Even the smallest ball bearing, if overlooked, has the potential to disrupt an entire system. A company with 350 Cr Mcap is undergoing a capital expenditure with expected 4-5x asset turns. The company was founded and run by a technocrat who understands the value and criticality of the product they manufacture. The company is equipped with all the latest technology in the industry.

About the company

SKP Bearing Industries Ltd (Mcap 350 Cr) was established in 1992.

The founders Shrinand Palshikar, Sangita Palshikar, and Urmila Bhonde, started SKP from scratch, with limited resources and no business background, today the company is growing rapidly and may become one of the prominent players in this segment in the future

They specialize in manufacturing needle rollers, cylindrical rollers, pins, and steel balls, supplying them to reputable bearing manufacturers and OEMs in the domestic market and exporting them to international customers

On 6th Jan 2022 – converted to Pvt Ltd and on15th Feb 2022 – converted to a Public Company

Management:

- Mr. Shrinand Kamlakar Palshikar serves as the Promoter, Chairman, and Managing Director of the company. Holding a Master of Technology degree in Mechanical Engineering with a specialization in Production Engineering from IIT Bombay, he brings extensive expertise. With around 34 years of experience in production, quality, and management, Mr. Palshikar is a visionary leader for the organization. Additionally, he has completed the Rolling Bearing Theory & Performance Course from SKF College of Engineering.

- Ms Sangita Shrinand Palshikar, a Promoter and Non-Executive Director, holds a Bachelor of Commerce degree from Pune. With expertise in accounts, finance, HR, and administration, she has received awards, including the “Special Award to Outstanding Women Entrepreneur of the Year” from the late President Shri Pranab Mukherjee and the “Successful Business Entrepreneur” award from the Chief Minister and Governor of Gujarat.

- Mr. Rajeev Vinayak Lokare, appointed Non-Executive Independent Director from January 31, 2022, holds a Bachelor of Engineering from Walchand College of Engineering, Kolhapur. With 40 years of experience, he specializes in operational excellence, systems implementation, and business development initiatives. Worked with Tata Motors, TVS Motor Company, Apollo Tyres, Sahyadri Hospitals, and Classic Industries.

- Mr Kishorbhai Chhanalal Parikh, appointed Non-Executive Independent Director from January 31, 2022, is a qualified Chartered Accountant from the ICAI. A graduate of Saurashtra University, he practices under his firm name M/s K.C. Parikh & Associates, bringing 35 years of experience in audit, taxation, accounts, and finance.

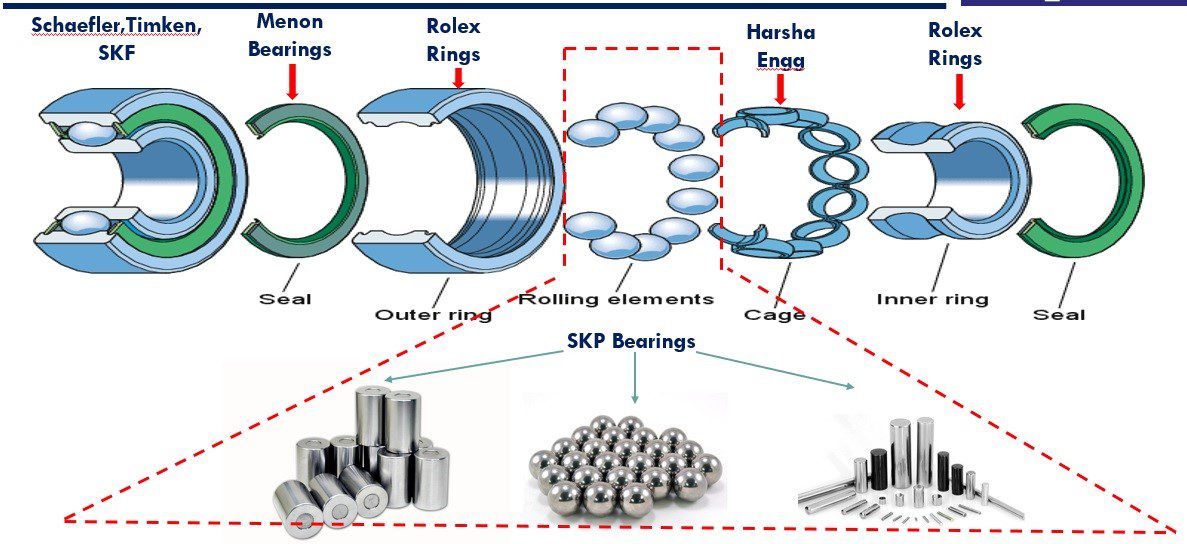

What are rolling elements?

A standard bearing comprises a seal, outer ring, rolling elements, cage, and inner ring. Although the outer and inner rings account for 80% of the bearing’s cost, the rolling elements constitute only 8% of the total cost. However, due to the crucial role these components play, clients are unwilling to compromise on their quality.

Product Portfolio:

- Needle Roller

- Cylindrical Rollers

- Pins

- Steel Balls

The company’s manufacturing unit is located at Surendranagar in Gujarat with a total area of 16,160 sq. mtrs

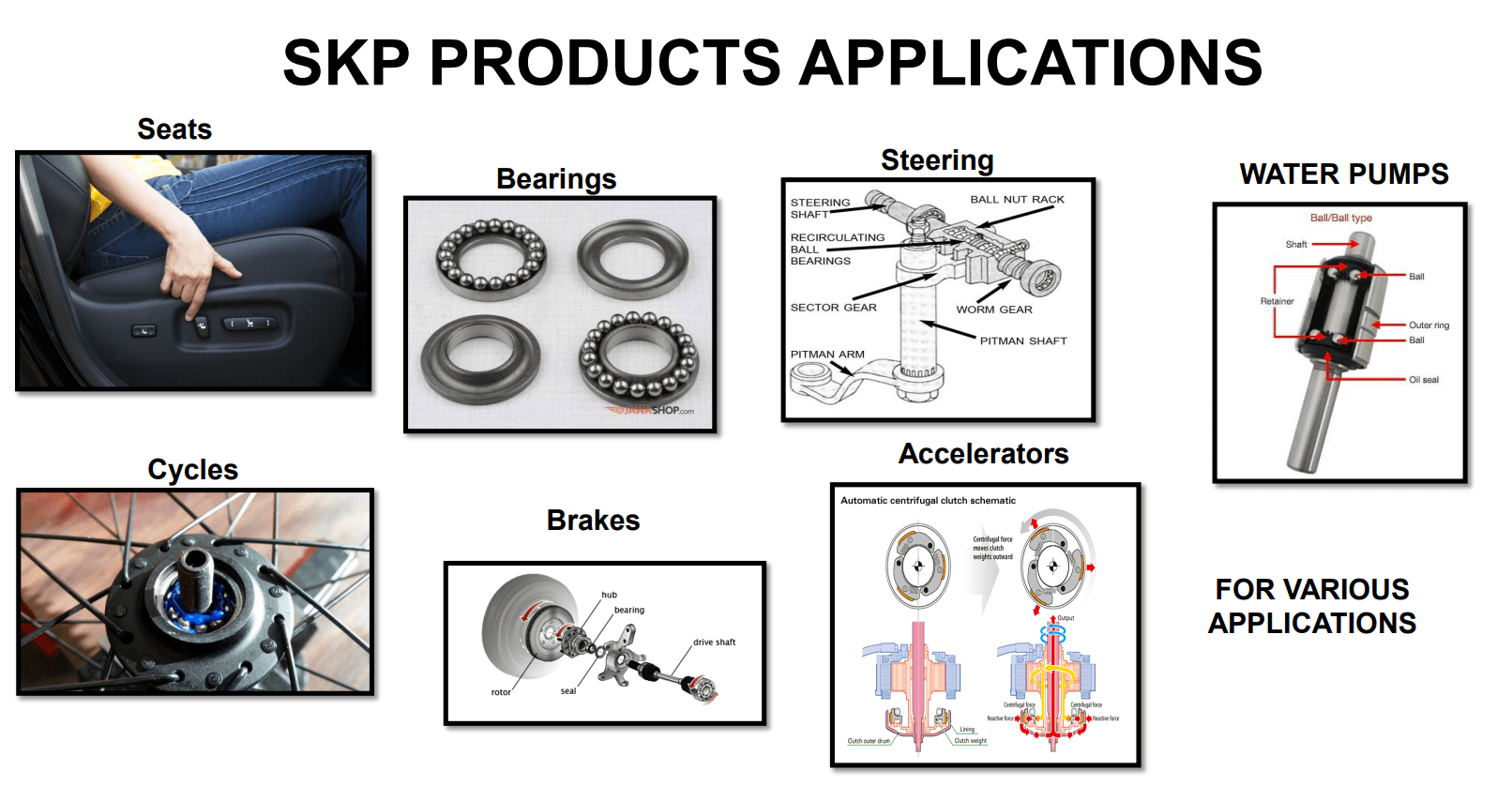

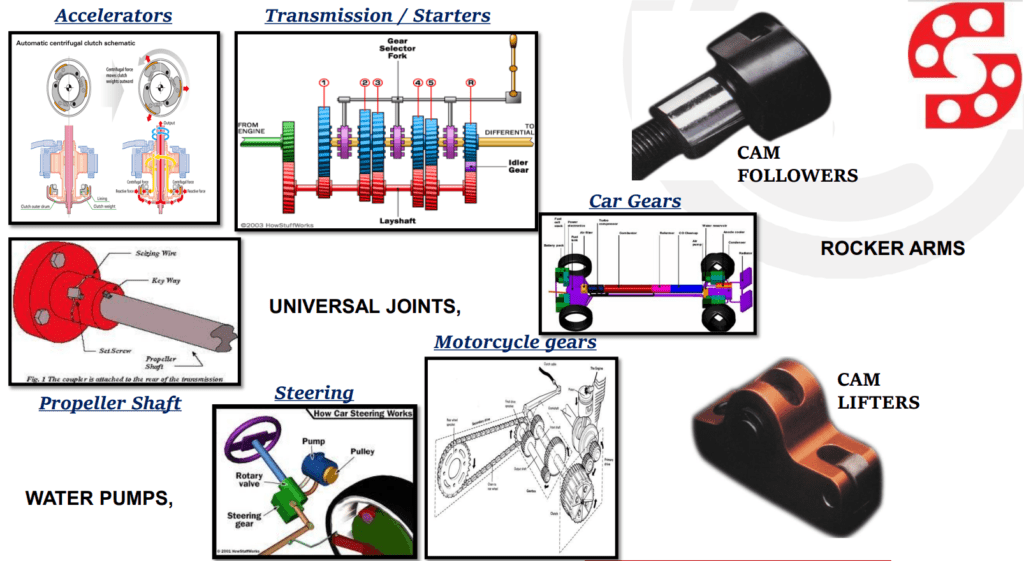

Product Applications:

Going through the Annual Report 2023 reveals these qualities:

To read the full article, please subscribe to PRUDENT Ideas Membership!

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

Very nice article. Keep it up

Thank you sir 🙏

Nice one .

Sir , what is most of this business??

Thanks in advance 🙏

The article is very good. I am trying to invest in it but the orders are getting rejected while placing stating that the lot is not correct. May i know from where i can see the lot size to buy this stock as i was trying for initial 10k investment with CMP.

Hi Rajesh, this is listed in SME platform currently. The lot size is 500

Valuation wise is it good price for taking entry for long term Investment?

Hi Umesh, point 4 in “Why PrudentParrot finds this company interesting?” gives the confidence to add at this level.

But please note that we are not SEBI Registered Research Analysts. So we can’t provide any Buy/Sell/Hold recommendation

Any comments on skp bearing result

According to management, there has been some payment delays from customers, hence the high receivables. They expect the trend to continue for the next 2 quarters. The flattish numbers is because both of their plants are running at 80-85% capacity. Once Plant 3 is commissioned, we should see some growth in H2 FY25.

How do you view their recent acquisition of Vallette ET (French company) ?