A CMO/CDMO pharma company, valued at 700 Cr Mcap and boasting a 20% CAGR over the past decade, is venturing into the Oncology Segment with a substantial 194 Crore capex (FY23 Networth: 173 Crores). This dynamic entity is raising funds through several Preferential issues, with a notable investment from a major industry giant in India securing a significant stake in the company.

About the company

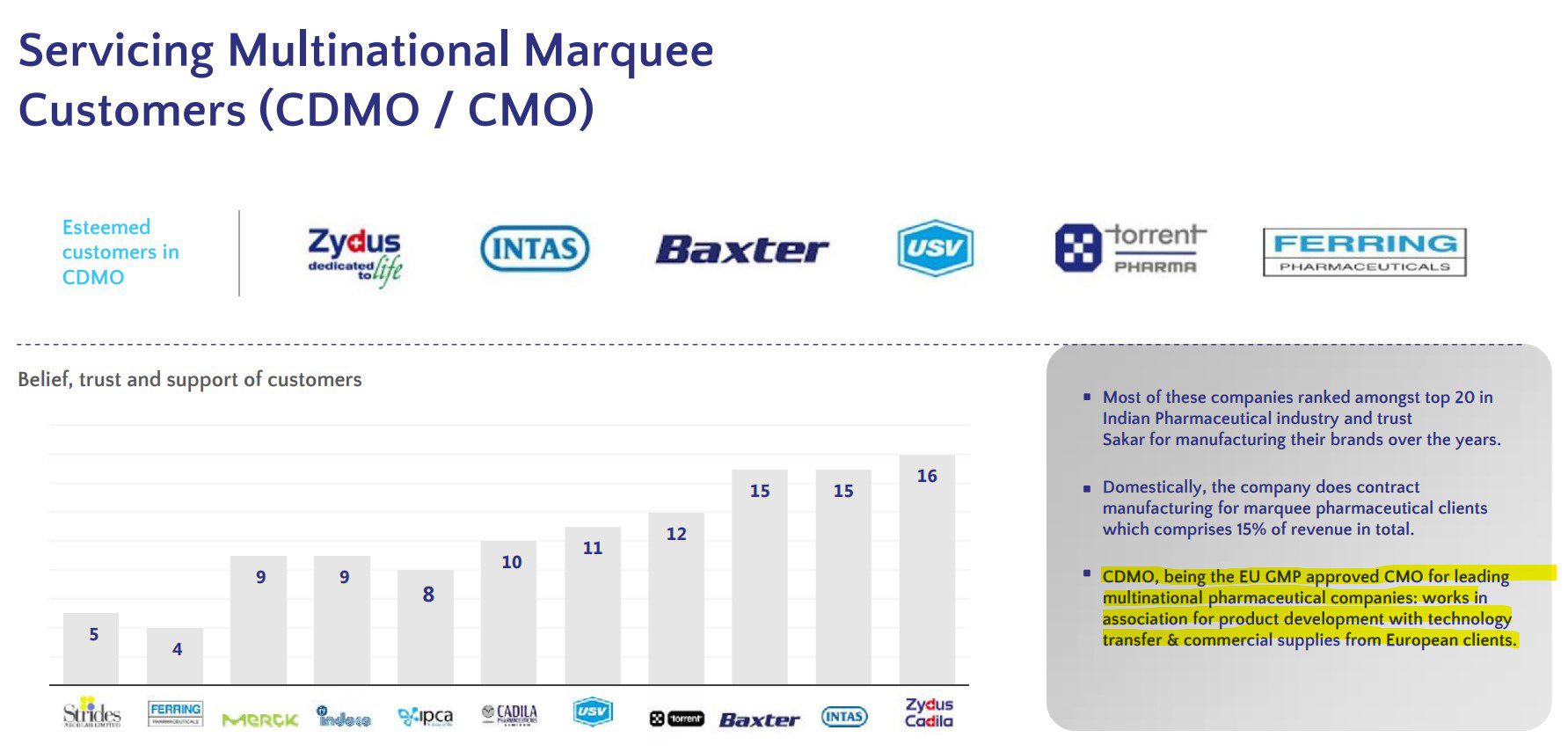

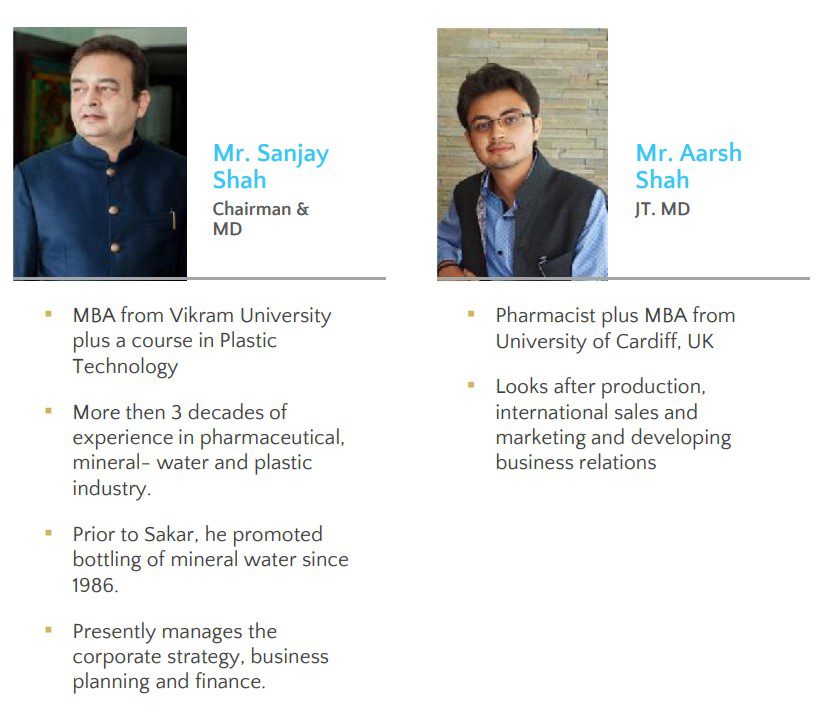

Established by first-generation entrepreneur Mr. Sanjay Shah in 2004 in Changodar, Gujarat. Sakar Healthcare Ltd started by manufacturing Oral Liquid as a Contract Manufacturing Organisation (CMO) for MNCs. They gradually diversified it’s business model including exports.

Corporate Video: Sakar Healthcare Oncology corporate video

Products

Over a period of time they have diversified into manufacturing a wide range of Pharma Formulations:

- Oral-liquid syrup & suspension

- Liquid injectable (SVP) – vials & ampoules

- Cephalosporin – dry powder injections

- Cephalosporin – oral solid

- Lyophilized injections (in vials)

- No. of Products:175

- Registered Brands: 292+

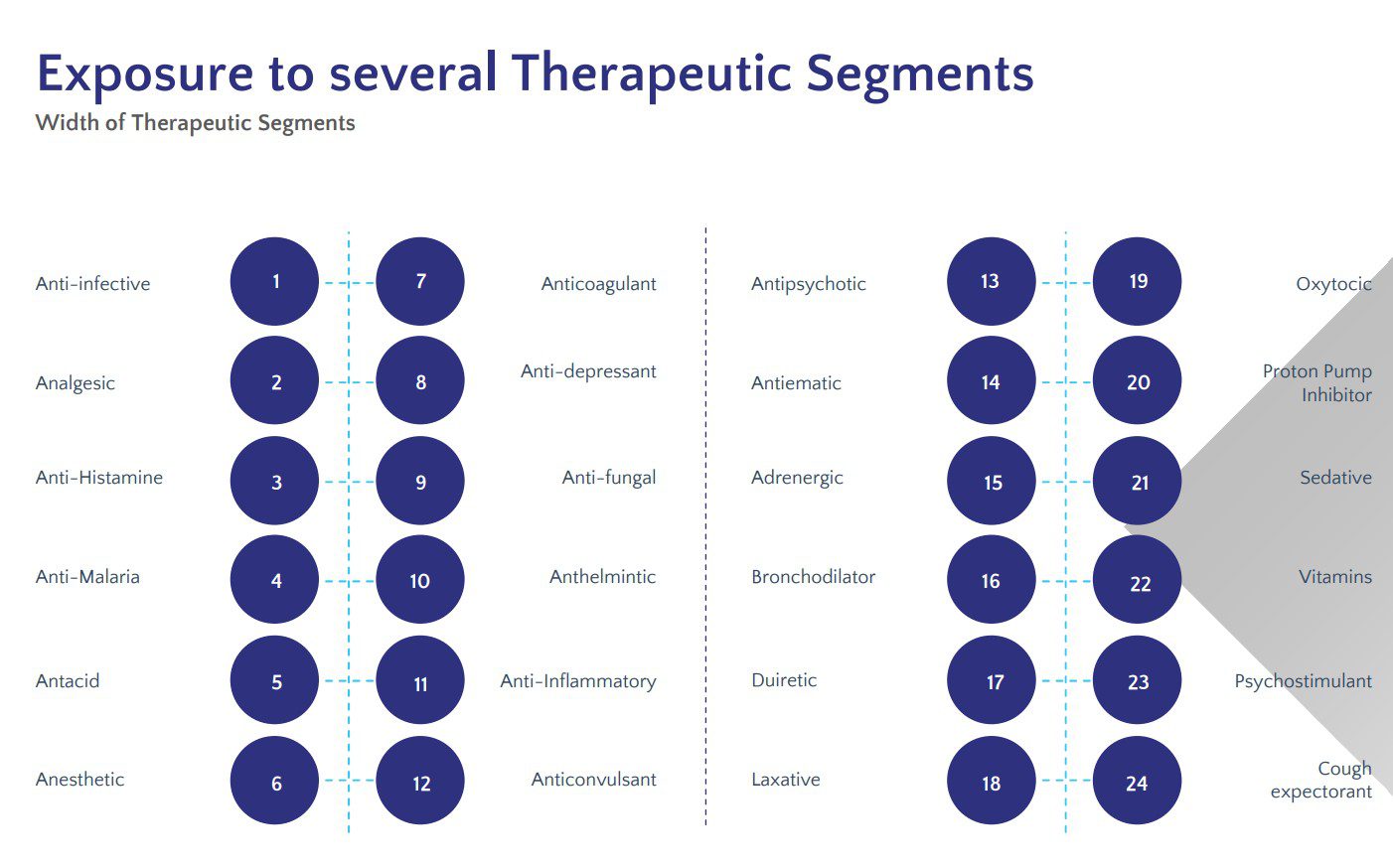

- Covers more than 24 therapeutic areas and 60 international markets

- No of Overseas Partners: 79+

- Currently engaged in developing, manufacturing (CDMO) & exporting of Pharma Finished Dose Formulation worldwide

Business Model:

The Transformation:

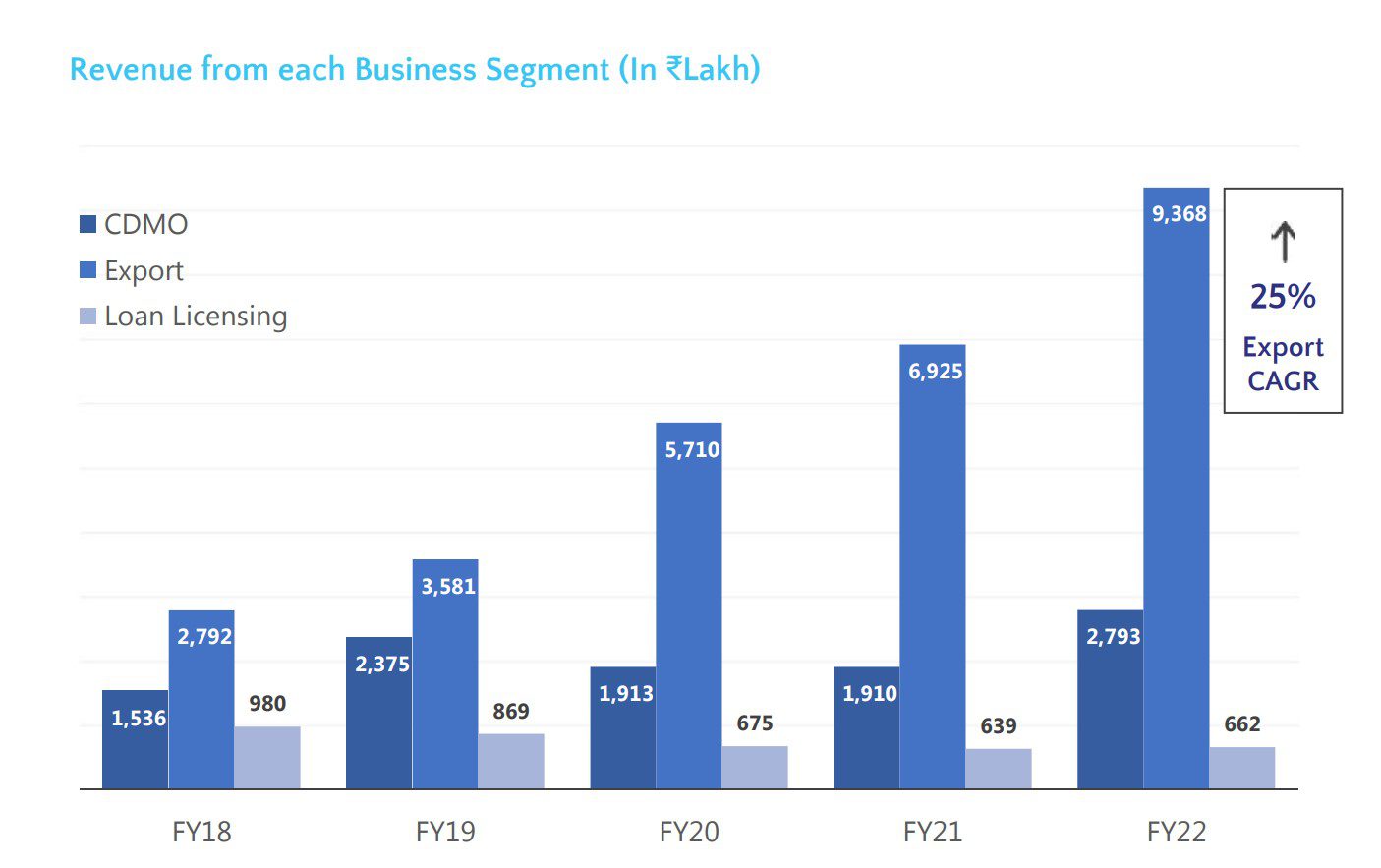

In FY18, Exports of their own brands constituted 53% of the revenue, fast forward to FY22 it contributed around 73% – a growth of 25% CAGR.

This growth has come primarily due to exporting their own registered Brands to APAC, Latin America, East & French – West Africa, CIS, Europe etc

Therapeutic Areas:

Out of 24 therapeutic areas, the top 5 segments are Proton pump Inhibitors, Antibiotics, Analgesics, Anti Coagulants, Anti Malarial

Formulation Segmentation:

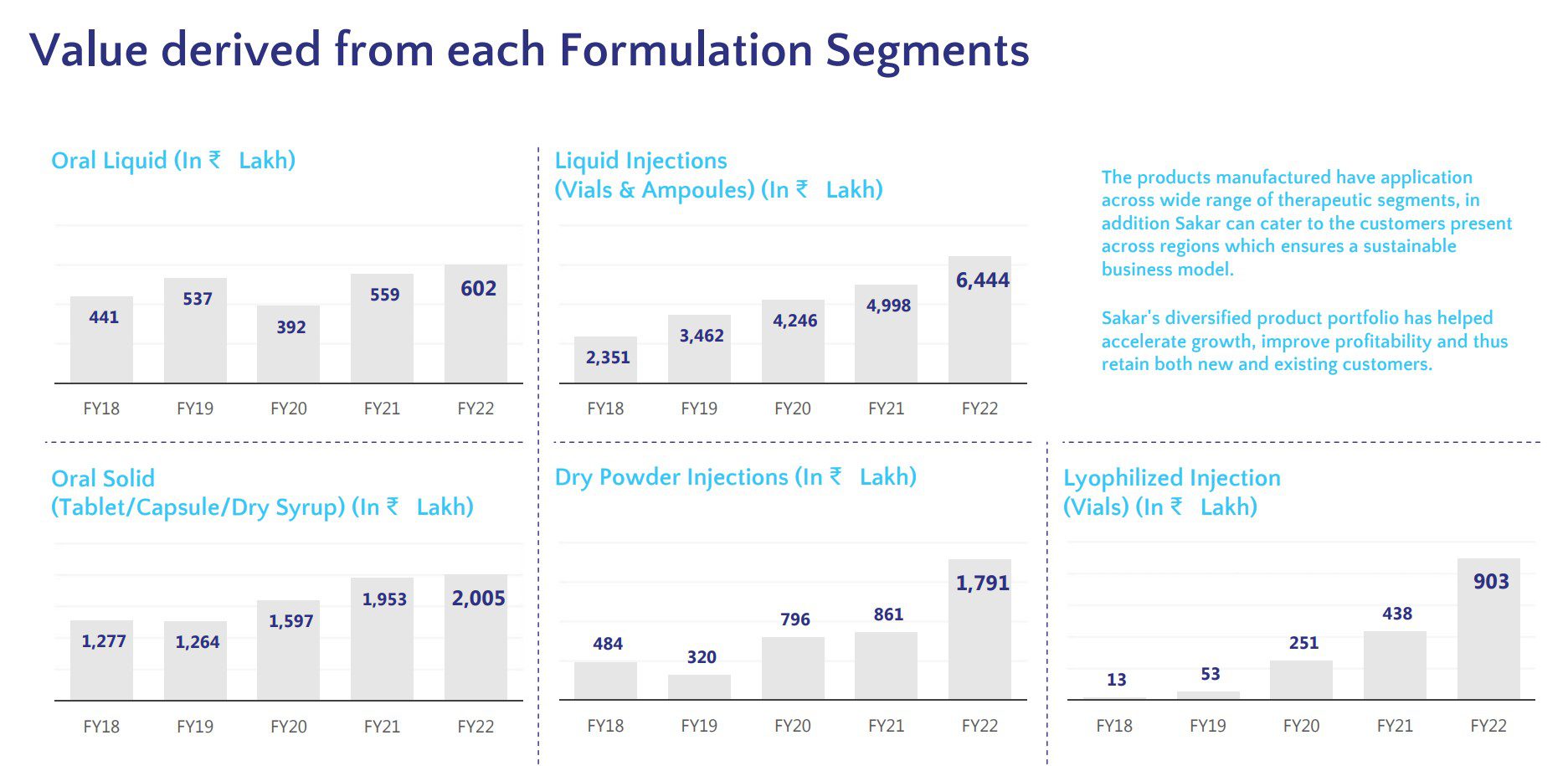

Injectible group (Includes Liquid Injections (Vials & Ampoules), Lyophilized Injection (Vials), Dry Powder Injections Cephalosporin) – 57% of sales

Oral Solid Dosage (Tablet/Capsule/Dry Syrup Cephalosporin) – 25% of Sales

The top 10 molecules contribute nearly 45%+ of the export sales

Formulation Segments growth rate:

The fastest growing formulation is Lyophilized Injection (Vials) – FY18 – 13L to FY22 – 9.03Cr

Clients

Management

Growth Triggers

To read the full article, please subscribe to PRUDENT Ideas Membership!

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

What are the antithesis according to you?

Beta drugs solely focused in Oncology segment. They have good market shares of their brand in oral formulation. Already have a presence in CIS countries via subsidiary in Uzbekistan. Now they are waiting for the approval for South America market. Brazil,etc. Good Track record of execution, delivery.

Very informative. I have two suggestions.

First can you add a small section about the company current valuation.

Second what are the risks involved (antithesis )

Great suggestions! A research report is incomplete without these two sections.

Needed to add CMP and expected target to make our selection easy. Thanking you.

Manoj kumar

How does sakar actually plan to compete with other Pharma companies and does it have a moat? Given that it is a cdmo business won’t majority of the profits be going to big brand Pharma , does sakar plan on getting a pie of this too ? Also is there any significant R&D for any new products .