Hi readers, we’re writing this to share our latest thoughts on the current market situation, the performance of our Prudent Ideas — both winners and losers — and a reflection on the calendar year 2025.

Looking back: year 2025

2025 was an extremely unstable and turbulent year. From crowd crushes, the Air India crash, Trump’s tariff shock, the Pahalgam terror attack, Operation Sindoor, Zubin Garg’s passing, the Red Fort blast, the IndiGo Airlines disaster — and of course, the carnage in small and micro-caps.

Too many bad events hit us this year, but we’re hopeful that better days are around the corner. We have to keep the light of hope alive to keep moving forward, right?

Having said that, let’s dig deeper into market sentiments.

Won’t add Nifty into the picture as it doesn’t resemble our investing space at all. And the current situation is well explained by this song by the Legendary Investor Mr. Vijay Kedia

Overall, the Market breadth looks very weak

Last time we shared our thoughts on 3rd March 2025, the Microcap 250 Index had risen about 16%. But this number is somewhat misleading because market breadth remains very weak. This is exactly the phase when select stocks become available at very attractive valuations.

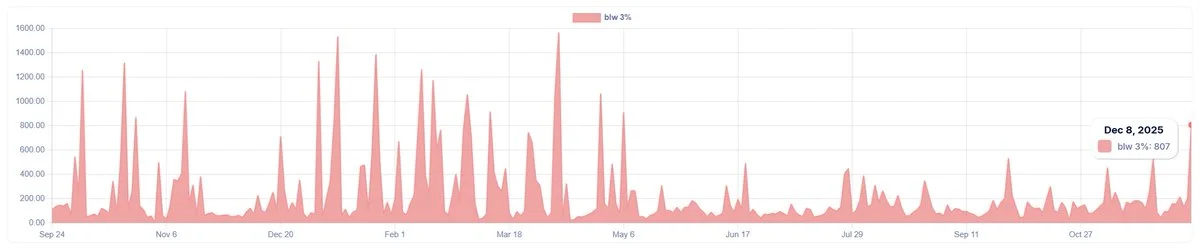

Today, on 8th Dec 2025, the number of stocks went down more than 3% is the highest since May 2025.

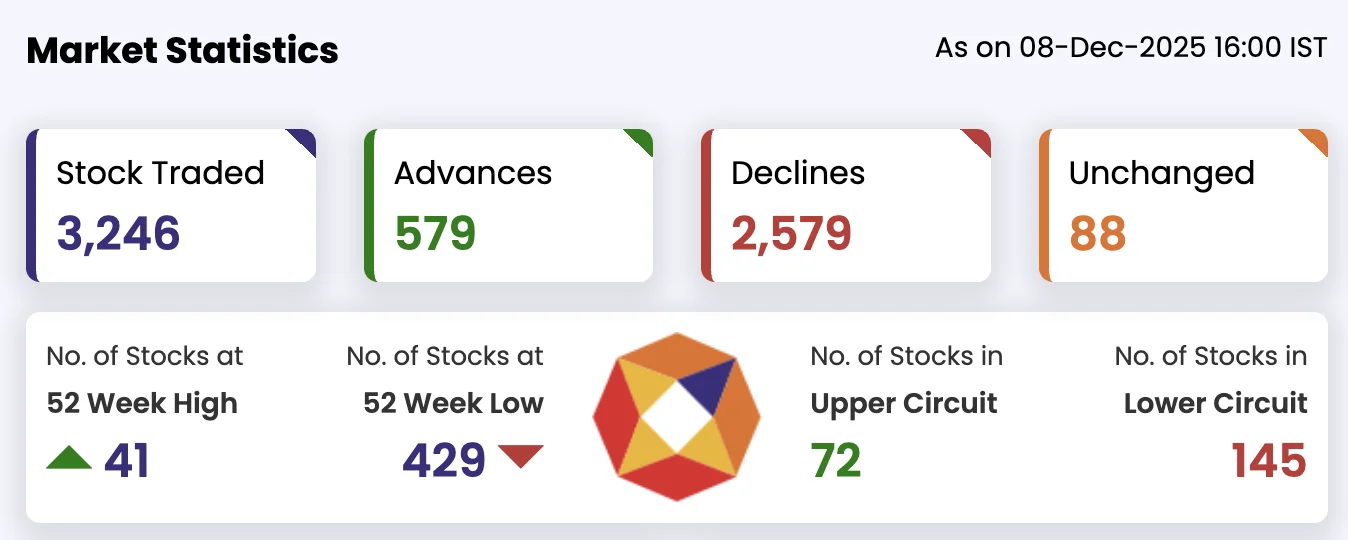

Have a look at the advances-to-declines ratio for today; it’s just 0.22

Prudent Ideas 2025 Performance

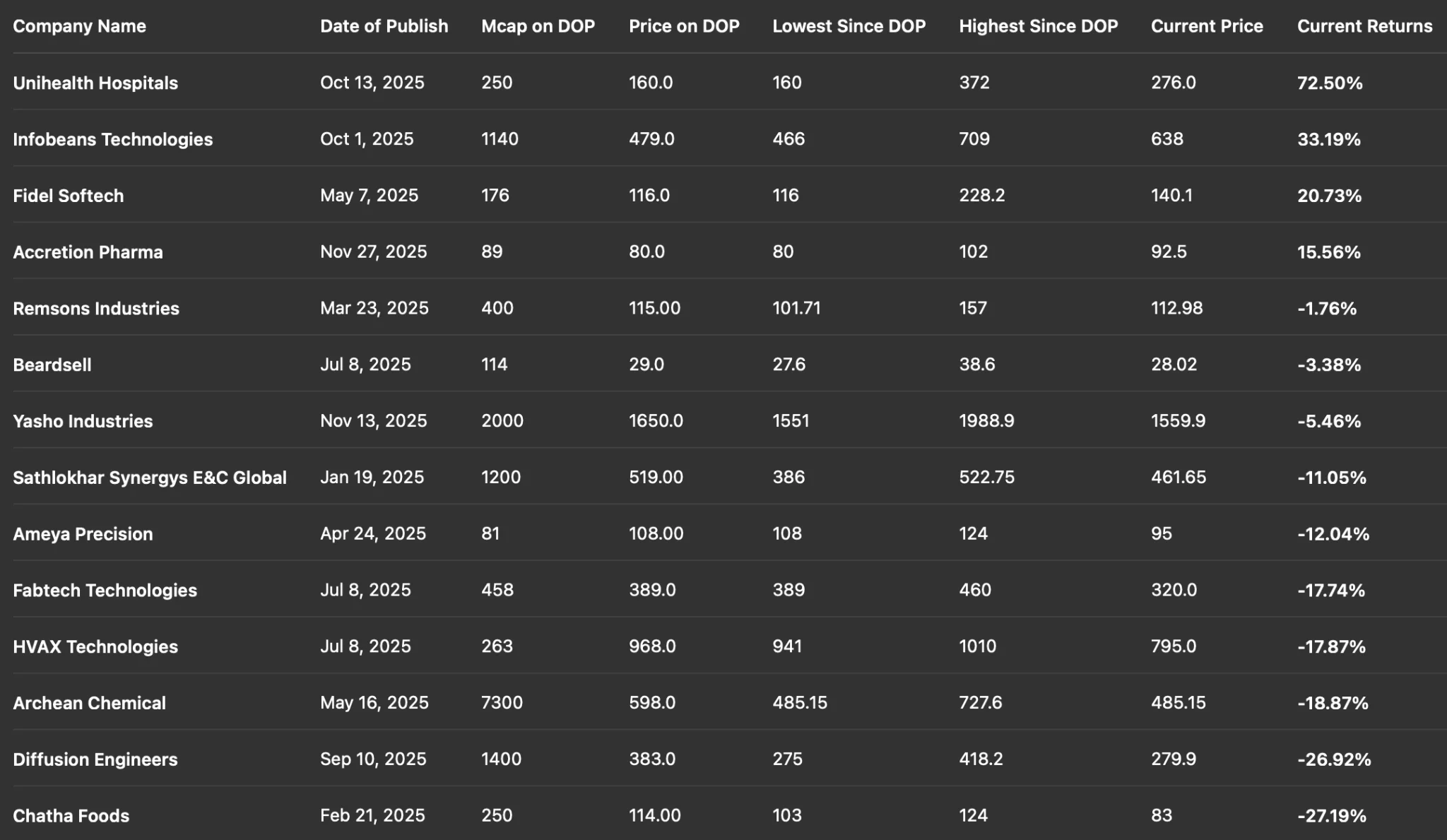

Now, let’s focus on the companies we posted in the year 2025

No of companies we posted under Prudent Ideas: 11, and free posts: 3

Stock price performance:

There are only 4 companies that are trading above the price on DOP (Date of Publication), and that doesn’t make the rest of the companies bad. It’s just normal price movements.

Earnings growth:

Overall, the earnings growth trend was in double digits except for a few names, viz. Chatha Foods, Diffusion Engineers, Fabtech Technologies Cleanrooms, Beardsell and Yasho Industries.

It’s not like there won’t be any earnings growth. They are well-positioned for future earnings in double digits.

Some ideas where valuations became more juicy post strong earnings:

- Remsons Industries: Q2FY26 numbers were robust, but the stock price declined post earnings.

- Fidel Softech: Q2FY26 – strong revenue growth, but margins declined. Now the stock is available at 19x TTM earnings.

- Ameya Precision: Slow and steady revenue and earnings growth. Stock is available at 13x TTM earnings.

- Sathlokhar Synergys: Superb numbers on all fronts. On the track to meet the guidance, even if they miss by 10-20%, we are okay to hold considering the valuations.

- Canarys Automations: 165% Revenue growth in H1FY26 and 125% PAT growth. The stock is still available at 15x TTM earnings.

And mind you, all the above companies have strong balance sheets.

Some names where accidents happened after we covered them:

- AVG Logistics (down 68%): We lost all confidence in the management. Numbers are nowhere where they’re guided. Moreover, they’ve stopped conducting earnings calls after posting pathetic numbers. The de-rating by the market is justified.

- Addictive Learning Technology (down 70%): Promoter is a loudmouth on social media. Again, multiple earnings misses de-rated the stock.

- Ikio Technologies (down 42%): We aren’t getting a good read on the promoters; things aren’t progressing in line with their commentary.

We sincerely apologise for any losses our subscribers may have incurred from these names. We firmly believe this is part of microcap investing—accidents do happen, and not every stock will perform according to expectations.

One name where we experienced “Delayed Gratification” is Fredun Pharmaceuticals. It performed after 1 year of consolidation. The stock became 3x in a matter of 38 weeks.

Some wise words from an experienced investor:

After witnessing this kind of carnage in small & microcaps, we usually sit with our father and pour our hearts out about what’s happening and why. He always reminds us of one simple truth:

You can’t have high certainty and low prices at the same time.

If you wait for full clarity, you’ll miss the juicy prices. Higher certainty always comes with higher prices—and lower odds of exponential returns. He tells us to think in terms of odds:

Your job is to position yourself where the probability of winning is the highest. And when are the odds highest? When you buy low.

It’s simple, yet most people do the opposite—they sell when they should probably be buying.

He often repeats a line we’re feeling deeply today:

“Opportunity is best known once it is gone.”

There are many such differentiated thinking we learnt from him about investing and in life, we will share with you some other day.

Please note that the idea of “buying low” in the above paragraph assumes that the company is well-researched and that you already have high conviction.

Tweet on guidance investing:

The thought behind old-school investing is simple: investing requires conviction—conviction to hold during ruthless selling and tough market conditions. The real question is why investors build their conviction solely on management guidance given during earnings calls or in investor presentations.

What are we doing now?

During this 15-month correction, we restructured our portfolio by exiting a few lower-conviction names and increasing our exposure to three core ideas. This shift reflects our conviction in the management teams and their ability to steer these companies in the right direction. Most of our close followers already know the names — Infobeans Technologies, SKP Bearing, and Macpower CNC Machines.

The idea is to bet on a few companies, but only those run by strong management teams and operating in businesses we understand well and that resonate with our inner wiring.

We’ve never been this concentrated in our portfolio before — and the reason is simple: extraordinary outcomes demand extraordinary actions. Even if we fail, we won’t regret it. There’s a powerful quote by Steve Jobs: “Remembering that I’ll be dead soon is the most important tool I’ve ever encountered to help me make the big choices in life.” This mindset has helped us take bold decisions.

Concluding thoughts

Our portfolios will make new highs soon! Just don’t lose hope now. Peace ✌️

Happy Investing,

Team PrudentParrot

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

Also Read:

Hi Manojeet,

Thanks for sharing the insights.

What ur opinion on Phantom Digital Effects Ltd ?

Hi Jaya, Phantom looks very cheap on TTM earnings indeed (although the entire VFX industry is de-rated currently), just available at 12x. H1FY26 numbers were superb.Trade receivables were under control in H1 but Cash flows are still negative and this is the only point that we find as a deal breaker. Revenue guidance for FY26 and FY27 are awesome, let’s see if the management can bring the commentary into reality. If in case, in H2FY26 cash flows improve we may want to revisit the company.

Thank you

Manojeet

thank you for 2025 thoughts and reflections

give some opinion on dharmaj crop guard

thank you in advance

Hi sir, Dharmaj is actually in a very good place. The only reason for the price drop from 380 to 230 is due to subdued Q2FY26 growth, as Q1 and Q2 are the strongest in the agrochem sector. And this happened because of the monsoon in the northern parts of India, the demand was affected. We are hopeful that the company will post better earnings growth next year.

thank you sir