Introduction

India with its $3.9 Trillion economy, is currently the fifth largest in the world. By 2027, it is expected to become the third largest, boasting a $10 trillion economy. This transformative growth is underpinned by significant investments in infrastructure development, laying the foundation for India’s remarkable growth story. Here, we have discussed 7 key sectors that are well-positioned for significant growth in the next decade.

Once known as the “Sone ki Chidiya”, India, is on the verge of positioning itself as a potential superpower. This is fueled by one of the youngest working populations globally.

Several other key factors are driving India’s growth. The manufacturing sector is transforming rapidly, the capital expenditure cycle is back on track. And the country’s positive geopolitical stance is creating favorable conditions. These elements, among others, are setting the stage for India’s flight to new heights.

In April 2024, the IMF (International Monetary Fund) raised India’s growth projection to 6.8%, surpassing China’s growth projection of 4.6%. Investment banking firm Jefferies predicts that India will become the third-largest economy by 2027. They also expect the stock market cap could reach $10 trillion by 2030.

In order to become a superpower, India would need a GDP growth rate of around 10% for a sustained period. This requires significant investments in capital goods from both internal and external sources.

Fueling Growth Through Capital Investments

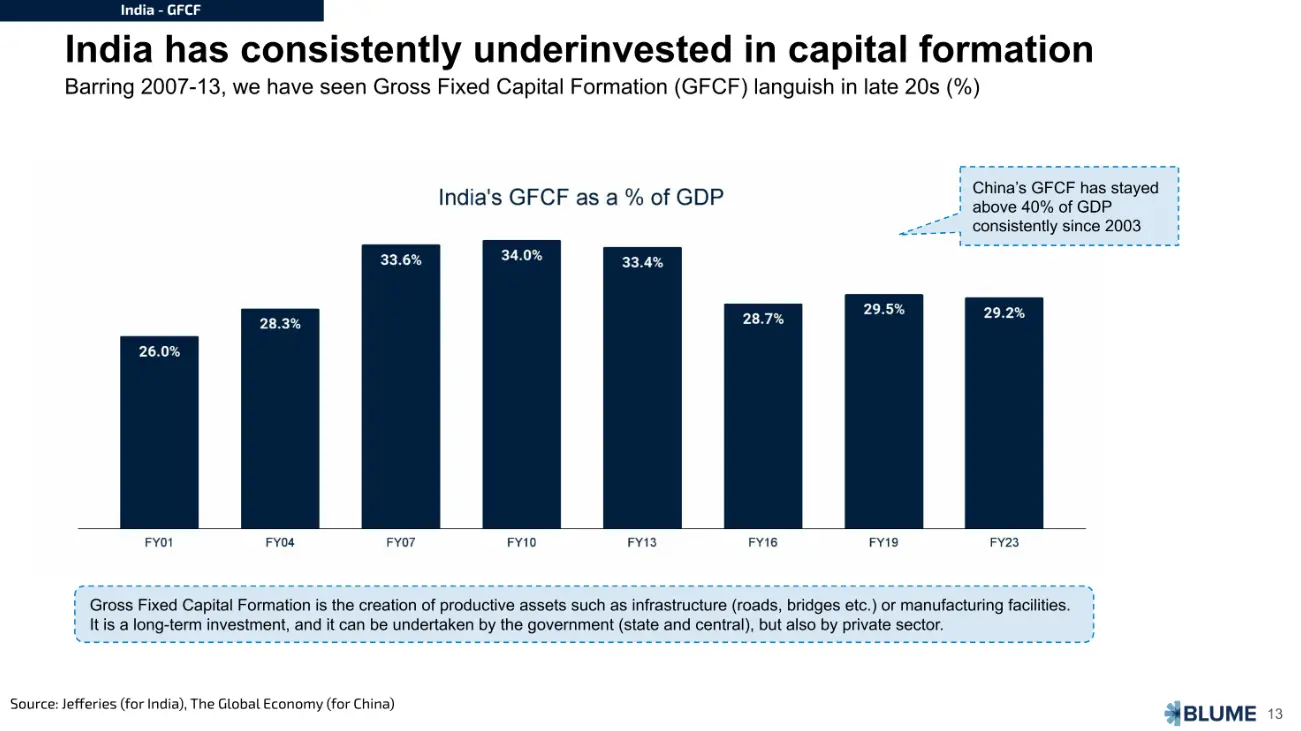

Currently, India invests 28% of its GDP into Gross Fixed Capital Formation. Whereas China has invested over 40% consistently, and for Bangladesh, the number is around 32%.

To bridge this gap, the Indian government has ramped up spending on infrastructure, focusing on sectors like energy, railways, and defense. Initiatives such as Make in India, the National Infrastructure Pipeline, Gati Shakti, BharatMala Pariyojana Project, and the PLI scheme are pivotal in this endeavor. In October 2023, CRISIL reported that India’s infrastructure investments are projected to rise to ₹143 trillion between FY 2024 and 2030. Additionally, private companies are significantly increasing their investments, particularly in energy projects, data centers, and electric vehicles (EVs).

Watch the full video on our YT channel: Youtube/@PrudentParrot

Here are a few capex or infrastructural themes that are well-positioned for future growth:

Indian Railways

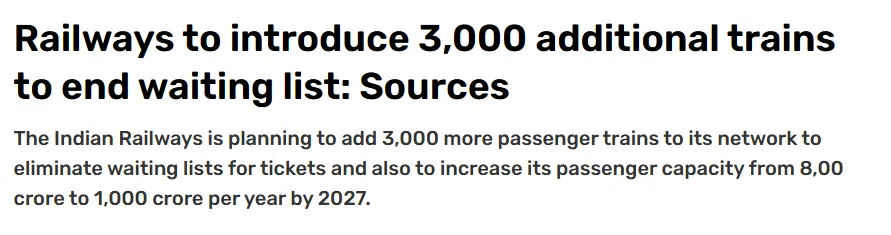

On June 14, 2023, the Government of India signed an MoU with USAID/India to help Indian Railways achieve Net Zero Carbon Emission by 2030. In the next five years, India’s railway market is expected to be the third-largest globally. The government is encouraging private companies to invest in passenger trains and station upgrades, aiming to attract over $7.5 billion. Indian Railways also plans to introduce 3000 new trains, which will increase passenger capacity from 800 million to 1 billion.

Additionally, Indian Railways is improving its technology. They are converting 15,000 km of tracks to automatic signaling. They are also fitting 37,000 km with a Train Collision Avoidance System called ‘Kavach’. These advancements will make travel safer and more efficient.

Road Network

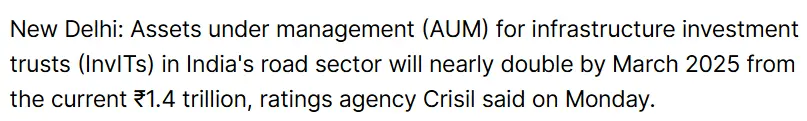

The Government of India has allocated ₹111 lakh crore for the National Infrastructure Pipeline by FY25. The road sector is expected to receive 18% of this capital expenditure. According to the Ministry of Road Transport and Highways, private investments in the highway sector are projected to rise from approximately ₹20,000 crore annually to nearly ₹1 trillion over the next 6-7 years. In the next five years, the National Highway Authority of India (NHAI) is projected to generate ₹1 lakh crore annually from tolls and other sources.

In October 2023, Crisil reported that the assets under management (AUM) for infrastructure investment trusts (InvITs) in India’s road sector are expected to nearly double by March 2025, from the current ₹1.4 trillion.

Marine Ports

The Indian government permits 100% Foreign Direct Investment (FDI) in port and harbor projects. They have also offered a 10-year tax holiday for companies that develop, maintain, and operate ports and inland waterways. By 2035, India plans to invest $82 billion in port projects, aiming to modernize and expand its maritime infrastructure.

Currently, most of India’s transshipment cargo is handled at foreign ports, but this is set to change with the approval of the Adani Group’s Vizhinjam Port as India’s first transshipment port. This strategic move will allow India to attract large container and cargo vessels which will significantly increase port traffic and bolstering the nation’s maritime capabilities.

The government is steering towards Maritime India Vision 2030, aiming to establish world-class mega ports and transshipment hubs. With an estimated investment of ₹1.25 lakh crore, this visionary initiative seeks to transform India’s maritime landscape, enhancing efficiency, and bolstering trade connectivity on a global scale.

Power Transmission & Distribution

The Central Electricity Authority of India (CEA) anticipate a surge in activity within the power transmission and distribution (T&D) sector. The sector is poised for significant growth, with a targeted expenditure of ₹2.4 trillion by FY30. This will equate to an annual market of ₹300-500 billion. An estimated ₹3.3 trillion is expected to be earmarked for distribution by the same fiscal year.

According to reports from CEA and Crisil, a considerable portion of investment is expected to be directed towards the extra-high voltage segment. Both domestic and international demand for T&D products is on the rise. It is fueled by the growing demand for additional generation capacity, driving a surge in demand for transformers.

The capital-intensive nature and lengthy lead times characteristic of the sector creates an entry barrier, restricting competition primarily to established players. This dynamic affords incumbents a pricing advantage, further solidifying their market position.

Manufacturing

The Manufacturing sector is undergoing a transformative shift towards advanced products driven by technology, innovation, and skilled labor. According to a report by Colliers, India’s manufacturing market is projected to surpass $1 trillion by 2025, with Gujarat, Maharashtra, and Tamil Nadu emerging as frontrunners in this growth trajectory.

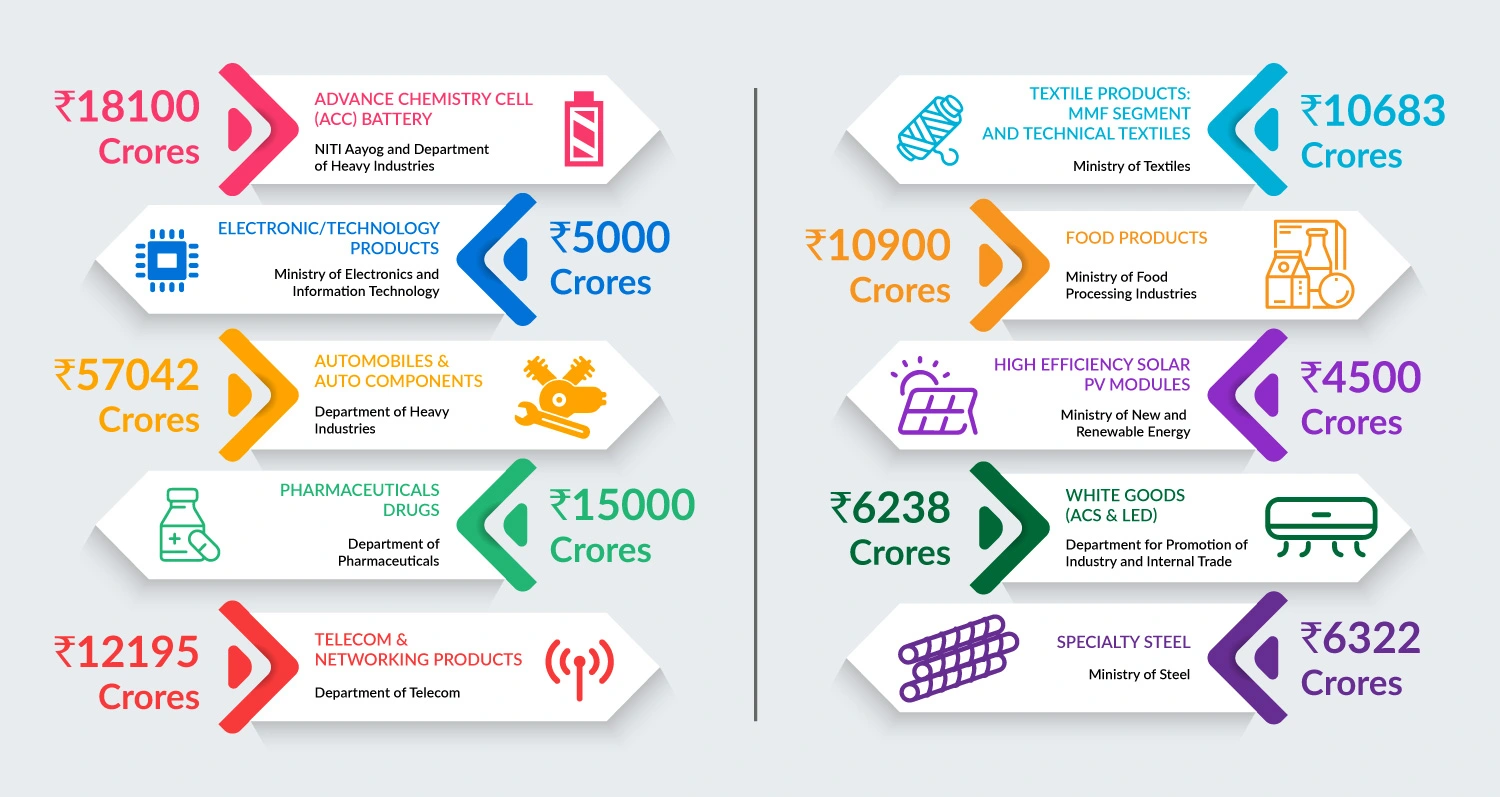

Currently, Manufacturing contributes 17% to India’s GDP, with government initiatives such as increasing FDI inflows and strategic programs like Production Linked Incentive (PLI) and Make in India aimed at elevating this contribution to 25% in the coming years.

Key sectors such as Automobile, Auto components, Electronics Manufacturing, Renewable Energy, and Pharmaceuticals are receiving substantial support, fostering growth, and innovation within the manufacturing landscape under the PLI schemes.

Green Energy

The Green Energy sector stands as a pivotal force, both economically and environmentally, shaping India’s sustainable future. With a targeted goal of achieving energy independence by 2047 and reaching net-zero emissions by 2070, India is charting a path towards renewable energy dominance. The government has set an ambitious target of 500 GW of renewable energy capacity by 2030.

To propel this vision forward, significant investments have been earmarked, including ₹19,500 crore allocated for a PLI scheme aimed at boosting the manufacturing of high-efficiency solar modules.

In line with this commitment, the Indian government has pledged that by 2030, 30% of all new vehicle sales in the country will be electric. Anticipating future market growth, particularly in the electrification of vehicles such as three-wheelers and small passenger automobiles, the Green Energy sector is poised for exponential expansion.

Data Centers

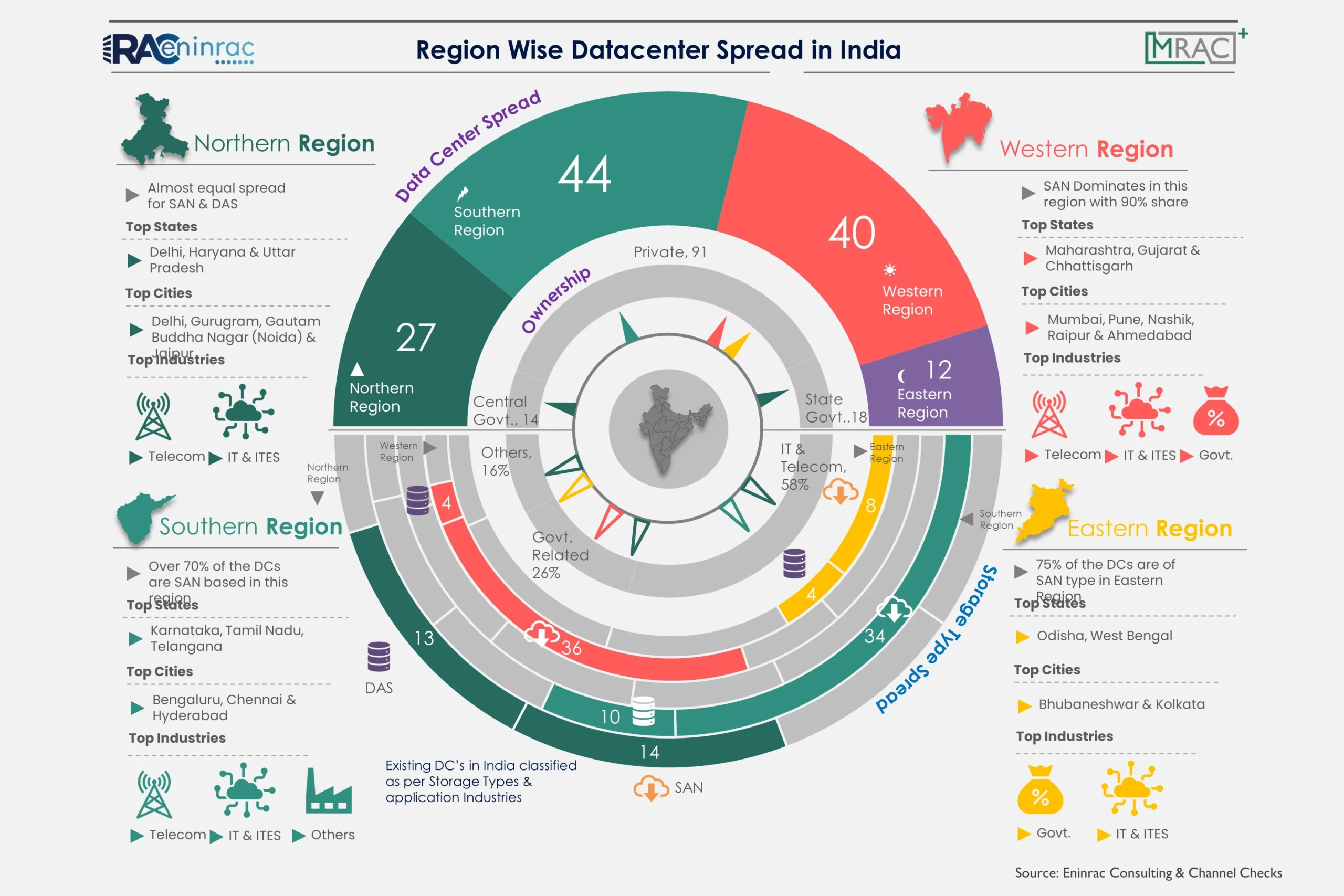

The data center landscape in India is poised for rapid expansion, with capacity expected to double in the next 2-3 years. Projections indicate that the Data Center market will soar to approximately $9.8 billion by 2028, marking a significant leap forward.

India has emerged as a key player in the Asia-Pacific region, solidifying its position as a data center leader. Between 2018 and 2023, the country’s data center industry attracted investment commitments exceeding $40 billion from both global and domestic investors.

For a long-term investor eyeing the promising future of India, focusing on the sectors and sub-sectors we’ve discussed could prove to be a prudent strategy. These themes are poised to unfold positively over the next decade, provided there’s meticulous planning and execution in place.

Investing in the discussed sectors and other infrastructural themes such as Defence and Semiconductors can offer lucrative opportunities for growth and profitability. These sectors are backed by robust government initiatives, increasing investments, and favourable market dynamics, positioning them for sustained success in the years to come.

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and any companies discussed here should not be considered investment advice

Also read:

Good

Very useful information for new investors , thank you so much for your support💪

Thank you for sharing this insightful article! I found the information really useful.