As you are already aware we are holding Balu Forge from 800 Cr Mcap. We have seen it growing to around 3000 Cr Mcap in a matter of 11 months or so.

The company posted outstanding results quarter after quarter, but the earnings multiple didn’t justify the pace of growth.

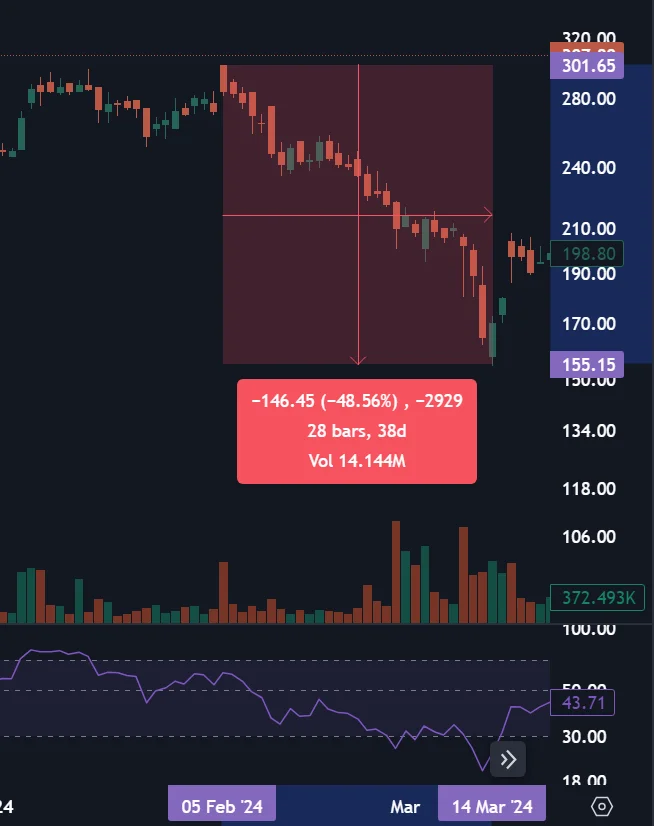

Balu Forge posted superb Q3FY24 numbers, the next day, 3rd Feb 2024, the stock opened at Rs. 300 and closed at Rs.284 which was very unusual.

From that day the stock kept falling without any news.

The valuations were mouth-watering as there was panic in the street.

On March 1st 2024, we happened to get this news – https://www.moneycontrol.com/news/business/ed-zeroes-in-on-dubai-based-operator-cum-fpi-in-mob-case-freezes-rs-581-cr-of-shares-12384881.html where it was mentioned that Enforcement Directorate (ED) has frozen shares worth Rs 581 crore held by associates of entities beneficially owned by Hari Shankar Tibrewal. Zenith Multi Trading DMCC, one of the companies promoted by Tibrewal, owns stakes in companies like Servotech Power Systems, Gensol Engineering, Pritika Auto, Balu Forge, and Star Housing Finance.

We didn’t react much to this news and we tried our best to keep our cool. The stock was getting beaten down for no “reason”.

There was super panic getting created on social media about these stocks.

One fine Sunday, we observed paid Twitter handles unrelated to the equity markets tweeting similar kinds of tweets mentioning @BaluForge in every tweet, which was scary but we tried our best to keep our cool. The stock then fell from 200 to 158 in a matter of a week.

Our value of the position got 50% wiped off moreover Balu Forge was the biggest position in our portfolio more than 20%.

Those were really painful days.

50% of value wiped out in a month (28 trading sessions to be precise)

What was going on in our minds?

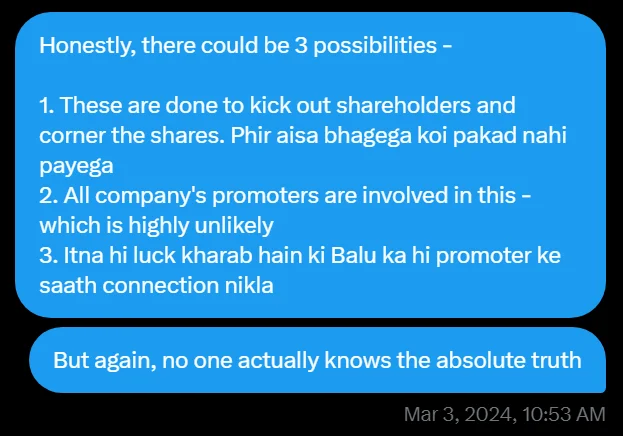

We thought of these possibilities:

1. Best case – These are some planted news and tweets to create panic on social media and remove all the weak hands.

2. All company’s management is involved in this which is highly unlikely.

3. Worst case – Balu Forge is the only company where management is involved in this ED case.

But again no one knows the absolute truth.

Our father’s experience helped us to keep us sane of this insane behaviour of the stock. Our father was chilling and was waiting for the price to come down. He said, “Aise opportunities ka fayeda nahi uthaoge to bada paisa nahi banega kabhi bhi”

He has seen many such stories, one of the examples he shared with us was of Ceat Ltd at Rs.35. The stock was getting beaten down because of some bad news and he exited the stock.

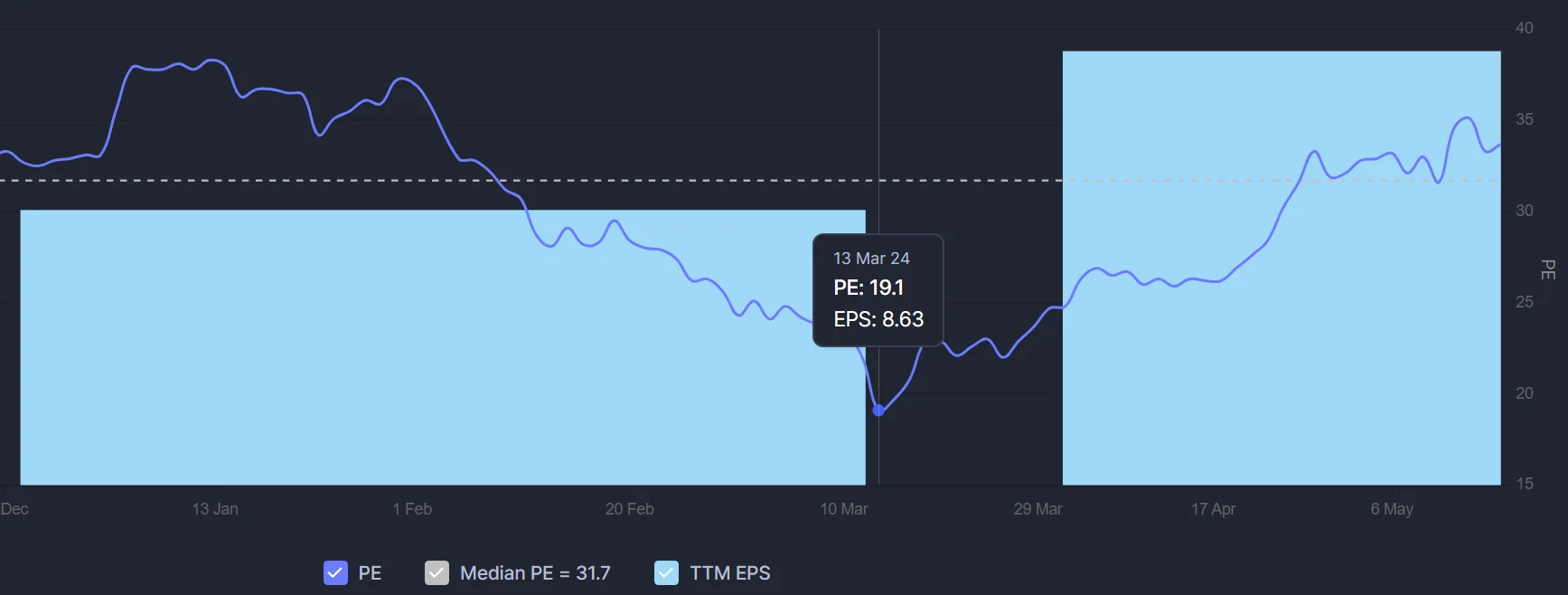

On 13th March 2024, the stock was available at only 19x TTM Earnings.

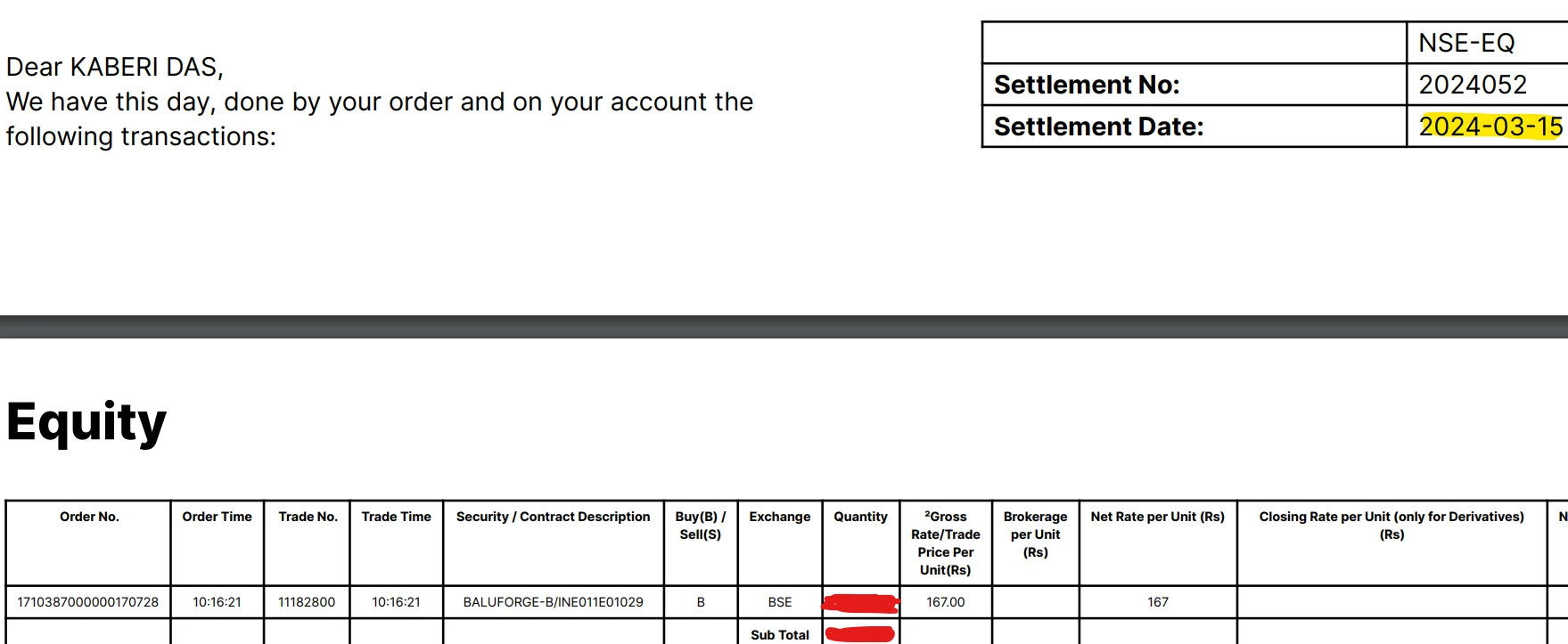

Father bought more qty at the most panic day, 15th March 2024 at around Rs. 167 which has become the fastest doubler for him.

Along with our father, Mr. Ashish Kacholia also increased his stake from 2.11% to 2.14% 😁

On 14th May 2024, Balu Forge yet again posted superb numbers.

The management guided for 40-45% revenue growth in FY25 over FY24 with 23-24% EBITDA margins in the Q4FY24 earnings release.

The next day, on 15th May 2024, the share price fell 6%. Operated?

As of today, we are holding our full qty and never sold. We believe that share prices are slaves of earnings. Balu Forge’s stock price has to go up.

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

Also read:

Thank you Manjeett for Balu forge.