In the world of grease and gears, one company is shifting the paradigm from manual to automatic. Incorporated in 1992, this company (Mcap 180 Cr) has a decent presence in India and across the globe. It also boasts a roster of illustrious clients like ACC, Toshiba, TATA, etc. The company promises increased efficiency and uninterrupted operations with their lubrication system.

About the company

Cenlub Industries Limited was incorporated in 1992. They are engaged in automatic lubrication system business.

The company designs, manufactures and supplies Centralized Lubrication System.

What is an Automatic Lubrication System?

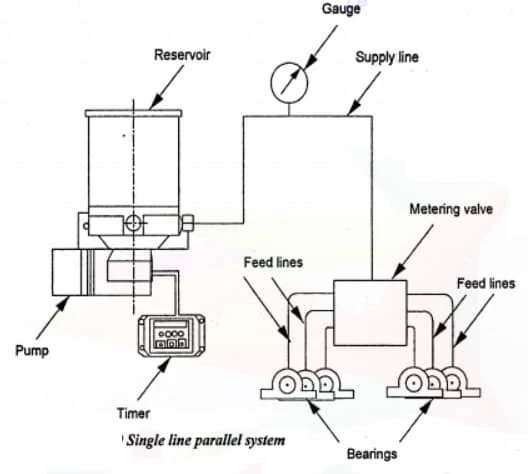

Automatic Lubrication System (ALS) is also known as Centralised Lubrication System. It is a mechanical setup that delivers precise amounts of lubricant to machinery parts at set intervals. This maintains equipment efficiency, reduces wear, and extends lifespan by preventing friction and manual lubrication needs.

Basic components of the ALS:

- Timer/Controller: Activates the system, controlling lubrication schedules.

- Reservoir & Pump: Stores and delivers lubricant to machine parts.

- Supply Line: Connects pump to metering valves/injectors.

- Metering Valves/Injectors: Dispenses lubricant to specific points.

- Feed Lines: Connects metering valves/injectors to machine parts.

Application areas of Automatic Lubrication System:

| – Machine Tools – Packaging Equipments – Textile Machines – Presses & Hammers – Pulp & Paper Processing M/cs – Food Processing Equipments – Cement Plants – Pharmaceuticals Machines – Mining & Const. Equipments – Metal Forming Machines | – Printing Machines – Calendaring Machines – Injection/Blow Moulding Machines – Shearing & Press Brakes – Sugar Plants – Rubber Mixing Machiness – Earthmoving & Mining – Sheet Metal Working Machines – Fertilizer Plants – Die Casting Equipments |

Advantages of using ALS:

- Appropriate Oil Consumption

- Variable Oil Dosages

- Enhanced Machine Life

- Elimination of Human Error

- Increased Reliability

- Increased Production

- Low Noise Level

- Less Power Consumption

- Less Wear & Tear

- SAFE, No Need to stop M/c

- Reduced Spares/Inventory Costs

- Overall Increased Profitability

Product Range

- Machine & Tool Lubricators

- Plant Lubrication Systems

- Vehicle Lubricators

- Conveyor Lubricants

- Barrel Pumps

Historical Annual Report Analysis

Analyzing the statements from different years in the annual reports of the company reveals several key trends and changes:

AR FY18:

- The company highlights its presence in various sectors, including Machines, Power, Steel, Paper, Railway, and Navy.

- Machine Tool sector dominance with a 90% market share.

- Mention of GDP growth and its impact on sectors like Machine Tool, Power, Steel, and Paper.

- Opportunities: Focused on growth in sectors like Machine Tool, Power, and Steel.

- Threats: Concerns about emerging multinational brands, imports, and changing consumer behavior.

AR FY19:

- Emphasis on Power sector becoming the main sector.

- Continued strong presence in Machine Tool sector.

- Opportunities: Expecting opportunities from Power and Railway sectors.

- Risk of COVID-19 not yet mentioned.

AR FY20:

- Power sector still expected to be the main sector.

- Continued focus on Machine Tool sector.

- Opportunities: Mention of Power and Railway sectors.

- First mention of COVID-19 pandemic as a risk.

AR FY21:

To read the full article, please subscribe to PRUDENT Ideas Membership!

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice.

good find looks interesting.

already 3.5 times in a year lets see where it goes

Good article . Always mention current market price and if possible, expected tgts .

Thanks. We always mention the current Market Capitalization. We are not providing any buy/sell recommendation.

I have just paid and joined this group. Great stuff! While I understand that “you always mention the current Market Capitalization and not providing any buy/sell recommendation.” It would be great if you include within ur “analysis/no financial advise” some margin of safety wrt what MC it can potentially command in the near future and when it can start becoming stretched/expensive. As we can see, it has already 3x within a year, how do I know whether I’m buying the top or it has some wiggle room left to the upside? Thank you for this precious service, nonetheless.

Again bad results by cenlub,can any one explain why manojeet?