As an ODM player, the company is well-positioned to capture the growth of the LED market. It maintains healthy long-term relationships with leading industry giants and boasts an established infrastructure with backward integration, contributing to high-margin financials. With a strong focus on R&D, the company is investing over ₹200 crore in capital expenditures and anticipates asset turnover of 5-6 times at certain utilization levels.

About the company:

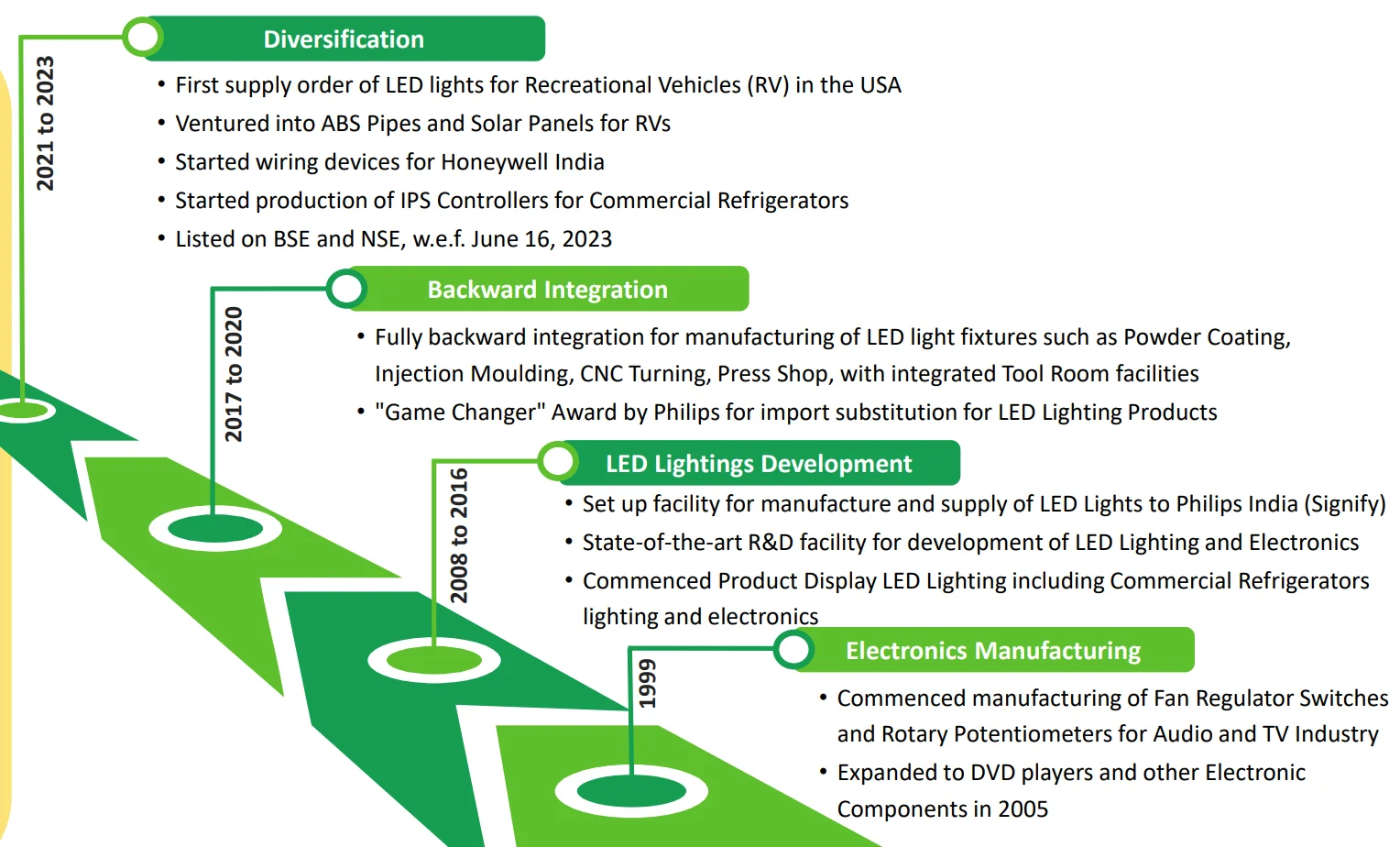

Ikio Lighting (Mcap 2300 Cr) is an Indian manufacturer of light-emitting diode (“LED”) lighting solutions. The company is focused on sustainability and providing low-energy LED products to assist India in achieving its sustainability objectives.

About the Management:

1. Hardeep Singh (CMD): As one of the founders and promoters, he has been involved with the company since its establishment. He has completed his Higher Secondary Education at Delhi University and with over two decades of experience in manufacturing television kits, electronic components, and LED lighting, he brings a wealth of expertise to the company. He has been recognized for his contributions to LED lighting production, receiving the “Game Changer” Award from Philips. He oversees the company’s operations, directs strategic growth initiatives, and spearheads expansion plans.

2. Surmeet Kaur (Whole-time Director): is one of its promoters. Holding a bachelor’s degree in Arts (Honours) from the University of Delhi, she has been involved with the company since its inception. Kaur’s primary responsibility lies in the management of Human Resources within the organization.

3. Sanjeet Singh (Whole-time Director): He earned his bachelor’s degree in Commerce from the Delhi University. Joining the company on February 1, 2019, Singh has been an integral part of its operations. His role entails overseeing the overall functioning of the company.

4. Chandra Shekhar Verma (Independent Director): He holds a master’s degree in Commerce from the University of Rajasthan, as well as a bachelor’s degree in Law and Masters in Business Administration from the same university. Additionally, he is a qualified Cost and Management Accountant and Company Secretary. Verma brings a wealth of experience from the Public Sector, having been associated with the company since April 14, 2022. Before this role, he held the position of Chairman and Managing Director at SAIL.

5. Kishor Kumar Sansi (Independent Director): He holds a bachelor’s degree in Science (Honours) from Delhi University, as well as master’s degrees in Science and Philosophy from the same university. Sansi has been associated with the company since April 14, 2022. Before joining the company, he held prominent positions in the banking sector, including Executive Director of Punjab & Sind Bank and Managing Director and Chief Executive Officer of Vijaya Bank. Sansi brings with him years of experience in Public Sector Banks.

6. Rohit Singhal (Independent Director): He holds a bachelor’s degree in Commerce from Delhi University and is a qualified Chartered Accountant. Singhal has been associated with the company since April 20, 2022, bringing with him over 12 years of experience as a practising Chartered Accountant.

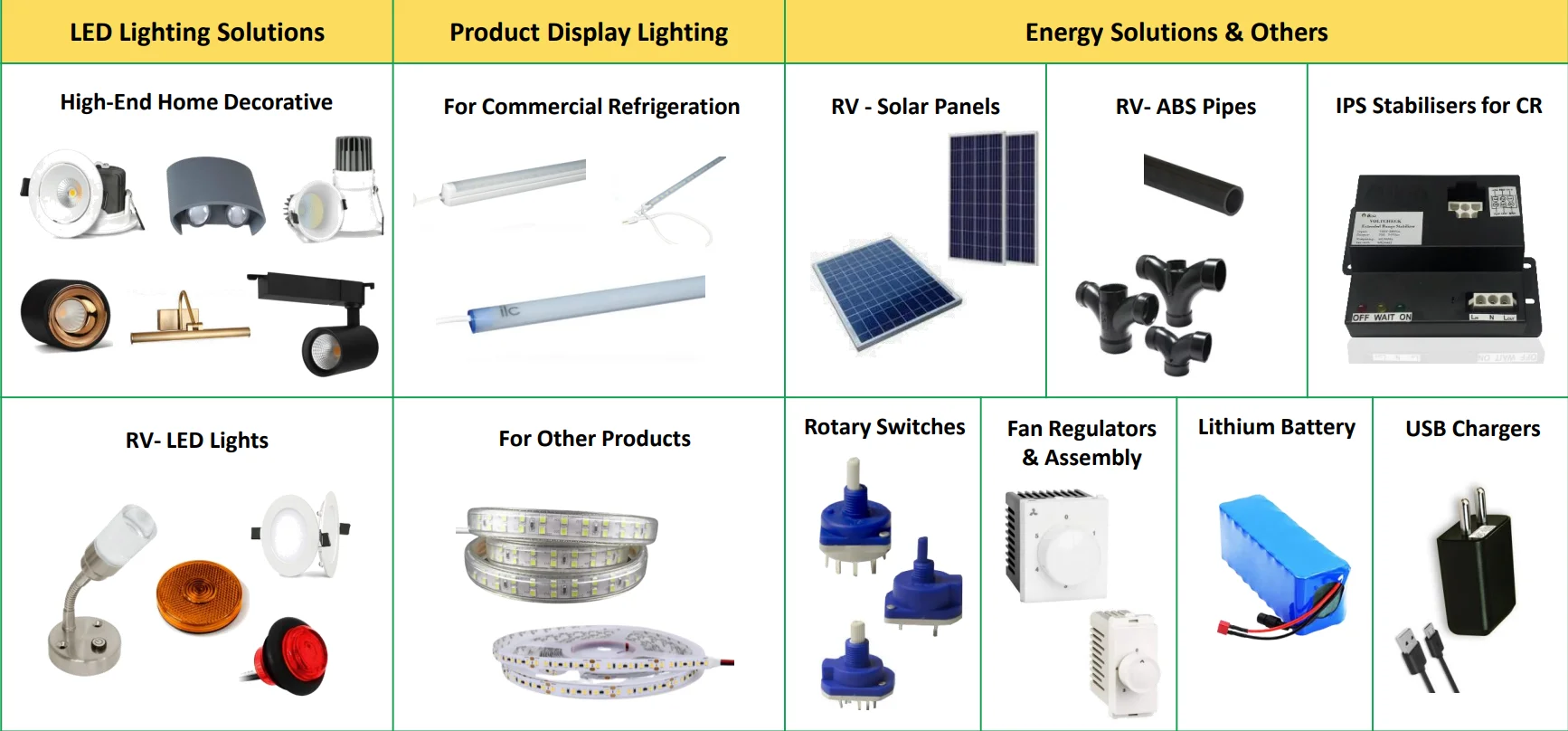

Business Verticals:

The company’s products are categorized as follows:

(i) LED lighting

(ii) Refrigeration lights and electronics

(iii) ABS (acrylonitrile butadiene styrene) piping

(iv) Solar system and charge controllers for Recreational Vehicle (“RV”)

(v) Other products

Revenue mix over the years:

| Verticals | 2022 | 2021 | 2020 |

| LED Lighting | 91.59% | 94.25% | 95.85% |

| ABS Pipes | 0.90% | 0% | 0% |

| Others | 7.51% | 5.75% | 4.15% |

Business Profile:

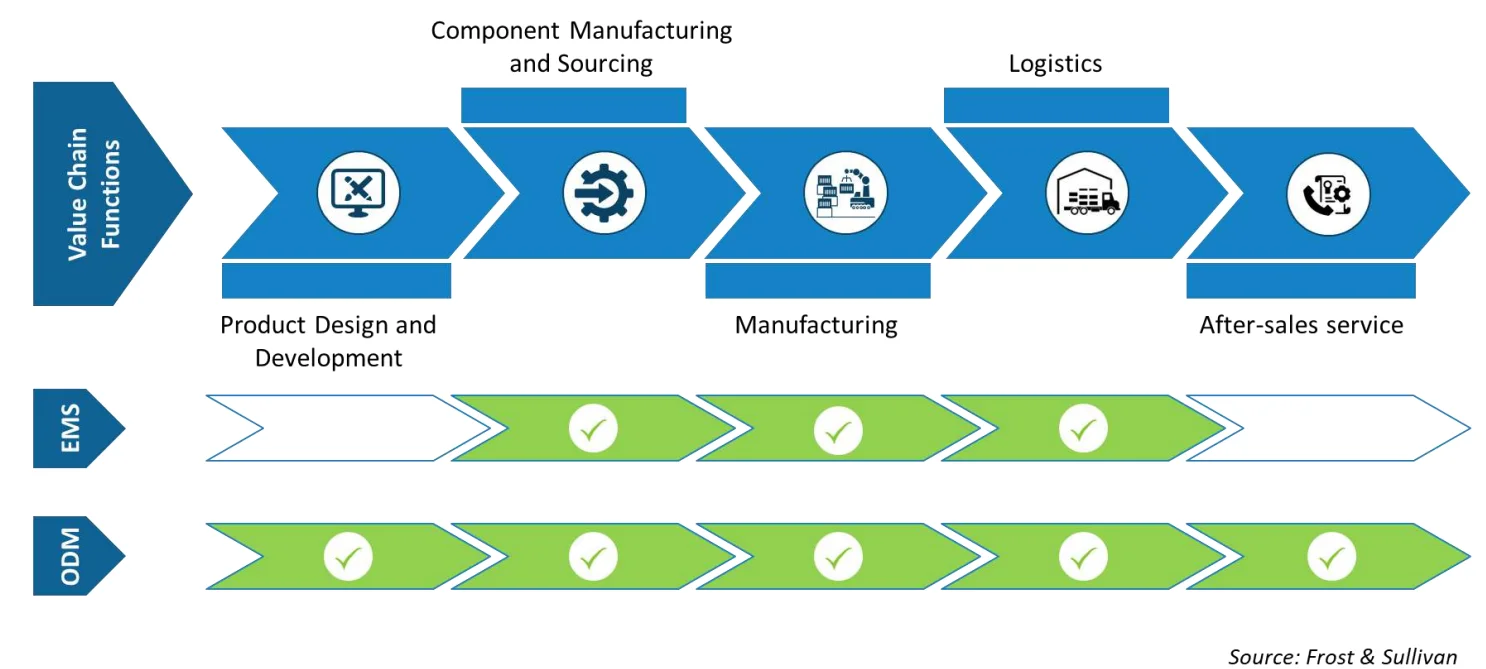

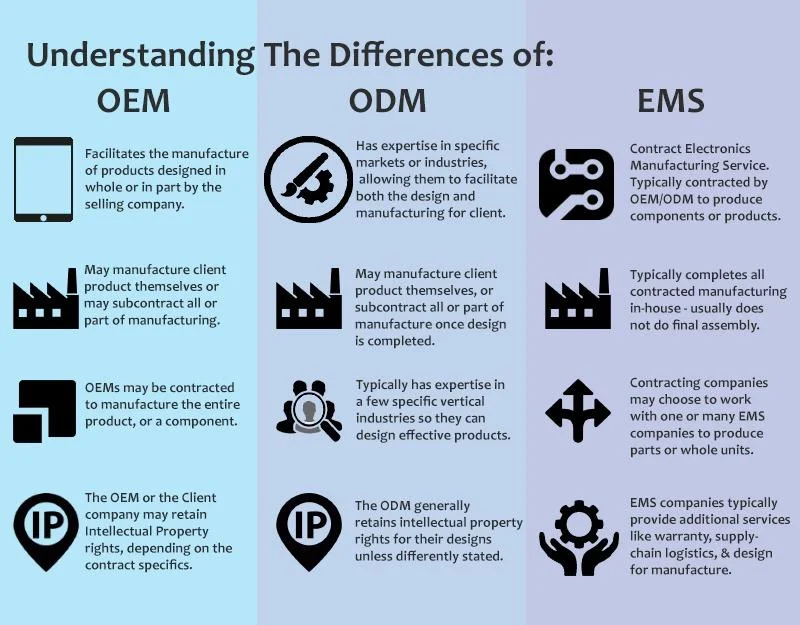

The company operates as an Original Design Manufacturer (ODM), engaging in the design, development, manufacturing, and supply of products to customers who subsequently market these products under their brands. Additionally, they collaborate with customers to create, manufacture, and supply products tailored to their specifications. With a focus on expanding their ODM business, they aim to venture into new international markets.

Difference between ODM and OEM:

ODM: In an ODM arrangement, the manufacturer designs and manufactures products based on their specifications and designs. The products are then sold to other companies, typically under the branding of the purchasing company. ODMs often have their own research and development (R&D) capabilities and may offer customization options to suit the needs of their clients.

E.g. Quanta Computer Inc. for the design and manufacturing of HP Notebooks.

OEM: In contrast, OEMs produce products based on the specifications provided by another company (the client or “brand owner”). The OEM is responsible for the manufacturing process, but the design and branding typically belong to the client. OEMs may or may not have their R&D capabilities, depending on the nature of their partnership with the client.

E.g. Apple iPhone was designed by Apple and then licensed to Foxconn to produce the product.

The LED business contributes to more than 90% of the company’s sales. Therefore, the company is diversifying into various ventures such as ABS pipes, solar panels, and energy solutions, including IPS stabilizers for commercial refrigerators, rotary switches, and more.

Manufacturing facilities:

Employees:

According to AR23, 1600 employees.

As of March 2024, 823 employees (source: EPFO).

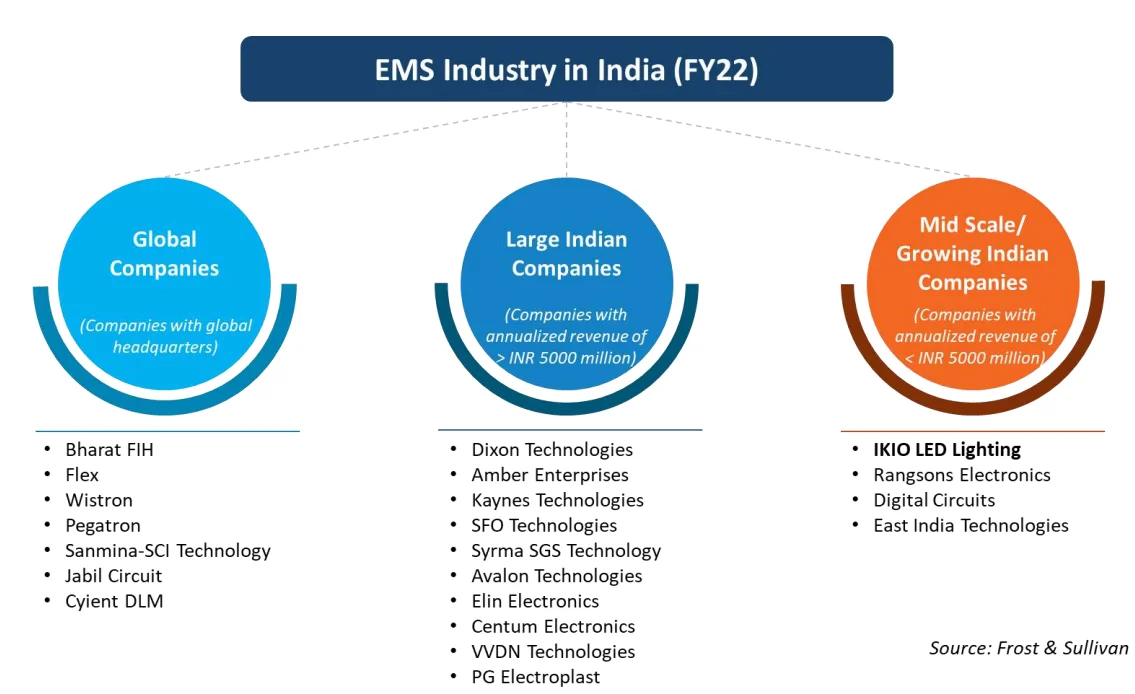

Presence of IKIO in different industries:

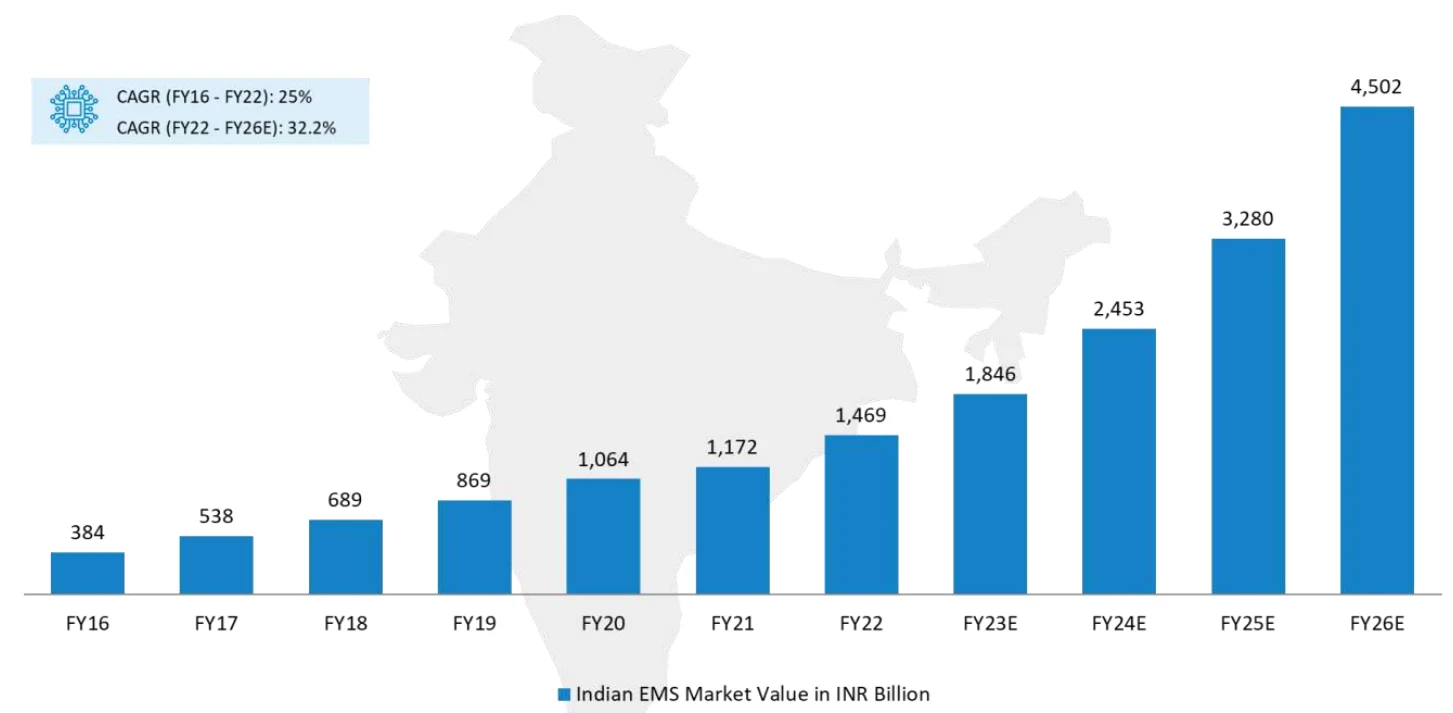

- EMS Industry

- Commercial Refrigeration Industry

- Recreation Vehicles Industry

1. Outlook of the EMS Industry in India

Growth Drivers:

To read the full article, please subscribe to PRUDENT Ideas Membership!

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

thanks for a such good article ( but i have 1 question how much % Philips contribute to sale ) thanks in advance

70% from Philips in FY23. There are no updates from the company yet for FY24.

Thank You Sir

can we still buy this as from last 2 qtr results are not looking good. Correct me if I am wrong please.

Yes, you are correct. Currently, they are some capex of around 75 Cr odd which can yield 4-5x asset turns as per the Management. We’ve gone through the concall and they are pretty much repeating the same thing about the market not being good last year, and they are doing some R&D and innovating new products.

Our view: Let’s wait for the next 2-3 Quarters and see the financial performance and the management commentary. If the numbers are encouraging we can go ahead.

Disc: This is just our view, please take an independent decision as all the stocks discussed on PrudentParrot are just for informational and educational purposes only.