We have previously discussed the intricacies of Cash Flow from Operations (CFO) in our article – Decoding Cash Flow Statement. If you haven’t read it, you must go through that article first to make sense of this discussion.

Now, let us explore the rest of the two key components:

- Cash from Investing Activity (CFI) – Shows cash flow from investments, such as buying or selling assets, stocks, or bonds.

- Cash from Financing Activity (CFF) – Illustrates cash from financing, like borrowing, repaying loans, or issuing stock.

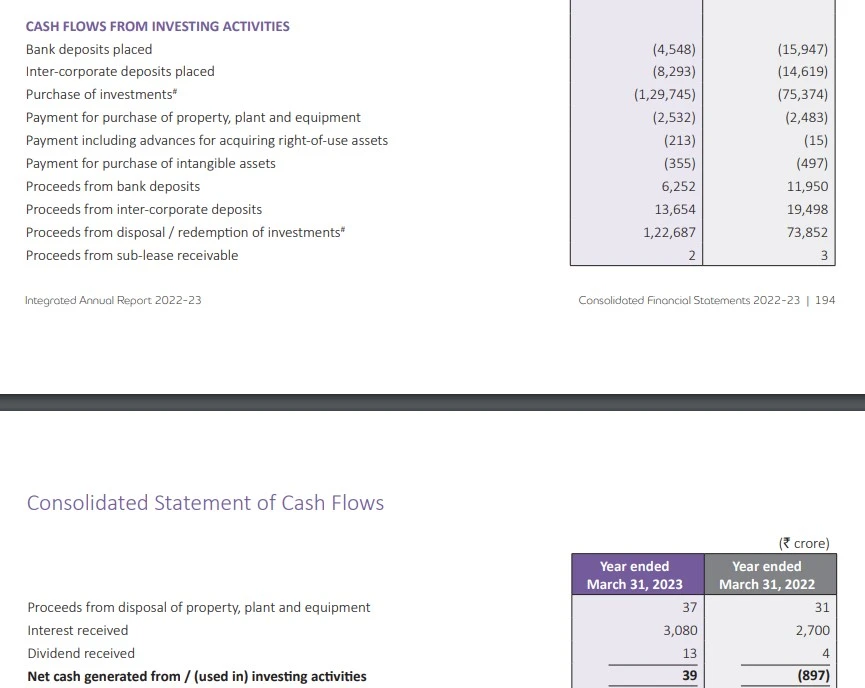

Cash Flow from Investing Activity:

This section focuses on the transactions involving long-term assets that affect the cash inflows and outflows of the company. Let’s break down the key line items using the Cash Flow Statement of Tata Consultancy Services (TCS):

- Bank and Inter-Corporate Deposits Placed: When the company parks funds in a bank/ financial institution or another company, it signifies either an investment for expected interest income or an investment in a financial instrument issued by a corporate entity which can be through ownership stake, equity or debt. This is generally shown as a negative figure because it involves the outflow of cash.

- Proceeds from Bank and Inter-Corporate Deposits: Conversely, when the company withdraws funds or receives interest income, it is depicted as a cash inflow.

- Proceeds from disposal/ redemption of investments: This indicates the cash received from selling investments.

- Purchase of Property, Plant, and Equipment (PP&E): This reflects the cash outflow when a company makes a payment to buy fixed (physical) assets like lands, buildings, machinery, etc.

- Proceeds from disposal of PP&E: This reflects the cash inflow from selling or disposing of physical assets.

- Other items like Interest earned, dividends received, loans extended to entities, and sale of business units are also included in this section.

A valuable tip: The allocation of cash into the company or external investments can reveal strategic intentions. A company heavily investing most of its cash in its own growth signals future expansion/ growth plans. On the other hand, significant investments in external entities would require extensive research to understand the motive behind such decisions and evaluate their impact on long-term prospects.

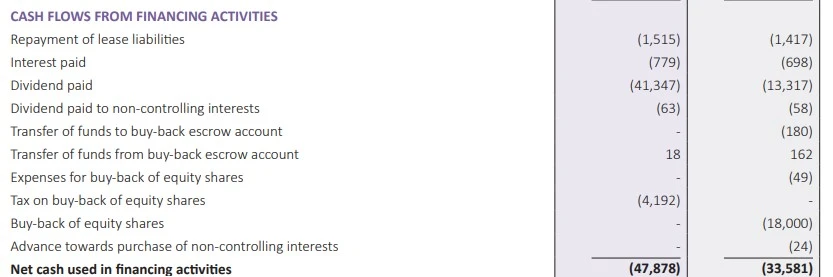

Cash Flow from Financing Activity:

This section zeroes in on the cash transactions utilized for funding the company. It involves the transaction between the company and the creditors. Let’s break down the major line items:

- Repayment of lease liabilities: This refers to the payments made by the company towards lease obligations for assets like buildings, machinery, or vehicles.

- Interest paid: Represents the interest paid by the company on the outstanding debt, also known as the cost of borrowing.

- Dividend paid: This indicates the cash payments made to the shareholders in the form of dividends.

Non-controlling interests are the parties who hold a minority stake in the company or its subsidiary. The dividend paid to these parties is mentioned under “Dividend paid to non-controlling interests”. - Buy-back of equity shares: This reflects the cash used to repurchase the company’s shares from the market. The expenses and taxes involved in these transactions are mentioned under their respective heads.

Upon summing up the net cash from operating, investing, and financing activities, we arrive at the net change in cash and cash equivalents. Adding this figure to the cash at the beginning of the financial year (cash at the end of the previous year), we get the cash at the end of the current year.

Calculation of Free Cash Flow

To derive the Free Cash Flow, we simply deduct the Capital Expenditure(investments in the company in the form of buying fixed assets) from the Net CFO.

In our example, FCF = 41,965 Cr – 2,532 Cr = 39,433 Cr.

This signifies the amount of available cash for various purposes as deemed fit by the management. This may include dividends, reserves, or repurchasing of stocks.

If you found this concise lesson on the Cash Flow Statement beneficial, feel free to share your thoughts in the comments section.

See you next time.

Until then… Stay Prudent!

Also Read: