Founded in 2015, this company (Mcap 800 Cr) is involved in safeguarding crops with its lineup of insecticides and herbicides. Not just the products, they also provide farmers with crop protection solutions. Currently exporting to over 20 countries, they’ve decided to switch gears with the aim of becoming the fastest-growing agrochemical company. They’re expanding their domain to accommodate other growth segments and backward integration.

About the company

Dharmaj Crop Guard Ltd. (DCGL) specialize in making, selling, and distributing agricultural chemicals like insecticides, herbicides, and plant growth regulators. They also offer crop protection solutions to farmers. They export their products to more than 20 countries in South America, Africa, the Middle East, and East Asia.

About the management

Rameshbhai Ravajibhai Talavia, the company’s Managing Director, boasts an impressive 28-year track record in the agrochemical sector. Prior to this role, he contributed his expertise to notable companies such as E.I.D Parry and Coromandel Fertilisers Ltd. Furthermore, the senior management team possesses over a decade of experience in their respective fields, ensuring a seasoned and knowledgeable leadership.

Business Verticals

1. Branded Formulations –

In the Branded Formulations business vertical, the company has made significant strides. It contributes 27% of the total revenue, amounting to ₹144.8 cr. Their impressive portfolio comprises 121 brands and 350 products, spanning across 20 states. They’ve established a robust distribution network with over 4,500 dealers and a presence in more than 13,500 retail outlets.

Product Portfolio:

- The company has introduced 21 new products in FY23, compared to 31 in FY22.

- Their product range covers insecticides, herbicides including insect control, termiticide, larvicide, indoor spray, rodenticide, and cockroach gels.

- Notable brands include Dhoofon, Dharmexo Gel, and Podcast 25WP.

- A strategic focus is on building their own sales channels for these product categories.

Future Plans:

- Having achieved a position among the top five players in branded agrochemical sales, the company aims to replicate this success across all their markets.

- Their vision includes expanding their presence into new markets to establish themselves as a pan-India player.

- They plan to introduce new products and fine-tune their existing portfolio to sustain and enhance profitability.

- A key strategic move involves scaling up operations through partnerships with global players.

2. Institutional Formulations –

- This is the primary business vertical of Dharmaj Crop Guard, contributing to 73% (₹328.7 cr) of the total revenue.

- Revenue breakdown:

- 62% of the total revenue is generated from domestic institutional business.

- 11% comes from the export institutional business.

- Product and Customer Base:

- In the domestic market, they offer 230 different products and serve over 730 customers.

- In the international market, the company has a portfolio of 200 products and maintains relationships with more than 70 customers spread across 20 countries.

- DCGL engages with a diverse spectrum of institutions, including multinational corporations, Indian companies, international clients, and small regional formulators. This broad customer base provides the company with economies of scale and ring-fence against seasonal fluctuations.

- The company is actively pursuing expansion plans by registering 14 additional products for its international market portfolio.

- Dharmaj is expecting to leverage the backward integration into the active ingredients segment to increase cost-effectiveness.

- Their formulation manufacturing facility, located in Kerala GIDC, Ahmedabad, has a capacity of 25,500 metric tons. In FY23, it operated at 50% capacity utilization.

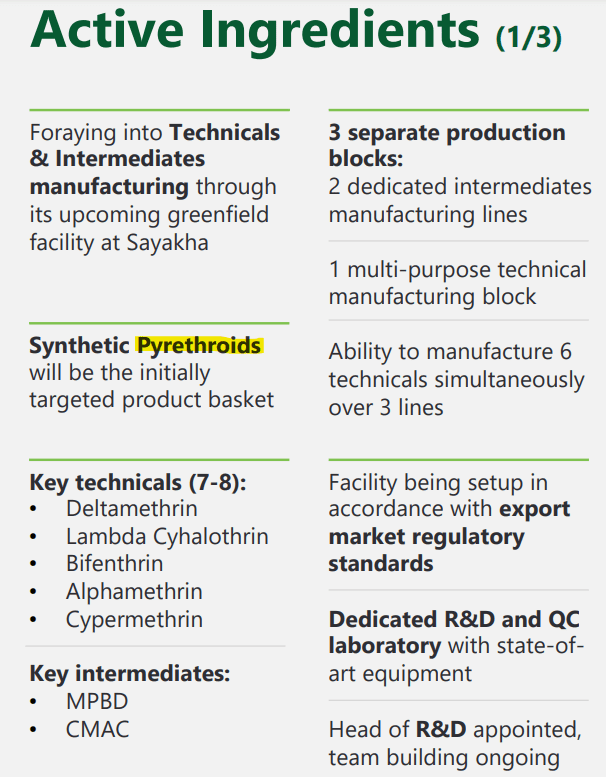

3. Active Ingredients and Intermediates –

- DCGL is in the process of establishing an Agrochemical active ingredients and intermediates plant in Sayakha, Gujarat. The plant’s commercialization is scheduled to commence by Q3FY24.

- The management intends to utilize 60-70% of the intermediates produced and 25-30% of the active ingredients produced for internal consumption. The remaining portion will be marketed to external customers.

- This venture is a significant step toward achieving backward integration for the formulation vertical. This would help them improve margins and become more competitive in the market.

- The plant is spread across a land of 33,490 sq. mt., leased for 99 years from Gujarat Industrial Development Corporation.

- The plant is structured into three distinct production blocks:

- 2,500 metric tons per annum (TPA) capacity for Meta Phenoxy Benzaldehyde (MPBD).

- 2,500 TPA for Cypermethric Acid Chloride (CMAC).

- 3,000 TPA for multipurpose technical capacity, providing versatility in production capabilities.

- The company expects 10-15% utilization of the plant after commissioning in Q3 FY24. They expect to reach 60-70% utilization in the next 2-3 years.

Agrochemical Industry Outlook

- The global pesticide industry is forecasted to experience a modest CAGR of 1.8%, reaching a market size of $71 bn by FY24.

- The Herbicides industry is expected to grow at a CAGR of 1.2%, with an estimated market value of $26 billion by FY24.

- The Fungicides segment has anticipated a CAGR of 1.7% to reach $18 bn by FY24.

- The Insecticides segment is expected to grow at a CAGR of 1.8%, resulting in a market size of $16 bn by FY24.

- On the other hand, the Indian Agrochemical industry is projected to expand at a CAGR of 8.5%, reaching $9.8 bn by 2028 (source).

Financials

To read the full article, please subscribe to PRUDENT Ideas Membership!

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

Very Good Analysis sir …Every point is covered…but when compare to other sector future Growth is low in Agro sector. Please do analysis of stock from high future growth sector.

Thanks for sharing idea sir👍

Sir great analysis, company never heard of

since the industry has probably not bottomed out yet, Is it wise to wait a bit to enter with peg around 1?

nice write up bought tracking quantity will add more

lets see

BTW will you make any write up on space tech sector

It’s help to get to know a company

Amazing presentation. Keep it up PP team.

Good Analysis 👍

wow nice analysis thanks team