Activity

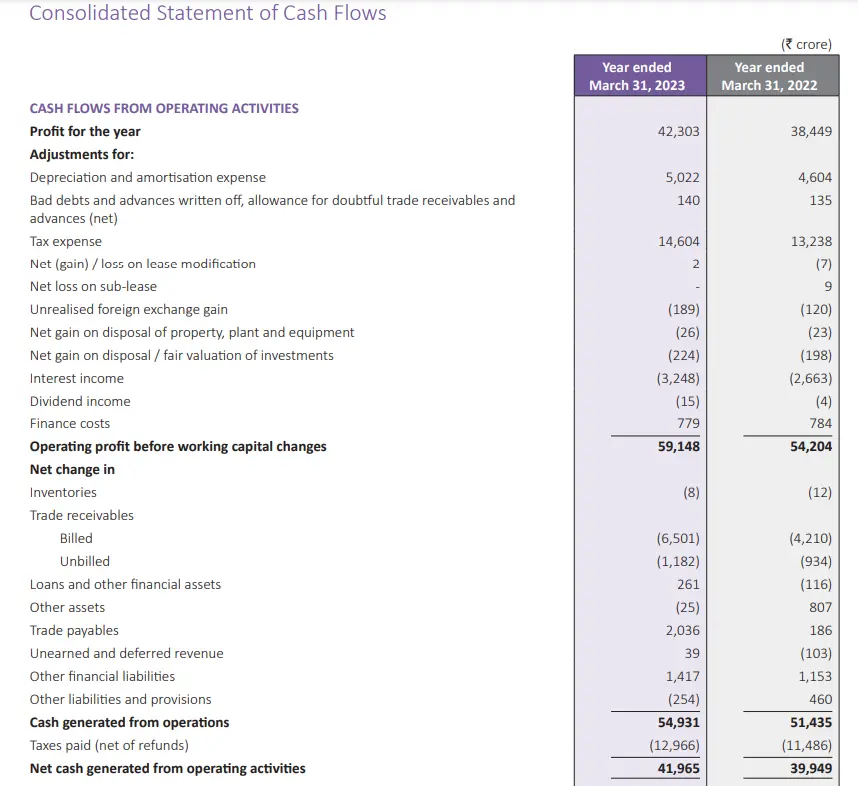

This section provides a detailed insight into a company’s core business cash flows. Let’s break down the key line items using the Cash Flow Statement of Tata Consultancy Services (TCS) as an example:

- Profit from Operations: This component tells us how much profit the company has earned from its core business activities (the business in which the company is involved). In our example, TCS has shown an increase in its Profit from Operations from last year.

- Depreciation and Amortization: Depreciation is the wear and tear of a physical asset owned by the company over the years. Amortization is similar to depreciation but applies to intangible assets like trademarks, copyrights, patents, etc. This is a non-cash expense which means that it doesn’t involve any cash payments.

- Tax Expense/ Deferred Tax: This is the tax the company expects to pay based on its earnings during the financial year.

- Net gain/ loss on disposal of property, plant, and equipment: It reflects the amount the company gains or loses when selling off its assets. It is shown as negative (in parentheses) because it is not directly related to the business operations, but it is accounted for in the net profit (1st line item). Hence, it is deducted to calculate the actual cash from operations.

- Interest income, Dividend income, and Finance costs: These items are again deducted here because it doesn’t involve the day-to-day operations of the business.

After this, we have adjustments for working capital change. Working Capital is obtained by simply deducting the Current Liabilities from the Current Assets. Here, current means the current financial year. In this part, the key items are:

- Change in Inventory: As we know, Inventory is unsold products. So when inventory increases as compared to last year, the cash goes out of the company’s hands. Therefore, it is represented as a negative figure. Similarly, if the inventory decreases, we would represent it as positive.

- Change in Trade Receivables: Trade Receivables are products sold on credit i.e. the product has been delivered to the customer but the payment is yet to be received. When a product is sold (on credit or cash), it is shown in the Net Profit. But for products sold on credit, the company has not yet received the cash. Hence, it needs to be adjusted in the Cash Flow Statement. If the company is selling more products on credit than last year, then we show it as a negative figure and vice versa.

After these adjustments, we derive the net cash generated from operating activity. This figure signifies the actual cash earned by the company from its operations during a financial year.

Check out the second part where we will discuss CFI and CFF.

See you next time.

Until then… Stay Prudent!

I go through your article about cash flow statement. And the way you explained it is really very nice.thanks a lot keep posting this kind of article about fundamental analysis.will be beneficial for our investing journey.

In very simple language great explanation. I would suggest one more thing – just explain screener.in cash flow.

Thanks !!

Sure, we will try to make a short article on that as well

Very interesting subject, thanks for putting up.