Kranti Industries is an intriguing nanocap (Mcap 70 Cr). The company operates in the field of precision machining and has a presence in the auto ancillary and allied sectors. Led by a visionary management team, Kranti Industries stands out as a promising player in its industry.

Auto components sector

India’s domestic market for auto components was worth US$ 49.30 billion in FY20 and is expected to reach US$ 300 billion by FY26

India’s share in the global auto component trade was at US$ 15 billion. India aims to double its auto component exports to US$ 30 billion by 2026

An article by ACMA

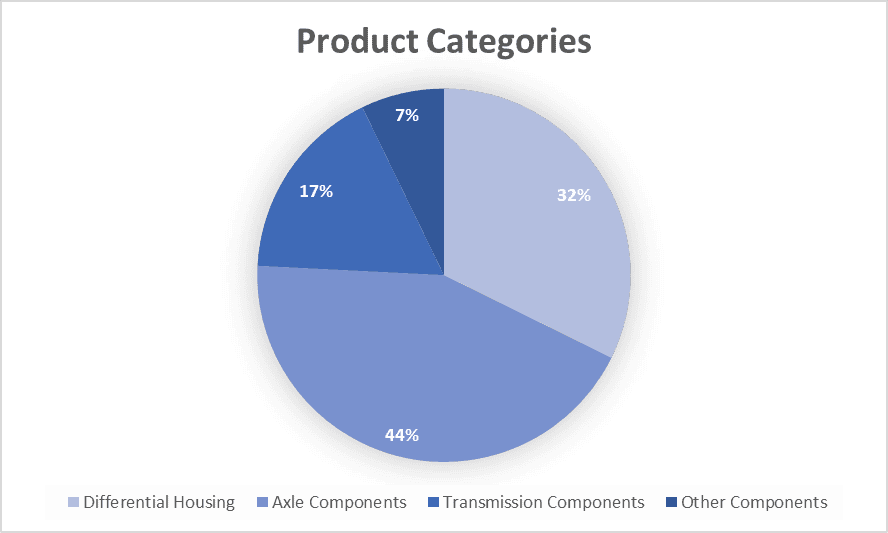

Kranti Industries product-wise sales breakup

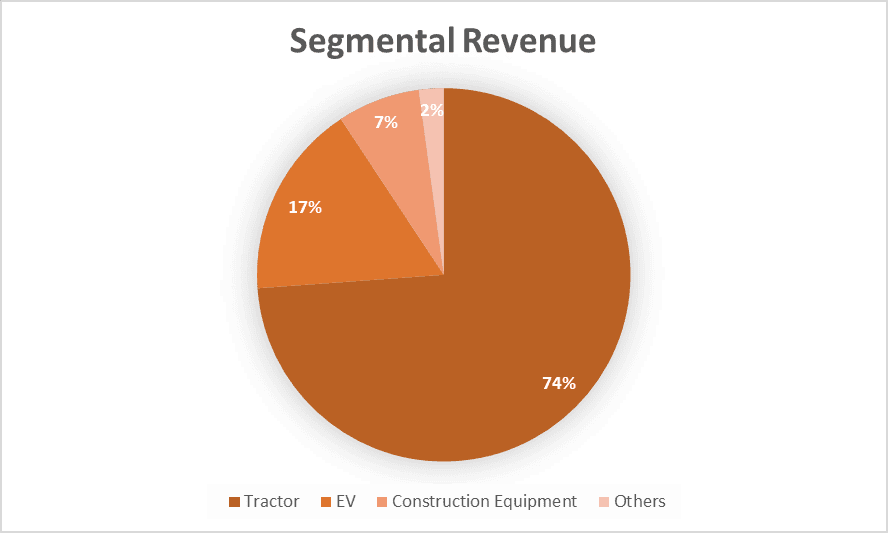

Kranti Industries segment-wise sales breakup

As we can see the top two segments viz. Tractors and EVs contribute to the major portion of the revenue for the company. Let’s see the growth trends of the same:

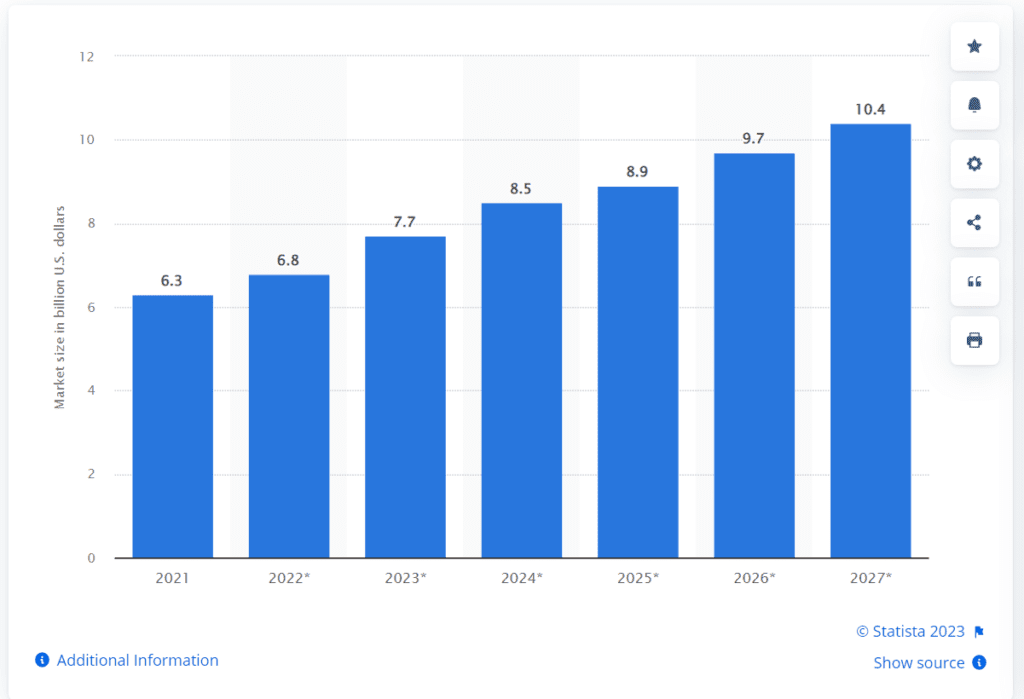

Tractors growth forecast in India

It is forecasted to grow at a CAGR of 8.9% (2021 – 2030). Exports of auto components were at USD 9.3 bn in 2021 and are projected to reach USD 80 bn by 2026 according to ACMA.

Electric Vehicle parts growth forecast

The global electric vehicle parts and components market size was estimated at USD 168.02 billion in 2022 and is projected to hit around USD 508.96 billion by 2030 with a registered CAGR of 14.86% during the forecast period 2022 to 2030.

About the Company

Kranti Industries Ltd was founded in 1981 with just Rs. 30,000 and a 2500 sqft facility in Pune. A company specializing in precision machining, primarily serving the auto ancillary and related industries. Their customer base includes both Indian and global automobile companies, recently they have ventured into supplying the Electric Vehicles Segment as well.

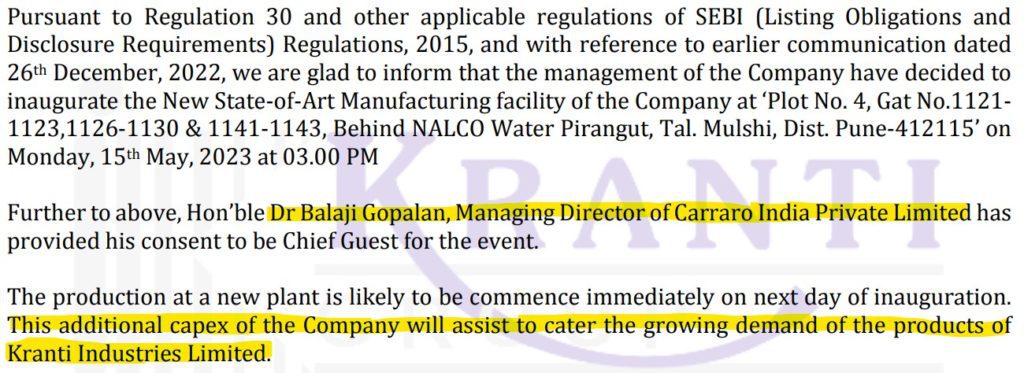

Presently, Kranti operates across all major sectors, including automotive, commercial vehicles, construction, and agriculture, among others. The company has formulated effective business strategies, including the adoption of the latest technology, acquisition of modern machinery, the establishment of efficient systems, recruitment of top talent ahead of time, and anticipation of industry changes, all of which have contributed to the company’s leading position in the industry. Kranti Industries Limited has recently constructed a “State of Art” plant in Pirangut and acquired a company in Pune.

As a precision machining company with over 40 years of experience, KRANTI currently has three units across Pune and a joint venture in Rajkot

Qualitative point

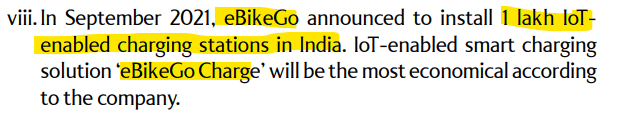

The Annual Report of Kranti Industries Ltd reveals insightful information about the ongoing developments in the auto industry. This indicates that the company is well-informed and up-to-date with the latest happenings in the industry. By staying aware of industry trends and advancements, Kranti Industries demonstrates its proactive approach and readiness to adapt to changes in the dynamic auto industry.

Kranti Industries decided to invest in a machine developed by a Japanese machine tool builder capable of manufacturing differential cases. Despite the substantial risk involved, they brought the machine to India after a successful trial.

This decision was particularly significant as the investment made was ten times their revenue in 2001. It exemplifies the management’s unwavering belief in the potential of the machine and their determination to take bold steps to drive the company forward. Their willingness to undertake such a high-risk venture showcases their conviction, commitment, and appetite for calculated risks in pursuit of growth and success.

This demonstrates the remarkable conviction, commitment, and risk appetite of the management of Kranti Industries.

About the Management

The management of Kranti Industries Ltd shows great promise. Despite being a relatively small-sized company, their Annual Report provides a level of detail that surpasses that of many large-cap companies. It is evident that they have a deep understanding of the market in which they operate, as demonstrated by their thorough competition benchmarking.

Moreover, the management is not just making empty promises but following through with their plans. This is evident from their initial intentions to increase production capacity, which have been successfully realized. The company’s management is taking tangible steps to achieve its goals, showcasing its commitment and capability to deliver on its promises.

The company is also holding 74% of its 1.06 Cr shares consistently which shows management’s confidence and skin in the game.

Clientele

Some marquee names can be seen:

Kranti Industries – Financial Standing

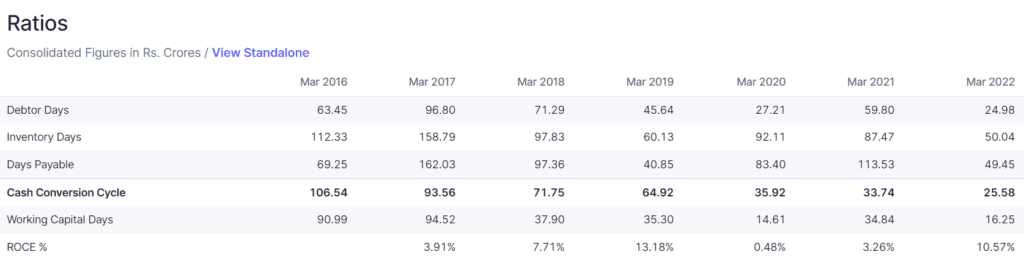

- Increasing Sales Y-o-Y since FY20. Revenue growth of 69% in FY22 from FY21.

- EBITDA grew by 70% to 8.6 Cr from 5 Cr.

- Operating Margin has increased from 6.7% to 9.7% from FY20 to FY22.

- The cash conversion cycle is one of the lowest among its peers.

- Kranti is gradually bringing down the Debtor days and Inventory days.

Potential Growth Triggers

- Acquisition of 55% of total issued Equity shares of Peciso Metall Private Ltd. (PMPL) at a valuation of 1.81 Cr (0.32 x FY22 Turnover). PMPL was incorporated in 2017

- Products and Services offered by PMPL: Machine Castings, Subassemblies supplies, Range of grades for both Cast Iron and Ductile Iron including Molybdenum.

- Turnover History (in Cr):

| FY20 | FY21 | FY22 |

| 2.1 | 6.2 | 5.6 |

- In their 2019 AR, Kranti Industries Ltd announced the acquisition of land with the aim of expanding their production capacity. The company has consistently kept shareholders informed about the progress of this development. Recently, they have successfully completed the construction of a state-of-the-art production plant to meet the increasing demand for their products.

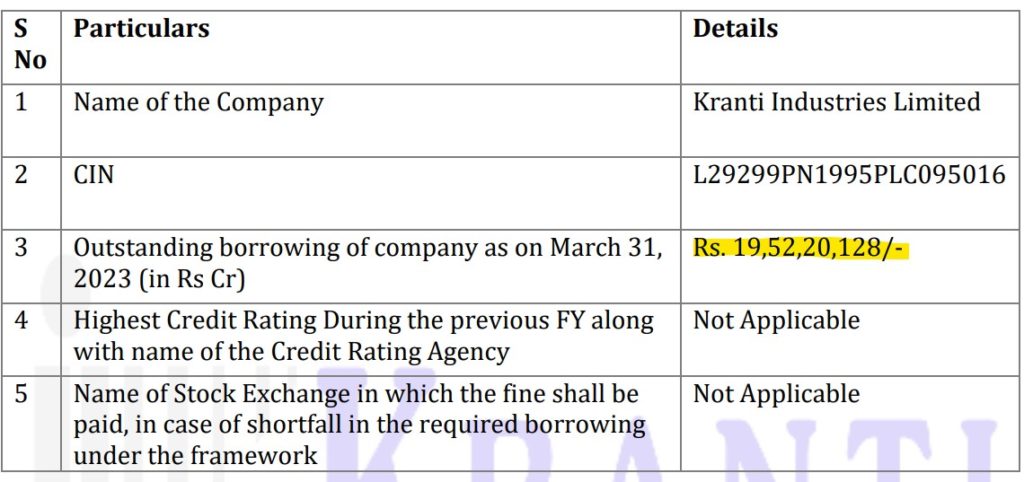

- Kranti Industries Ltd has made significant progress in reducing its debt burden. In the past eight years, the company has achieved its lowest level of borrowings, amounting to 19.5 crore.

Key Points

- Kranti Industries is relatively very small as compared to its peers.

- The management has more than 20 years of experience in the auto ancillary industry.

- Management’s hunger for growth is evident from the quality of disclosures and walk-the-talk attitude.

- The projected growth of auto ancillary in the global market, demand for India as an OEM hub, and value migration from Internal Combustion Vehicles to Electric vehicles may act as a propellant for the growth of the company.

This company falls under a very famous investor’s investing framework. Can you guess the name of the investor or the framework?

See you next time.

Until then… Stay Prudent!

Disclaimer: This article is provided for informational purposes only and should not be considered investment advice.

Also read:

Good work

Thank you!

Good Article…Worth Read.

Very nice article about promising company. Thank you so much for the information.

Your acknowledgment is truly valued. Thank you!

Thank you very much for sharing your findings!

Your recognition is truly cherished. Thanks!

What about cons/negatives/concerns?

Hi ,

You have put a screenshot from their annual report on what Sona BLW and ebikego are doing in the industry, that all fine n all, but how does it translate to business for Kranti. Can you give more insights on what they are doing on the EV front and what partnerships are they building towards that.

Thanks

They are currently manufacturing Differential Housing for EVs as per their latest investor presentation. No further details have been disclosed by the company yet.

Smile framework by Vijay Kedia sir

Pingback: Prudent Ideas: FY25 Results Updates