Introduction: Seeking Value vs. Riding Price Waves

Before we talk about investor sentiments, we should first understand the difference between an investor and a trader.

Investing and trading take different approaches to profiting from the stock market. Investors aim to uncover a company’s intrinsic value and hold stocks long-term, trusting that, over time, the market will recognize that value. They focus on fundamental factors like cash flow and growth potential, seeing earnings reports as a story of the company’s future.

Example: A steady rise in revenue from a new product might confirm an investor’s belief in a company’s growth, even if quarterly profits dip.

Traders, on the other hand, are focused on short-term price movements. They buy low and sell high by following market sentiment, often reacting immediately to earnings reports for any shifts in mood or momentum.

Example: A lower-than-last-quarter earnings beat may trigger selling among traders, as they might see this as a loss of momentum.

In essence, while investors look for long-term value, traders look for immediate price shifts to capitalize on short-term gains. Both groups interpret the same earnings data differently, based on their goals and timeframes.

Psychological Pitfalls: Understanding Investor Sentiments in the Market

Stock markets are driven by numbers and hard data, but human psychology often takes the wheel, swaying investment decisions in surprising ways. Let’s look at some psychological factors that play a major role in investor sentiments and stock market behaviour—and how common investors can learn to avoid these pitfalls.

Over-Optimism and Extrapolation: Riding the Wave Too Far

- The Pitfall: After periods of rapid earnings growth, investors can become overly optimistic, assuming that high returns will continue indefinitely. This rosy outlook leads them to project past trends into the future, inflating stock prices far beyond the company’s actual worth or intrinsic value.

- Impact: This misplaced confidence can create market bubbles, as investors pour money into overvalued stocks. When reality fails to match expectations, prices drop, and those who buy in at peak optimism face substantial losses.

- Takeaway: Investors should base their expectations on a company’s long-term fundamentals, not short-term trends. A dose of scepticism can help temper over-optimism and keep portfolios on a more stable path.

Short-Term Focus and Under-Reaction: Missing the Big Picture

- The Pitfall: Many investors fixate on short-term results, reacting slowly or dismissively to earnings growth signals that don’t match their immediate return goals. This happens mostly if the growth story is complex or is not one of the trending/ buzz stocks. This can lead to short-term mispricing as they fail to recognize growth potential early on.

- Impact: When investors finally catch up to the longer-term prospects after the reality is reflected in the news, prices may adjust sharply, either up or down, based on the market’s delayed response.

- Takeaway: Maintaining a long-term perspective and avoiding hasty reactions can prevent investors from losing out on valuable growth opportunities. Recognizing the underlying potential, even if it’s not immediately apparent, often pays off big time over time.

Mood and Market Momentum: Herd Mentality

- The Pitfall: Market mood and momentum are powerful influencers, especially for traders looking for quick gains. Positive news can create a snowball effect of optimism. On the other hand, negative news can pull prices down as the market’s sentiment shifts.

- Impact: These fluctuations based on mood rather than fundamentals can create volatility, with prices rising and falling more sharply than justified by company performance.

- Takeaway: Investors should be wary of the herd mentality. Following crowd-driven momentum can lead to risky decisions. A solid strategy based on fundamentals is often safer and yields better long-term returns.

Fear and Panic Selling: When Emotions Take Over

- The Pitfall: Negative news or broader economic uncertainty can trigger panic selling as fear takes over. Rather than assessing the real impact on a company’s value, investors may sell based on fear alone, driving prices down further.

- Impact: Panic selling often amplifies market downturns, harming both individual portfolios and overall shareholder value.

- Takeaway: Investors can protect themselves from fear-driven losses by focusing on their investment goals and staying grounded. Understanding that market dips are temporary can prevent impulsive selling.

Mismatched Time Horizons

- The Pitfall: Every investor has a different goal and timeline for which he is investing. Someone wants to buy a property, while another wants to save for his child’s education. Some look to capture short-term gains, while others are in it for long-term growth. When a company’s long-term strategy fails to deliver immediate results, short-term investors may feel dissatisfied. This can lead to selling pressure that doesn’t reflect the company’s true value or future potential. This also hurts long-term investors if they have a herd mentality.

- Impact: This mismatch can cause dissatisfaction and selling pressure among investors. It happens when a company’s long-term vision doesn’t align with the market’s short-term expectations.

- Takeaway: Investors should clarify their time horizon and choose investments that match their goals. Those with a long-term focus may find greater success in staying patient, rather than chasing short-term price swings.

Investors also fall victim to cognitive biases like anchoring (relying heavily on the first information they receive) and framing (being influenced by how information is presented). By being aware of these tendencies, investors can catch themselves before making decisions based on incomplete or misleading information.

Warren Buffett on Investor Sentiments

Warren Buffett, in a 1999 article, accurately predicted weak US stock market returns (2.5% annual return) for the subsequent 17 years. He based his prediction on three key factors: interest rates, market valuations, and corporate profits as a percentage of GDP. His insights remain highly relevant today, as similar market conditions are present in 2024. These carry valuable lessons as they help keep investor sentiments and expectations in check. Here’s a closer look at how these factors apply to India and the takeaways for prudent investing.

Interest Rates and Market Valuations

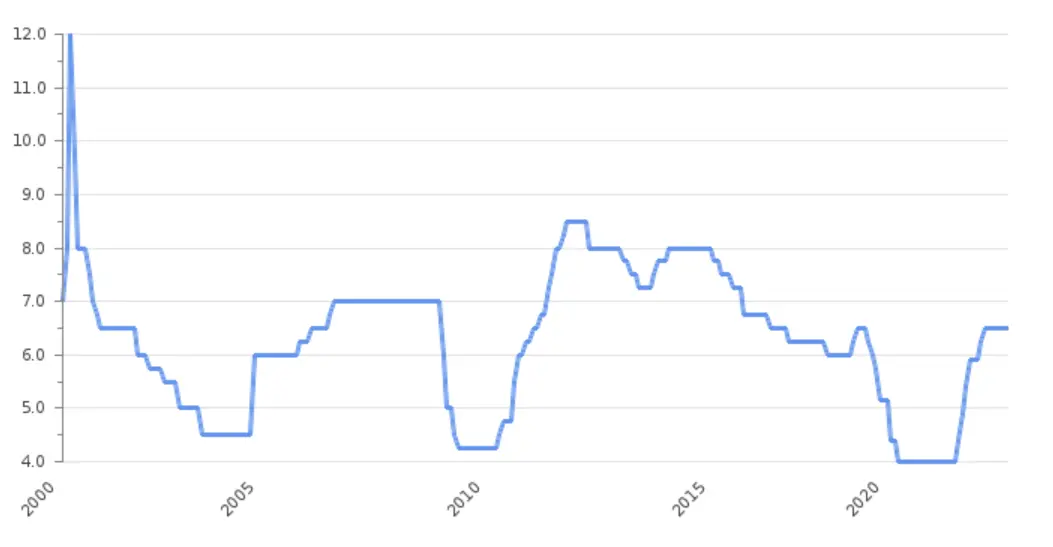

- Buffett’s US Insights: Buffett observed that high interest rates from 1965 to 1982 resulted in weak stock market performance, while the declining rates from 1982 to 1999 sparked a major bull market. By 1999, he was wary of unsustainable valuations boosted by artificially low rates.

- India’s Situation: In India, interest rates have followed a similar cyclical path, with high rates in the 1990s, followed by cuts during economic slowdowns and more recent cuts in response to the pandemic. These lower rates increased market liquidity and contributed to higher stock valuations. As rates rose again post-pandemic, valuations faced downward pressure, showing a correlation with Buffett’s caution about rising rates affecting stock performance.

- Food for Thought: The connection between interest rates and market valuations is also strong in India, suggesting that Buffett’s caution about rising rates leading to lower market performance is relevant. Investors should monitor interest rate cycles as an indicator of potential shifts in market valuations.

Corporate Profits as a Percentage of GDP

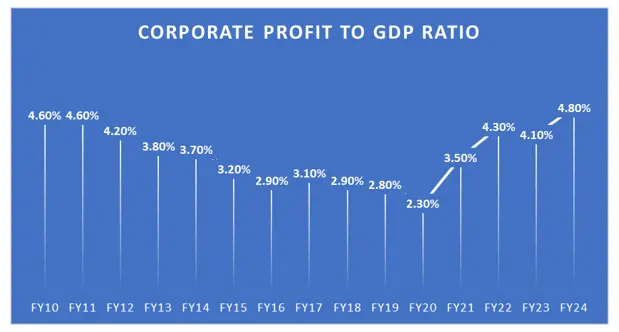

- Buffett’s US Insights: Buffett observed that Corporate profits as a percentage of GDP have a huge effect on investor sentiment, and therefore stock prices. Despite rising stock prices, U.S. corporate profits remained stable as a percentage of GDP from 1982 to 1999. He viewed this as a warning: inflated stock prices without profit growth indicated a bubble.

- India’s Situation: India’s corporate profit-to-GDP ratio has fluctuated, influenced by economic reforms, global conditions, and domestic policy. After rising in the early 2000s, this ratio declined during slower economic periods, only recently recovering to about 4.8% as of 2024. If stock valuations soar without matching profit growth, as Buffett warned, the market could face corrections.

- Food for Thought: High price-to-earnings (P/E) ratios in some sectors raise concerns if corporate profits don’t keep up. Investors should be cautious about sectors with high valuations but slow profit growth, as they may be more susceptible to correction.

Market Valuations and Earnings Multiples (P/E)

- Buffett’s US Insights: Buffett noted that U.S. stock prices had grown detached from economic fundamentals by 1999, driven largely by speculative bubbles, especially in tech stocks. His concern was that high P/E ratios often lead to lower returns over time.

- India’s Situation: India’s market has seen similar valuation spikes in sectors like technology, financial services, consumer goods and other new-age sectors, driven by investor enthusiasm. Recently, some small and midcap stocks in India have reached absurd valuations, showing speculative trends.

- Food for Thought: High multiples in certain sectors may not be justified based on their earning growth. Investors should focus on valuation discipline to avoid overpaying for speculative growth/ guidance that may or may not materialize. If stock valuations outpace actual earnings growth, investors should tread very carefully.

Key Lessons to Keep in Mind

- Realistic Return Expectations: Just as Buffett predicted lower returns for the U.S., Indian markets might see modest returns too. This is especially likely in sectors with high valuations. Realistic expectations lead to controlled investor sentiments.

- Caution with High P/E Ratios: Investors should remain cautious about stocks with inflated P/E ratios that lack corresponding profit growth. Like the tech bubble in the U.S., sectors fuelled by speculative growth are vulnerable to corrections when expectations are unmet.

- Focus on Fundamentals: Adopting Buffett’s approach, Indian investors may benefit from focusing on companies with strong fundamentals and fair valuations. This disciplined strategy could offer sustainable returns, even when broader markets face volatility due to high valuations and rising rates.

Conclusion

Effective investing requires understanding expectations, psychological biases, and rational/ irrational behaviour that affect investor sentiments. Many investors get caught up in short-term optimism or market mood, risking costly mistakes. Growth lies in distinguishing value from price—knowing when a stock is truly undervalued versus temporarily appealing. By focusing on fundamentals, staying realistic, and heeding caution on high valuations, investors can achieve tremendous success.

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

Also read:

Very helpful