This Microcap company moving up the value chain through its subsidiary valued at 65% of the parent company. The company is spending almost 45% of its current Mcap on capex. The capital work-in-progress is around 90% of the current fixed assets. There are many upcoming triggers lined up for this company. The only thing we need to look out for is the execution by the Management.

About the company

Natural Capsules (Mcap 370 Cr) was established in 1993 in Bangalore and in the year 2003 at Pondicherry by Mr. Sunil Mundra identifying a huge demand in the pharma industry. Natural Capsules Limited has a well-equipped modern manufacturing plant to manufacture Hard Gelatin Capsule shells, Hard Cellulose Capsule shells and Pharmaceutical Dosage Forms in Capsule Dosage Form.

The company currently operate in two distinct business verticals:

- Capsules

- API

Capsule Segment:

The company offers a wide range of products including:

- Hard Gelatin Capsule shells

- HPMC (Vegetarian Capsules)

And various other value-added capsules –

- Shiny capsules

- Sweet capsules

- Fast-release capsules

- Regulatory variants

- SLS free capsules

- Preservative free capsules

- TSE free capsules

They anticipate becoming India’s second-largest manufacturer of empty hard capsules after completing their ongoing CAPEX

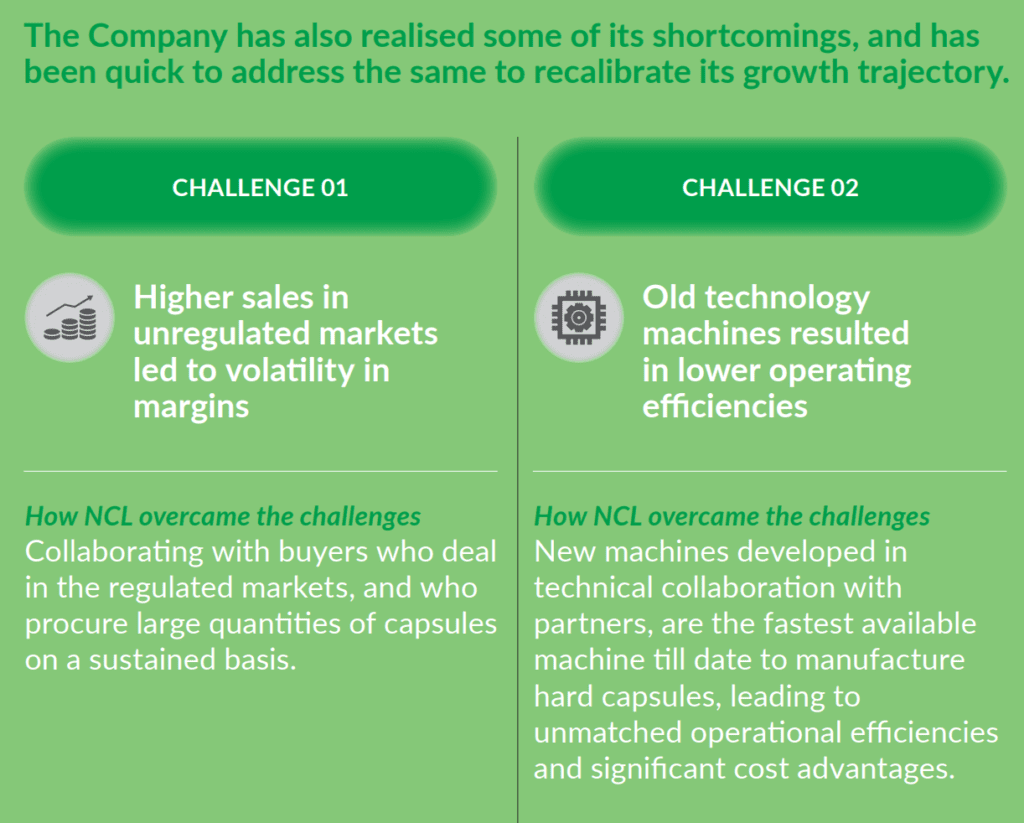

In 2019, they were able to identify their limitations and they quickly addressed them.

In a groundbreaking collaboration with DBDS Robotics Private Limited, NCL has redefined capsule manufacturing with advanced process innovation. The state-of-the-art machines, meticulously installed within their facilities, stand at the forefront of technological advancement, ensuring unparalleled efficiency and speed in the realm of hard capsule manufacturing.

The new machines offer significant benefits, including:

- Consuming approximately 40% less power per unit compared to the older machines, resulting in reduced energy costs.

- Being highly automated, requires less manpower, leading to decreased labour expenses per unit produced.

- Having lower rejection rates at only 3%, compared to 8% with the old machines, resulting in less wastage and improved productivity.

- Increasing manufacturing speed to approximately three times faster, from 1.5 million capsules per day to 5 million capsules per day.

- These factors combined result in higher efficiencies and increased profitability for NCL.

Capacity: Billion Capsules Per Annum (BCPA) over the years

| Capacity | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|

| BCPA | 7.8 | 10.8 | 14.4 | 18 |

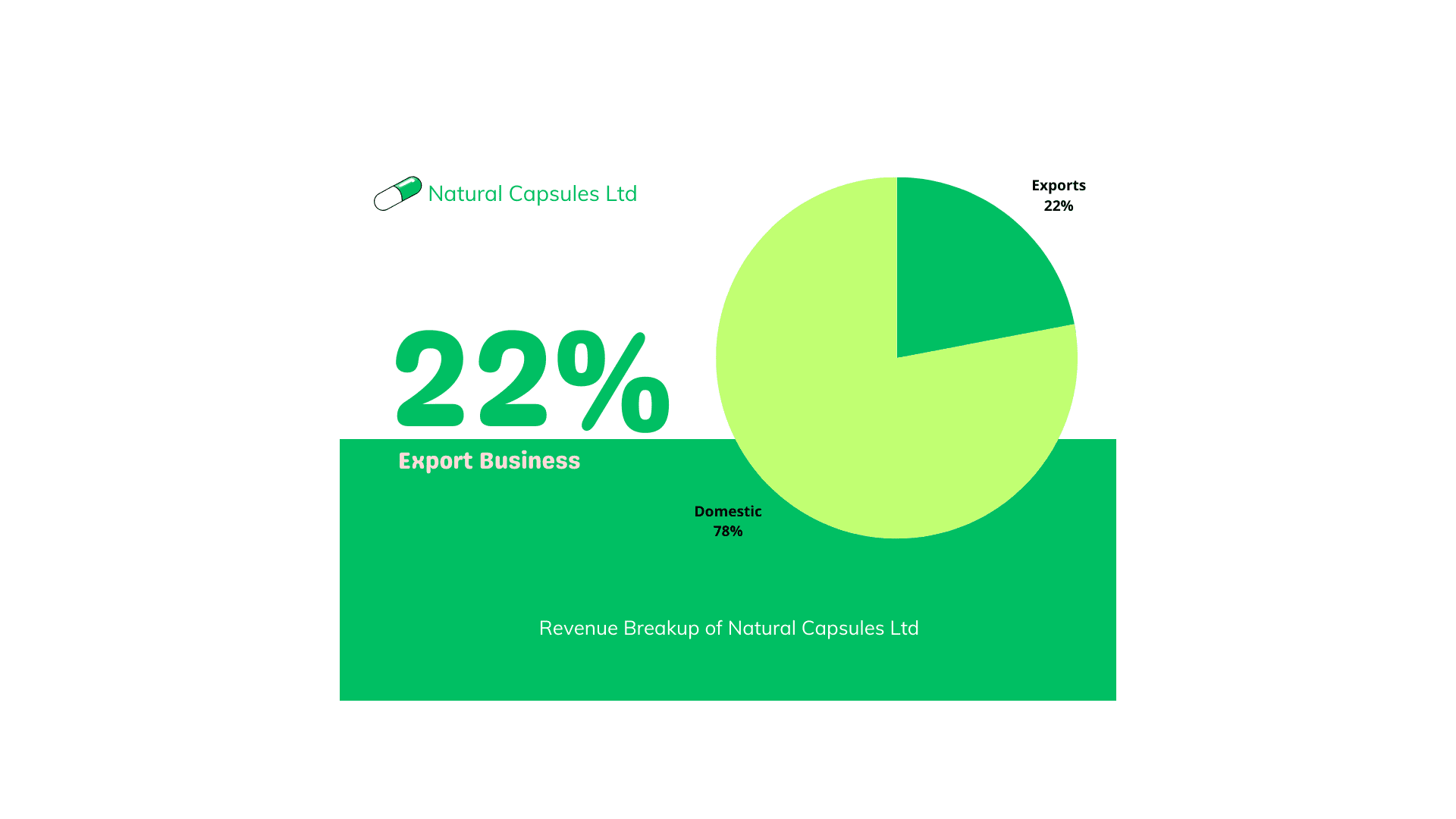

Revenue Breakup for FY23:

Export Business:

Natural Capsules exports to 30 countries across 5 continents, bringing in sizable revenue from its export. Africa contributes highest with ~43%, Middle east contributes ~22% , Asia contributes ~17% etc

The company expects a boost in exports from Mexico orders in Q2, with a projected increase from 22% to 35% over the next year

CAPEX :

- Capsule Manufacturing Capacity:

To read the full article, please subscribe to PRUDENT Ideas Membership!

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

The first article i read since subscribed, good to know that I have holding in this already as I am from similar field by virtue of my profession , will increase the allocation now

I just completed reading it fully and searched almost everything what I didn’t understand and this analysis is very nice and great ,i already invested in mankind but currently not confident enough about MANKIND

now after reading it’s opportunity I’m allocating my MANKIND IPO alloted money into this

Will add more through sip and please keep us updated if any changes happen

Thanks team prudent & manojeet da

Good article, keep up the good work guys

Thank you for the detailed report. I am already holding this share and now get confidence to enhance my holding

JUST A LITTLE UPDATE ABOUT CO ,@PRUDENTPARROT TEAM

& MANOJEET DA

:-

M/S. Natural Biogenex Private Limited, Subsidiary of the company has performed

its Inauguration of SMALL VOLUME PRODUCTION BLOCK AND R&D BLOCK on Wednesday,20th

September 2023 at Karnataka.

This production block consists of chemical synthesis reactions and clean rooms areas to produce final API

(Active pharma ingredients) in small volume batches.

This facility consists of Glass Reactor assemble of 200 liters, 100 liters & 50 liters capacity and other process

equipment to manufacture Final API, on receipt of relevant drug manufacturing License.

Thank you for the update.

Welcome 🤗 SIRji ❤️

Still it’s in range..iska bhi premier ke jaisa kholna chahiye gate 😌🤞